EURO FORECAST, DAX INDEX ANALYSIS, EUROZONE GDP PREVIEW – Talking Points

- Euro could rise with German DAX equity index on Eurozone GDP reports

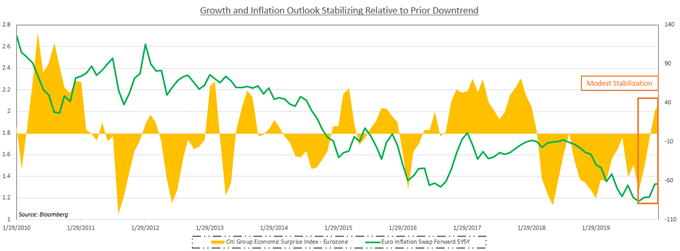

- Stabilization in regional growth may pour cold water on ECB rate cut bets

- Coronavirus fears could undo progress if risk aversion overflows from Asia

ASIA-PACIFIC RECAP: AUD SHRUGS AT CHINA PMI, FOCUSES ON CORONAVIRUS

The Australian Dollar shrugged after Chinese PMI statistics were published, suggesting the cycle-sensitive AUD was focused on risk trends future fundamental risks. Some APAC equities were nursing their losses while others continued their decline amid the region-wide selloff as coronavirus fears infected market mood.

EUROZONE GDP

Advanced, seasonally-adjusted Q4 Eurozone GDP data is expected to show a 1.1 percent growth rate on a year-on-year basis, while its quarter-on-quarter counterpart is estimated to show an unchanged print at 0.2 percent. Regional economic data has been tending to outperform economists’ expectations as global growth continues to show signs of stabilization according to the International Monetary Fund’s assessment.

Euro May Rise on Better-Than-Expected Economic Data

At the most recent ECB interest rate meeting, President Christine Lagarde warned investors that they should not assume the central bank is on “autopilot”, adding that policy changes in the next year are not ruled out. While these comments cooled easing expectations, the outbreak of the coronavirus saw overnight index swaps gradually price in modestly higher probabilities of easing in anticipation of the virus’ economic impact.

WHAT TO WATCH FOR POST-FOMC: US PCE, CONSUMER DATA

The Euro may also continue its recovery against the US Dollar if Core PCE data – a well-known favorite inflation tool of the Fed – shows a weaker-than-expected print for December. Price growth in the US continues to remain subdued despite signs of global growth stabilization and political respite from the US-China trade war. However, those fears may soon be replaced by another trade tiff – only this time it may be with an ally.

PCE Core Deflator data on an annual timeframe is anticipated to show a 1.6 percent print, unchanged from the prior figure. University of Michigan sentiment data will also be released which may elicit volatility since a softer report could signal that the consumer – the driving force behind the world’s largest economy – is growing worried. What other consumer-related indicators should traders be watching?

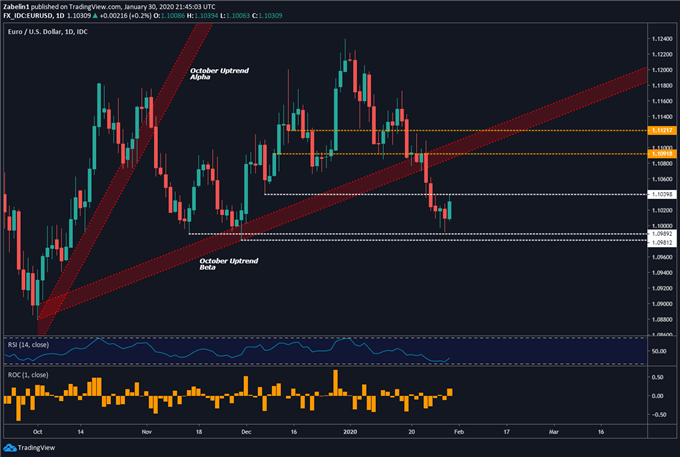

EUR/USD TECHNICAL OUTLOOK

After clearing support now-turned-resistance at 1.1091 (gold-dotted line), EUR/USD is now trading just below 1.1039 after bouncing back from December lows at 1.0989 (white-dotted lines). Breaking below last year’s support could precede an aggressive selloff and open the door to re-testing the bottom of what became the October uptrend.

EUR/USD – DAILY CHART

EUR/USD chart created using TradingView

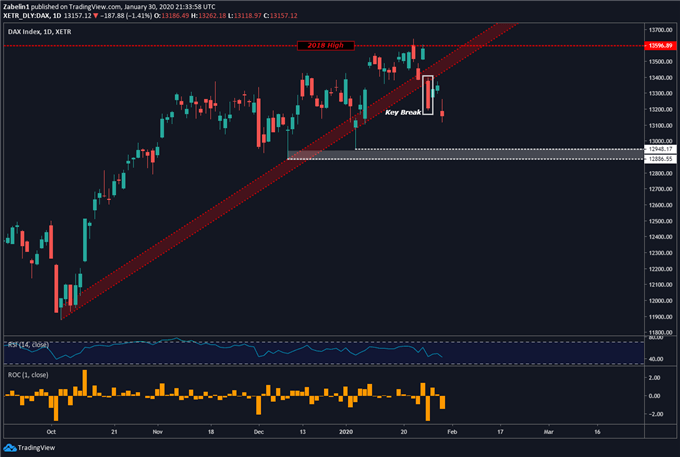

DAX PRICE CHART

As outlined in my prior technical DAX outlook, the German equity index continues to fall after failing to clear 2018 resistance and breaking below the October uptrend. It is now approaching a critical support zone between 12886-12948. A bounce back could be met with a renewed desire to retest the 2018 high. On the other hand, breaching below this area could open up the door for further losses and make a near-term recovery less likely.

DAX INDEX – DAILY CHART

DAX chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter