Talking Points:

- Bitcoin is the undisputed leader of cryptocurrency interest in the financial world, but not necessarily the best one

- Ultimately, digital currencies are aiming to replace traditional fiat monies; yet the practicality of that day looks far off

- The disparity and similarities between Bitcoin, Ethereum, Litecoin, Ripple and others speaks to motivation behind this market

Are you looking to learn more about Bitcoin and how to approach it as an investor? See the new Bitcoin Trading guide written by analyst Nicholas Cawley on the DailyFX Trading Guides page.

Despite the holiday restraint across the financial system, there is still a remarkable amount of volatility bubbling in the cryptocurrency world. That activity level is a feature of the asset class. Lacking a centralized exchange, there is no downtime for holidays. Yet, this virtue is also a vice. In such conditions where activity in the economy and transactions across the financial system naturally abate, we still have a strong turnover in Bitcoin and its cousins. That is in part evidence of the strong influence of speculation that has swept into this emergent market. It is the appeal of dramatic volatility and incredible trends that has helped raise the profile of this effort to unseat traditional currencies, but it can also prove a future encumbrance or even its undoing. Yet, comparing Bitcoin to gold or the Dollar yields unproductive debates that pit the rapid evolution of technology versus the academic uses of monies for transaction or stores of value. A better means of evaluation of the market is a comparison within the asset class.

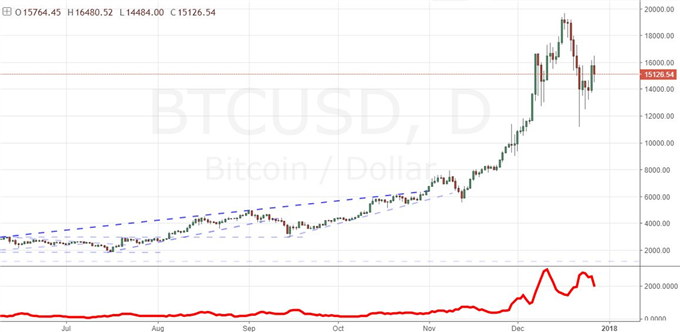

Bitcoin is the champion of the cryptocurrency asset class. It is far from the most virtuous member of the cadre of coins looking to drive evolution of the financial system, but it is by far the most popular. And, it is that popularity despite its flaws that should draw attention to the potentially destabilizing effects of speculation behind this market. Ultimately, the cryptocurrency market is looking to replace fiat currencies like the Dollar, Euro and Yen to facilitate future transactions. Yet, is that viable when it takes days to settle a transaction and cost between $15 and $25 per action? Further, would an environmental footprint the size of which has been discussed in the news of the mining and transaction operations for BTC seem a viable future solution? Nonetheless, trading remains robust in this benchmark and its levels lofty. It so happens that we are approaching the fifth hard fork for Bitcoin (a split supposedly to solve the underlying shortcomings of the original), but the previous four have drawn limited interest despite their supposed directed solution.

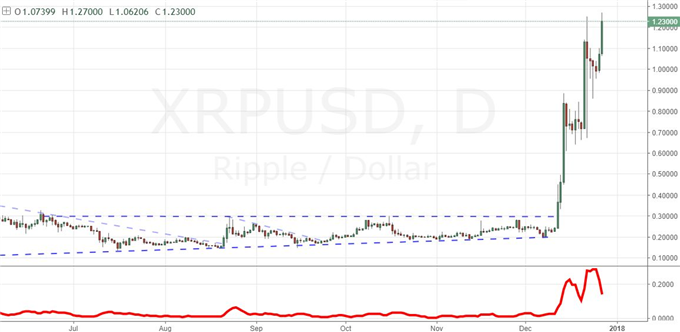

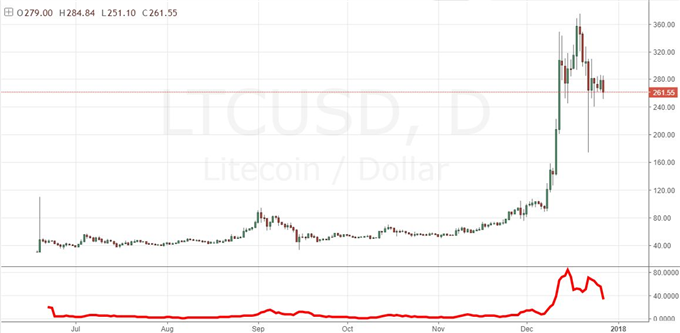

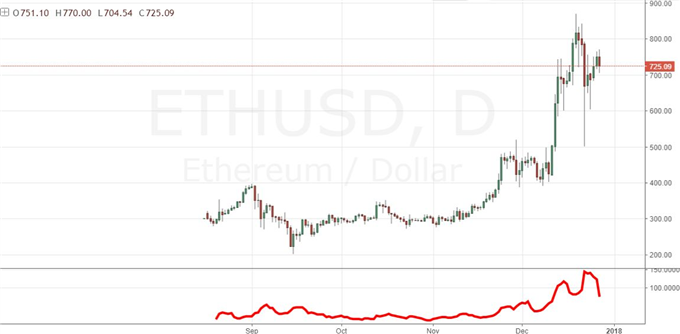

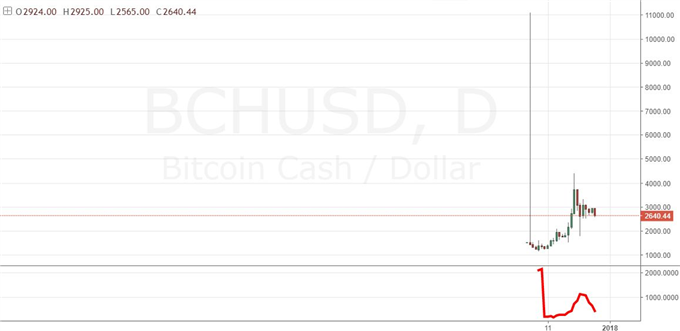

Bitcoin Cash was the most recent split, and it has garnered the greatest traction yet. It is even being tested out on the largest cryptocurrency exchanges which is the best possible chance of hitting critical mass. That said, this adapted (improved?) version of the original has not escaped the pull of the BTC nor its extreme volatility. Perhaps the other top tier liquid alternatives are better off and the future of a stable market at high prices? Doesn't seem so. Ethereum is the second most liquid, popular and heavily traded on top exchanges. It has held up better than Bitcoin has perhaps, but its restraint for further appreciation behind the rise and fall driven by its predecessor is clear. The same goes for Litecoin, the other cryptocurrency that is most readily available on the exchanges. Perhaps one of the most nimble of the liquid offerings, it carves out one of the most dangerous technical patterns. So, where is their disparity to the positive? Ripple has actually pushed new highs in the retreat of its larger brethren. But, it is difficult to say whether this is genuine appetite for a true alternative to the flawed or just speculation of the next coin to be added to the exchanges and readily dumped when liquidity improves. We look at the cryptocurrency market in general in today's Quick Take video.

To receive John’s analysis directly via email, please SIGN UP HERE.