US DOLLAR HIGHLIGHTED BY JULY FED MEETING

- The July Fed Meeting is anticipated to reveal the central bank’s first interest rate cut since December 2008

- The US Dollar will likely react sharply to the upcoming FOMC rate review judging by volatile rate cut bets

- Spot USD/JPY could be set to carve a path higher if the Fed fails to capitulate to lofty rate cut bets or provides relatively hawkish guidance

Persistent uncertainty surrounding the US-China trade war, mixed US economic data and ambiguous Fed-speak have all provoked significant volatility in Fed rate cut bets and consequently the US Dollar. Forex traders could be provided clarity on Wednesday, however, with the Federal Reserve slated to publish its latest monetary policy statement at 18:00 GMT.

While rate traders have priced the probability of a rate cut as a near-certainty according to overnight swaps, speculation over the size of the anticipated rate cut will likely linger into the FOMC’s interest rate decision.

The sharp improvement in US economic data over recent weeks has seen little impact on lofty rate cutbets – driven largely by slowing global GDP growth and ongoing trade policy uncertainty – which could position the US Dollar for major upside if the Fed refuses to capitulate.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

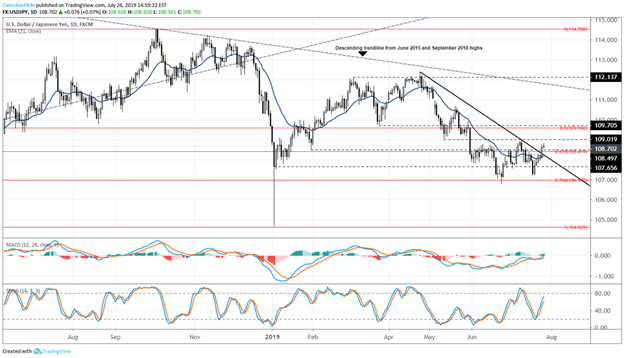

SPOT USDJPY TECHNICAL ANALYSIS: DAILY PRICE CHART (JULY 2018 TO JULY 2019)

Spot USDJPY has proven resilient in recent days, carving a path higher through several key resistance levels while breaking the downtrend from the April high. Momentum indicators have started to turn the corner: daily MACD is pushing higher, on the verge of a move into bullish territory above the signal line; and Slow Stochastics have continued their gains towards overbought territory (often a sign of a strong market).

Yet, there is still work to be done before a true bottoming call can be made. The break of the downtrend from the April high is a good start; but clearing out the May swing low and July swing high area near 108.96/109.02 would be better. In doing so, USDJPY would have established a series of higher highs and lower lows in context of price action since the start of June.

Seeing as how Fed rate cut odds have been the driving factor behind moves in US Treasury yields – and according to the Bank of International Settlements (BIS), two-year yield differentials matter most to FX markets – we expect USDJPY price action around the Fed meeting on Wednesday to closely mirror that of the bond market.

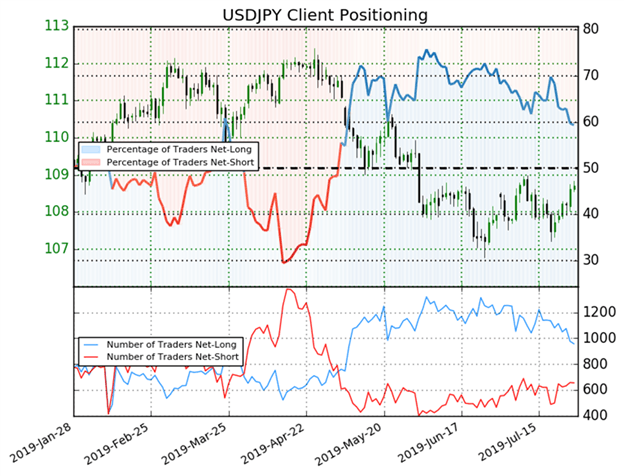

IG CLIENT SENTIMENT INDEX: USDJPY DAILY PRICE CHART (JANUARY 28, 2019 TO JULY 26, 2019)

Spot USDJPY retail trader data shows 59.3% of traders are net-long with the ratio of traders long to short at 1.46 to 1. In fact, traders have remained net-long since May 03 when spot USDJPY traded near 111.913; price has moved 2.9% lower since then. The number of traders net-long is 5.0% lower than yesterday and 16.0% lower from last week, while the number of traders net-short is 5.8% higher than yesterday and 13.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USDJPY price trend may soon reverse higher despite the fact traders remain net-long.

FOREX TRADING RESOURCES

- Download the Q3 DailyFX Forecasts for comprehensive fundamental and technical analysis on major currencies like the US Dollar and Euro in addition to equities, gold and oil

- Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real time

- Find out how IG Client Sentiment data can be used to identify potential forex trading opportunities

-- Written by Christopher Vecchio, CFA, Senior Currency Strategist & Rich Dvorak, Junior Analyst

Connect with @CVecchioFX and @RichDvorakFX on Twitter for real-time market insight