USD – Price, Chart and Technical Analysis

- $200billion of tariffs on Chines goods may kick-in next week.

- EU offer of 0% tariffs on industrial goods likely to be turned down by the US.

- The US dollar may continue to get a bid as risk returns.

The DailyFX Q3 forecasts and analysis of the US Dollar is available to download here.

Trade Wars are Back in the Headlines as the US ups the Ante on Two Fronts

After a brief lull, trade wars are back on the front page and dominating market action as the week draws to a close. And this may boost the US dollar, if past risk action remains constant, despite US President Trump sparing with two of the world’s largest economies at the same time.

US China trade relations are likely to worsen after President Trump said that he is prepared to impose an additional $200billion of tariffs on Chinese products – at a rate of 25% - as early as next week. He added that the Chinese currency continues to move against US interests – USDCNH weakening – a situation he finds untenable. POTUS said that China is trying to make up for a lack of business by weakening the CNH; “It’s no good. They can’t do that. That’s not, like, playing on a level playing field.”

Further impositions of US tariffs will likely be met by more counter-measures from China, leading to USDCNH weakening further.

The latest US China trade spat may see the US dollar get a bid with the greenback lately seen as a risk-haven asset despite the political backdrop. The dollar basket (DXY) remains fairly well bid around 94.00 - the August low – and may begin to push higher, with supportive economic data adding a further tailwind.

The US dollar may also get a technical boost from the weekly Fed Balance Sheet Unwind when negative liquidity days boost the greenback.

US dollar traders should also be aware of two medium-impact releases later in the session.

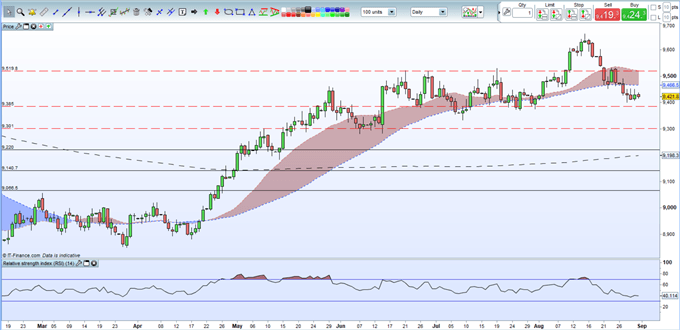

US Dollar Index (DXY) Daily Price Chart (February – August 31, 2018)

US Brushes Off EU Concession Talk

In a move that further weaken the euro, President Trump also rejected talk from the EU of 0% tariffs on US industrial goods, including the automobile sector. The President’s reasoning was seemingly based on comments that the proposal was not good enough as Europeans don’t buy American cars, only domestic ones. The EU have held firm in the face of US tariffs in the past and this latest refusal by President Trump is likely to draw a firm response from Europe, with ongoing action and counter-action expected to dampen interest in the euro.

DailyFX analyst Daniel Dubrovsky sees NZDUSD as one way of capturing the latest bout of trade risk, aided by dovish RBNZ monetary policy expectations.

If you are new to foreign exchange, or if you would like to update your knowledge base, download our New to FX Guide and our Traits of Successful Traders to help you on your journey.

What’s your opinion on the latest bout of trade tariffs? Share your thoughts with us using the comments section at the end of the article or you can contact the author via email at Nicholas.cawley@ig.com or via Twitter @nickcawley1

--- Written by Nick Cawley, Analyst