US Dollar Talking Points:

- This morning brought the release of November CPI numbers out of the US.

- Later today brings the FOMC’s final rate decision of 2019, and the primary focal point will be on expectations for policy in 2020. Outside of the US, tomorrow brings both an ECB rate decision along with the UK general election, keeping both EUR/USD and GBP/USD in the spotlight.

- The US Dollar has pushed lower so far this week off of a key zone of resistance, following the Friday rally on the back of better-than-expected NFP data.

US CPI Beats Expectations, Focus Shifts to Fed

We’re now part of the way through today’s US drivers with the big one looming for later this afternoon. This will mark the Fed’s final rate decision of 2019 while shifting focus of Fed policy into 2020 and thereafter. There’s little expectation for any actual moves today out of the Fed and given the fact that the bank has cut rates at each of the past three meetings following an aggressive hiking posture last year, the big question remains what the FOMC might be looking to do as a next step.

This morning’s CPI data came out above expectations, printing at 2.1% versus an expectation of 2.0. This marks the first print above 2% since November of last year, as well as the strongest rise in the indicator in over a year. The impact to the US Dollar, however, has been fairly subdued at this point as a much bigger driver awaits for later on today.

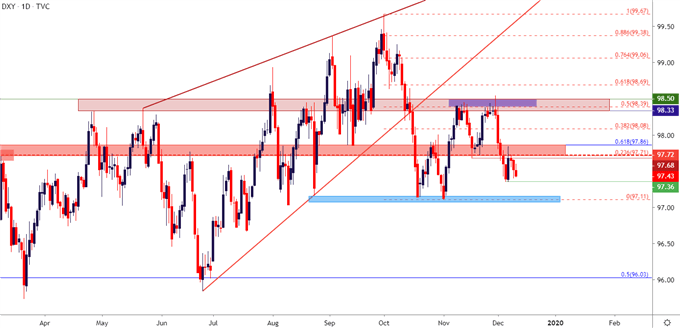

In the US Dollar, prices remain very near December lows and just a little-lower is the three-month-low at 97.11. Last week brought a flicker of strength to the currency after sellers re-appeared around the December open, and this was largely driven by a better-than-expected NFP report. The big question now is whether bears will remain in-control around the FOMC rate decision later this afternoon.

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

As discussed earlier this week, expectations for any actual moves at today’s meeting are minimal. More interesting is what the FOMC says about forward-looking policy, and this will be largely communicated through the dot plot matrix and the accompanying press conference set to begin at 2:30 PM ET.

At the most recent rate decision in late-October, the bank cut rates for the third time in as many meetings but the initial response was one of US Dollar strength. Prices in the currency quickly flickered up to a key zone of resistance, holding in that area as the press conference began. But the big takeaway for that outlay came about ten to twenty minutes later, when FOMC Chair Jerome Powell said that the bank wasn’t looking to hike rates unless there was a ‘really significant’ rise in inflation.

That hasn’t happened, at least not yet, but the question remains as to whether the Fed sees more cuts in 2020 or whether they’re expecting a continued pause in policy as a number of headline items, such as trade wars or upcoming elections, carry the potential for further volatility.

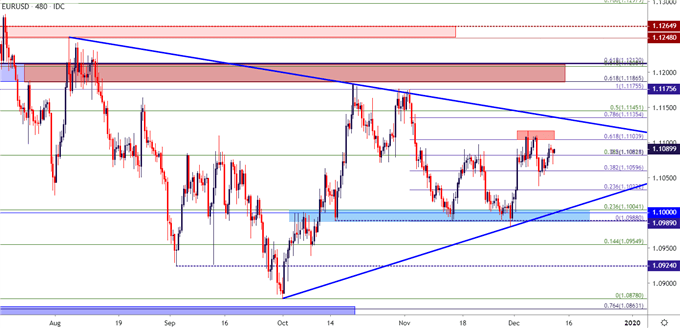

EUR/USD Continues Coil, Will the Pair Pick a Direction?

At this point EUR/USD has spent Q4 coiling into a tighter range. The pair found resistance in early-August, leading into a sell-off that held into the October open, after which prices have continued to move into a narrowing wedge. So far in December, that range has been just a little over 130 pips, with support holding around 1.0980 and resistance at 1.1116.

Tomorrow brings an ECB rate decision and this is Christine Lagarde’s first atop the ECB. It may be easy to dismiss this as a ‘tone setting’ meeting but, as usual around such subjective events, the devil is in the details.

EUR/USD Eight-Hour Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

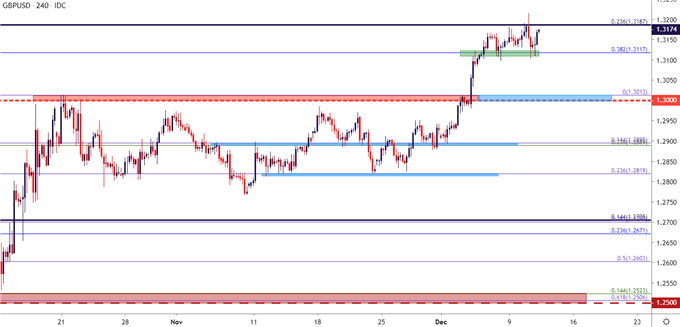

GBP/USD Holds Near Highs Ahead of UK Election

Tomorrow brings some significant headline risk for the British Pound as UK voters go to the polls for another round of general elections. I had looked at this one in yesterday’s webinar as it’s been a theme-of-interest for a few months now. After a back-breaking downtrend pushed the British Pound lower through this summer, support arrived in August/September in the form of a long-term trendline projection. That helped to hold the lows and buyers soon showed up ahead of the Q4 open. But it was October when bulls really made their mark, pushing GBP/USD up to the 1.3000 psychological level after the 1.2000 price had been tested just a month before.

At this stage, the breakout is overbought by a number of metrics. But that hasn’t stopped bulls from continuing to push ahead of the election, begging the question as to just how long GBP/USD can continue to gain.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX