EU-US Trade War, Euro Outlook – Talking Points

- Euro outlook gloomy as EU-US trade tensions mount despite recent truce

- US President Donald Trump has threatened to impose auto import tariffs

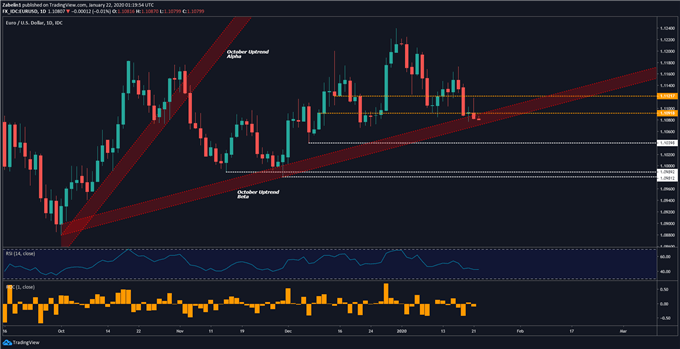

- EUR/USD testing October uptrend; downside breakout may catalyze selloff

Euro at Risk From EU-US Trade War

What once seemed to be blue skies appears to have been more a fickle moment of respite as the Euro now finds itself under the dark clouds of a looming but familiar fundamental risk: a revived EU-US trade war. At the World Economic Forum (WEF) in Davos, Switzerland, US President Donald Trump threatened to impose auto tariffs against the EU “if they don’t make a deal that’s a fair deal” (WSJ).

What this essentially does is render the prior trade truce Mr. Trump established with his French counterpart, Emmanuel Macron, worthless. Trade policies with single EU member states are agreements with the entire bloc. By levying tariffs against one, it is essentially an attack against all. Consequently, the regional bloc would have to respond in kind. Another trade tiff would likely boost ECB rate cut bets and pressure the Euro.

A cross-Atlantic trade war would batter the Eurozone’s growth prospects and push inflation expectations lower. In the IMF’s World Economic Outlook report, analysts pointed to signs of economic stabilization but warned that geopolitical risks – like growth-hampering trade policies – could make GDP fall under the projected baseline. Learn more about how politics impacts markets here !

EUR/USD Technical Analysis

EUR/USD has broken and closed below the lower bound of the 1.1091-1.1121 (gold-dotted lines) support-turned-resistance range, opening the door to testing the floor at 1.1039 (white-dotted line). The pair is also testing a key upward-sloping support channel (labeled as “October Uptrend Beta”), which, if broken may catalyze an aggressive decline beyond the 1.1039 floor.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter