Economic event risk makes a dramatic return in the week ahead as central banks in Japan, the UK and the US offer rate decisions all while top-tier data flows across the wires.

US Dollar Forecast: US Dollar Still in Trump Watch Mode as FOMC, Key Data Loom

The US Dollar might have been encouraged to rise by supportive data flow and an optimistic Fed but lingering fiscal policy uncertainty severely complicates things.

Euro Forecast: Euro Due for More Chop as Inflation Data Point Higher; Draghi on Thursday

Despite important data due out over the coming week, there’s not much reason to think that the Euro, broadly speaking, will be able to find much direction. Much like last week, when the Euro’s performance was largely dictated by movements in other currencies – the rally in the British Pound, the ongoing erosion of the US Dollar – the supersaturated calendar over the coming days means the Euro’s own incoming data may take a back seat.

British Pound Forecast: GBP/USD to Take Cues From FOMC/BoE Interest Rate Outlook

The Bank of England’s (BoE) ‘Super Thursday’ event may shake up the near-term outlook for GBP/USD should Governor Mark Carney and Co. show a greater willingness to gradually move away from its easing-cycle.

Japanese Yen Forecast: How Much Confidence Does the BoJ Have in the Trump Trade?

Next week brings the Bank of Japan to global markets, and while little by way of ‘new information’ is expected, the context with which the bank is communicating to markets makes for an extremely interesting opportunity to gauge what the BoJ might be looking to do in the remainder of the year.

Canadian Dollar Forecast: Canada May Win the Trump Trade Game At Other’s Expense

The Canadian Dollar has almost completely retraced the jawboning on January 18 from BoC Governor, Stephen Poloz against the US Dollar.

New Zealand Dollar Forecast: As Global Risks Increase, Markets May See that Kiwis Can Fly

In terms of upcoming data, December’s New Zealand overseas trade data (released Monday) and the fourth-quarter labour market figures (out Wednesday) are likely provide more evidence that the effect on activity of November’s earthquake was fairly limited.

Chinese Yuan Forecast: Yuan Faces Major Event Risks Despite Holiday

China will release the Caixin PMI manufacturing print for January on Thursday, which is expected to drop slightly to 51.8 from 51.9, yet still in the expansion territory.

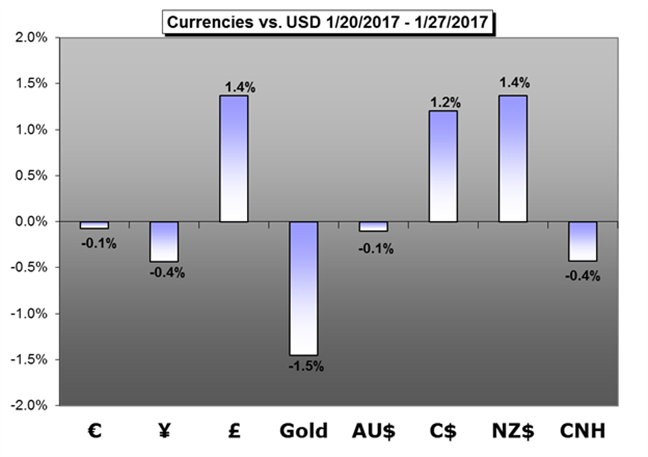

Gold Forecast: Gold Prices Post First 2017 Weekly Loss- Fed, NFP to Challenge Support

Gold prices snapped a month long winning streak this week with the precious metal down 1.78% to trade at 1188 ahead of the New York close on Friday. The pullback marks the first down week for gold this year and heading into the close of January trade, the focus shifts to key event risk on tap next week.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See the DailyFX 1Q 2017 forecasts for the Dollar, Euro, Pound, Equities and Gold in the DailyFX Trading Guides page.