US Dollar Talking Points:

- Yesterday’s FOMC rate cut initially brought little bearish impact to the US Dollar. But a comment from FOMC Chair Jerome Powell during the accompanying press conference appeared to take a toll, and USD price action has continued lower ever since.

- The US Dollar is currently sitting at two-month-lows following the early-October/Q4 reversal. Can USD sellers continue to push now that the Fed has indicated rate hikes won’t be in the equation until a ‘really significant’ rise in inflation?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

For most of yesterday’s FOMC rate decision and press conference, the US Dollar held support and showed some element of strength, even as the Fed cut rates for the third time in as many meetings, almost completely taking-out last year’s hikes. But, there was a catch point, and it appeared to show right around the time FOMC Chair Jerome Powell said that the bank would need to see a ‘really significant’ rise in inflation before hiking rates. This turned the US Dollar lower from a key zone of resistance, the same that was looked in these articles of recent, and sellers have continued to push ever since.

So, at this point, it would appear that Chair Powell has threaded the needle for this particular scenario: He didn’t pledge or commit to additional cuts but on the same token he removed a bit of the fear that remained after posing prior rate cuts as ‘mid cycle adjustments’ or ‘insurance rate cuts,’ each of which kept the door open to near-term hikes should the data indicate stronger inflation. But with yesterday’s comment, this is no longer as large of a concern and the Greenback has continued tracking-lower through Asian and European sessions.

The focus now moves on to data with this morning’s release of the Fed’s preferred inflation gauge of PCE to go along with tomorrow’s release of Non-Farm Payrolls data for the month of October.

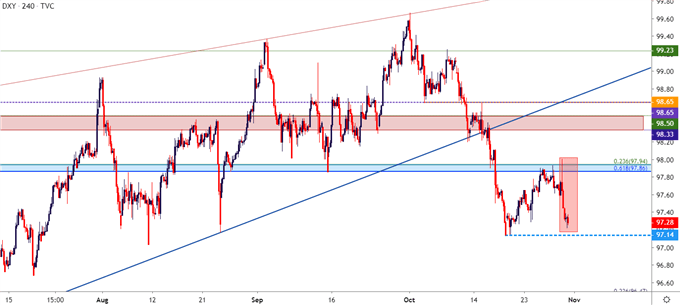

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

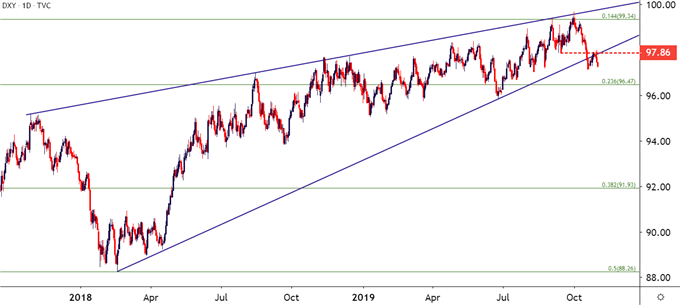

Taking a step back on the US Dollar and additional weakness can be an attractive theme to work with. This was looked at in the Q4 Technical Forecast for the US Dollar, focusing-in on a rising wedge formation that will often be approached for bearish reversals. With the first month of Q4 now almost in the books, that’s been the backdrop for the USD so far as a series of negative data points have brought sellers into the mix since the October open.

Download the Q4 Forecast for the US Dollar

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

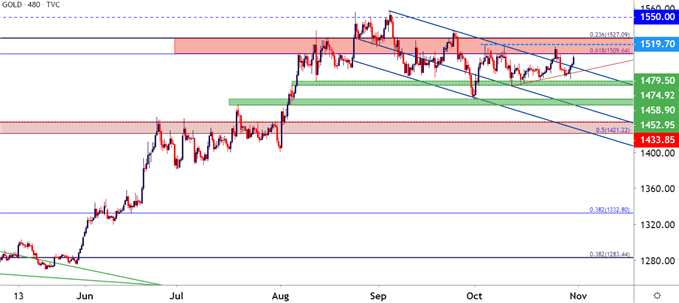

Gold Prices Push-Higher to go with US Dollar Weakness

With USD-weakness coming into play one of the natural directions is to look for strength in Gold prices. At this stage, the advance in Gold has been relatively muted as price action has yet to test the October highs. This can be a precarious spot to investigate topside exposure in Gold as price action is lurking below resistance. This can, however, keep the door open for support inflections off of the 1475-1480 zone that’s been in-play over the past few weeks or, alternatively, topside breakouts above the October high showing around 1520.

Gold Eight-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX