Fundamental Forecast for GBP: Neutral

Sterling (GBP) Talking Points:

- Party leaders cannot agree on television debate schedule.

- Brexit vote on December 11 may be delayed.

The DailyFX Q4GBP Forecast is available to download.

The Brexit agreement vote on December 11 is now looking unlikely according to talk from some senior Conservative members as the Irish backstop conundrum continues to dominate proceedings. The chair of the influential 1922 committee of Conservative backbenchers said yesterday that unless the UK had an answer to how it may remove itself from the Northern Irish backstop that he would ‘welcome the vote being deferred until such time as we can answer that question’. Prime Minister Theresa May, who is fully expected to lose the vote if it occurs, brushed aside such thoughts and said the vote would take place as planned. This is contrast to the television debate between the PM and the leader of the opposition which has now been cancelled as both the BBC and ITV have refused to host the debate due to the demands of either leader.

There has also been a growing groundswell from MPs to shift course from PM May’s deal to a softer Brexit with Parliament taking control of negotiations if/when the PM’s deal is voted down on Tuesday. As it stands, next week could be a make or break moment for Theresa May who may well not be the Prime Minister going into the New Year.

Brexit Latest: Sterling Sinks as UK PM May Loses Control.

Brexit News: Sterling (GBP) Soars after EU Dangles Brexit Carrot.

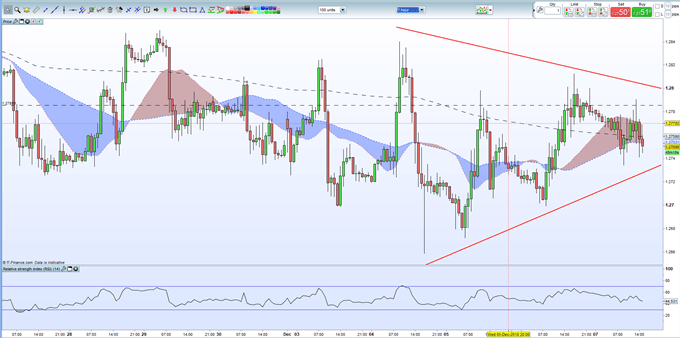

Against this chaotic background, Sterling has traded sideways with investors unwilling to commit themselves in such a volatile market. A softer Brexit would be met with some enthusiasm by the market and see Sterling push higher, while a lost vote and increased pressure on PM May to resign would leave the British Pound adrift and probing fresh 18-month lows. We are neutral on Sterling and will remain so until there is some Brexit clarity, and leadership, something that has been lacking over the last two years.

Brexit Impact on Sterling: How the Pound Might Move After the Parliamentary Vote.

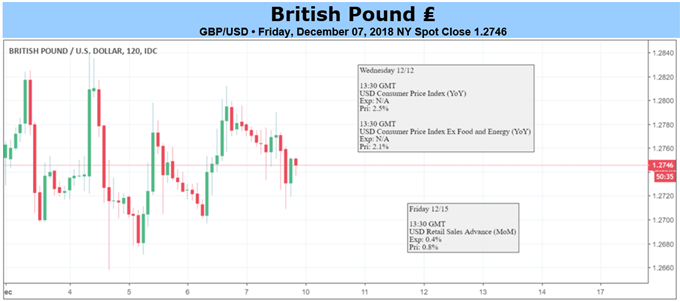

GBPUSD One Hour Price Chart (November 27 – December 7, 2018)

IG Client Sentiment data show 65.4% of traders are net-long GBPUSD. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests that GBPUSD prices may continue to fall. However, the combination of recent daily and weekly positional changes suggests that GBPUSD may soon reverse higher.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Fundamental Forecast:

Japanese Yen Forecast - USD/JPY to Track October Range as Attention Turns to U.S. CPI

Oil Forecast - OPEC And Friends Production Cut Exceeds Expectations, Crude Rallies

Canadian Dollar Forecast –Canadian Dollar's Shifting Sentiment May Boost Short Term Prospects