DXY INDEX PRICE OUTLOOK: US DOLLAR & FX VOLATILITY PULL BACK, MARKET SENTIMENT GROWS MORE SANGUINE AS CORONAVIRUS FEARS FADE

- The US Dollar has slid nearly 3% from its recent swing high

- DXY Index drops below the 100.00 price level as FX volatility sinks

- USD price action could remain under pressure while coronavirus fears fade

The US Dollar now trades on its back foot following a 2% jump to start the month and 2Q-2020 judging by performance of the DXY Index. USD price action is now down about 3% on balance from its March 20 swing high. The latest bit of downside in the US Dollar appears driven by investors unwinding their recent rush into safe-haven currencies amid the wave of coronavirus concerns.

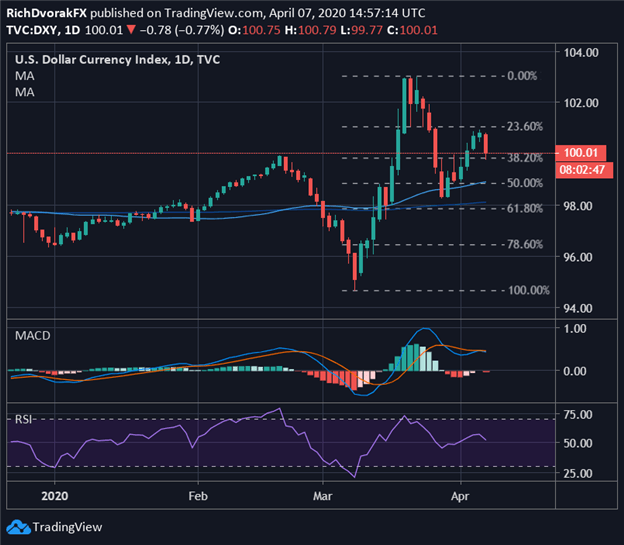

DXY INDEX – US DOLLAR PRICE CHART: DAILY TIME FRAME (23 DECEMBER 2019 TO 07 APRIL 2020)

Chart created by @RichDvorakFX with TradingView

The DXY Index plunged back below the 100.00 price level early Tuesday as investor risk appetite carries forward from the prior trading session. Improving market sentiment, initially sparked by the flood of stimulus from global central banks and governments, was fueled further by ‘flattening the coronavirus curve’ after Italy and New York reported decelerating COVID-19 cases, hospitalizations and deaths.

If the shift in sentiment lasts, there could be potential for the US Dollar to keep edging lower as the DXY Index retraces last month’s trading range, perhaps to test technical support provided by the 50-day and 200-day simple moving averages.

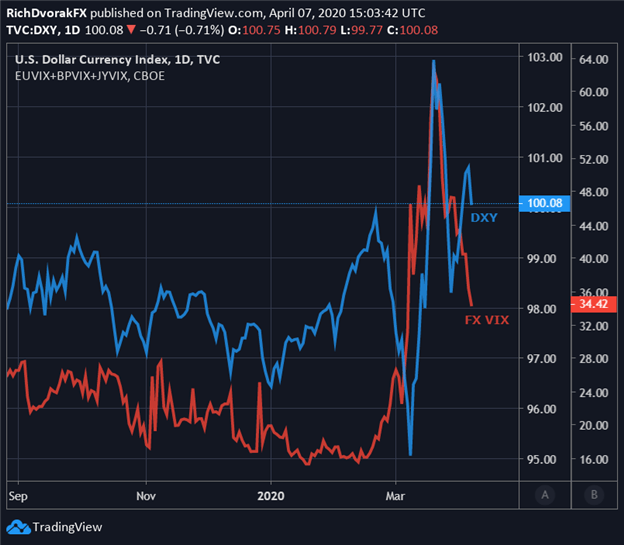

FX VOLATILITY FADES & WEIGHS ON US DOLLAR

Chart created by @RichDvorakFX with TradingView

Alongside the recovery in market sentiment has been a pullback in measures of volatility like the VIX Index and 30-day implied volatility on the Euro, Pound Sterling and Yen (FX VIX). As investor outlook turns more positive and optimistic that the apex of the coronavirus pandemic is in the rearview mirror, currency volatility could fall further, which may continue pressuring the US Dollar.

However, as unemployment spikes and the economy struggles to recover, economic data could rekindle recession fear and steer traders back into anti-risk assets such as the US Dollar.

Keep Reading – AUD/USD Price Outlook: Virus Optimism Boosts Australian Dollar

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight