Australian Dollar Fundamental Forecast: Neutral

Talking Points:

- Australian Dollar appreciated this week as Wall Street recovered and volatility cooled

- RBA’s Governor Philip Lowe reinforced that the central bank is in no rush to raise rates

- Risk appetite and external factors seem to be what could drive Aussie Dollar next week

Not sure where to start on your trading strategy? Check out our beginners' guide !

After two weeks of heavy selling pressure amidst market-wide risk aversion, the sentiment-linked Australian Dollar launched a recovery against its US counterpart. Its appreciation was accompanied by a recovery on Wall Street and other stock exchanges as volatility cooled. The CBOE’s VIX, which came under manipulation allegations, fell below 20 on February 14th.

A slightly disappointing local jobs report failed to hinder the Aussie Dollar’s advance. There, Australia experienced an overall net gain in employment. In fact, the outcome even beat expectations. However, traders cared more about the contraction in the full time sector, which was the worst since September 2016. That was also accompanied with a decline in the labor force participation rate.

The following day RBA Governor Philip Lowe testified to the House of Representatives. He noted that the next rate move will likely be up and that “less monetary stimulus is appropriate at some point”. However, a key takeaway from the speech was that he didn’t “see a strong case for a near-term policy adjustment”. This also brings us to what might be in store for the Australian Dollar going forward.

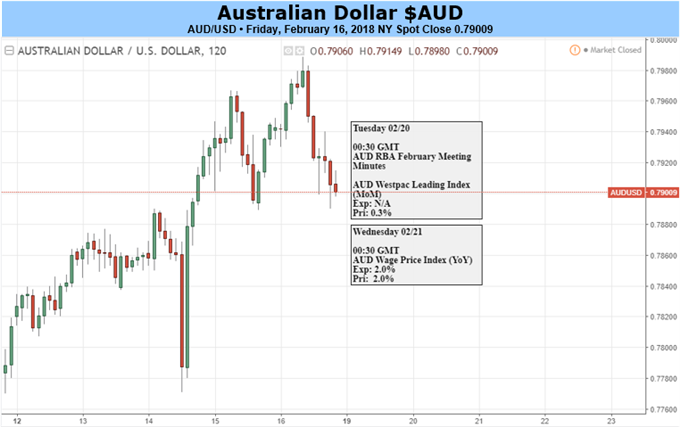

Australia’s economic calendar is lacking critical event risk in the week ahead. Yes, we do have the minutes of RBA’s February monetary policy statement and then the wage price index release. The former will probably echo the central bank’s reluctance to commit to changing rates for now. The latter could be a wildcard if strong wage growth inspires another bout of inflation fears (though the recent better-than-expected US CPI report failed to do so).

Given a static RBA outlook, the Australian Dollar will probably be most vulnerable to risk appetite and external factors in the coming week. We do have the FOMC meetings minutes coming up, but the details of the release will be tied to a rather uneventful monetary policy decision. With that in mind, the outlook will be neutral as the Aussie seems likely to continue tracking stock markets.