Altcoin Talking Points

- Altcoin valuations are surging as investors move into low cash price cryptocurrencies.

- Ripple (XRP) is now eyeing a place in the top 50 most valuable companies in the world list.

The DailyFX Bitcoin Glossary is designed to provide traders with a reference for important terms and concepts essential for understanding the emerging cryptocurrency universe.

Altcoins Surge Leaving Bitcoin’s Place as the Market Leader under Pressure

A range of altcoins – Bitcoin (BTC) alternatives – continue to post daily double-digit gains, sending their market valuations soaring. And a look at the most popular coins show that investors are buying on price as much as on company specifics, hoping to find the next company that jumps from a few cents to tens of thousands of US dollars. In the last month, Ripple (XRP) has surged from $0.23 to $3.79, Cardano (ADA) has jumped from $0.13 to $1.22, NEM (XEM) has risen from $0.27 to $1.88, while Stellar (XLM) has soared from $0.10 to $0.88. And the effect of this surge in interest in altcoins has hit market heavyweight Bitcoin, with BTC’s market dominance reduced from around 55% one month ago to around a current low of 34%.

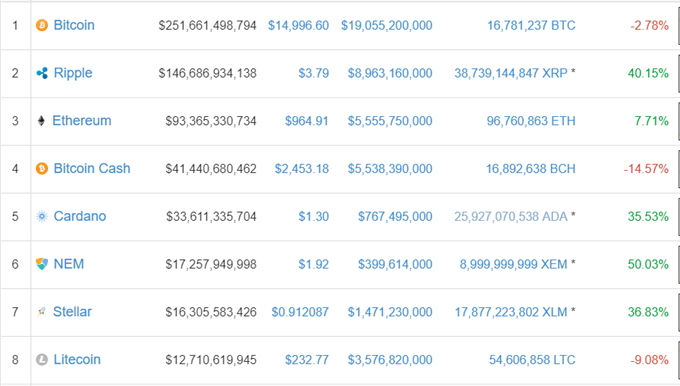

Cryptocurrency Market Prices and Capitalizations – January 4, 2018

We discussed the rise of altcoins and their current chart set-ups in this week’s Bitcoin and Cryptocurrency Webinar, while DailyFX chief currency strategist John Kicklighter recently noted that the Discrimination between Bitcoin and Top Cryptocurrencies Continues.

Ripple nears Stock Market Stalwart Unilever’s Market Valuation

The second largest cryptocurrency Ripple currently trades with a market capitalization of nearly $147 billion, around $10 billion lower than one of the stock market’s largest and most respected companies, Unilever (ULVR). The British-Dutch multinational employs around 170,000 people worldwide while its products are used by over 2.5 billion people a day. In May 2017, Unilever was worth $144 billion while Ripple was worth $2.1 billion.

--- Written by Nick Cawley, Analyst.

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1