US DOLLAR PRICE OUTLOOK: ISM SERVICES/NON-MANUFACTURING PMI & JOBS DATA DUE

- US Dollar takes another spill as EUR/USD, GBP/USD, and AUD/USD continue to surge

- DXY Index drops below the 98.00 price level as USD/CAD weakness offsets USD/JPY strength

- ISM services/non-manufacturing PMI and ADP employment data on deck for release during Wednesday’s trading session

The US Dollar keeps bleeding lower. This sets the DXY Index on pace for its six-straight day of downside as the broader US Dollar sinks nearly 3% since its 18 May high. USD selling pressure appears far-felt with the Greenback weakening considerably against other major currencies like the EUR, GBP, AUD, and CAD over recent trading sessions.

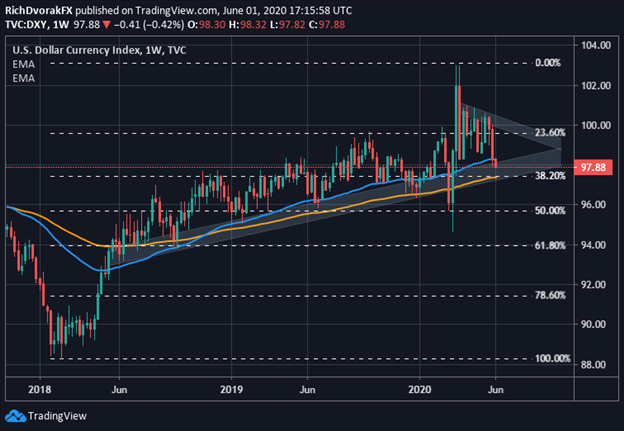

DXY INDEX – US DOLLAR PRICE CHART: WEEKLY TIME FRAME (OCT 2017-JUN 2020)

Chart created by @RichDvorakFX with TradingView

US Dollar price action continues to face headwinds largely stemming from a prolonged influx of coronavirus optimism. The improvement in market sentiment and trader appetite for risk has weighed negatively on safe-haven currencies such as the US Dollar. The recently-adopted Fed backstop has helped alleviate USD funding pressure and likely serves as another primary bearish driver steering the US Dollar lower.

With the US Dollar hemorrhaging, perhaps the 100-week exponential moving average, which is also underpinned by a key Fibonacci retracement level of the February 2018 to March 2020 trading range formed by the DXY Index, could provide an area of buoyancy for the US Dollar.

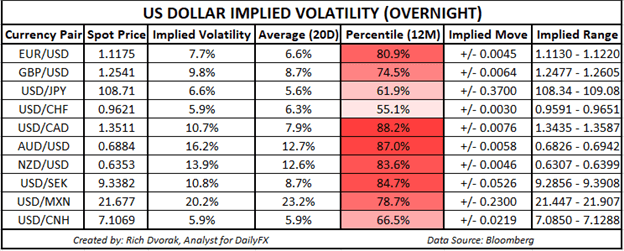

US DOLLAR IMPLIED VOLATILITY TRADING RANGES (OVERNIGHT)

That said, several fundamental forces present opportunities for the US Dollar to stage a bullish reversal. Escalating China tension and the growing possibility that complacent equity investors might face a day of reckoning stand out as prominent themes with potential of sparking a return of risk-aversion and US Dollar demand.

High-impact economic data on deck for release, like the ISM Services/Non-Manufacturing PMI report or ADP Employment figures, are also noteworthy risk events that might catalyze currency volatility in the US Dollar. According to the DailyFX economic calendar, ADP Employment data is due Wednesday, 03 June at 12:15 GMT while ISM Services data is slated to cross the wires shortly after at 14:00 GMT.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight