Canadian Dollar, USDCAD Outlook Talking Points:

- USDCAD makes a trip back to range resistance after last week’s visit to support.

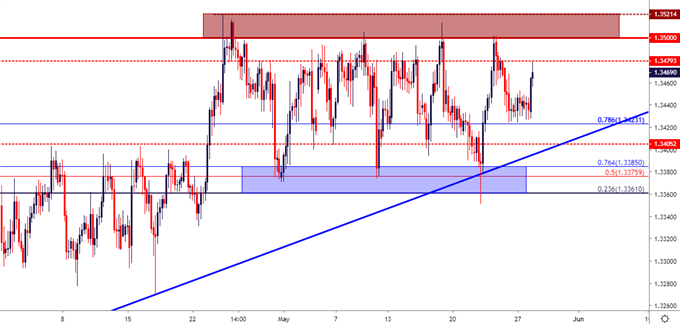

- The range in USDCAD has been going for more than a month now, with resistance around the 1.3500 handle and support taken from a batch of confluent Fibonacci levels from 1.3361-1.3385.

- Tomorrow brings a Bank of Canada rate decision on the economic calendar: Is this the driver that the pair’s been waiting for to set a fresh higher-high or lower-low?

- DailyFX Forecasts are published on a variety of currencies such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

USDCAD Rally to Range Resistance Ahead of Bank of Canada

The range continues in USDCAD, and this comes despite last week’s threatening test of support on Wednesday, at which point prices in the pair temporarily tested below the zone that’s helped to hold the lows since late-April. At that point, buyers returned, helped by a bullish trend-line that connects support in the pair since late-February, and staged another topside push back up to resistance in USDCAD. Tomorrow brings a Bank of Canada rate decision with the wide-expectation of no moves, begging the question as to whether the BoC tips their hand toward future rate cuts after getting more dovish at the April rate decision.

USDCAD Four-Hour Price Chart

Chart prepared by James Stanley

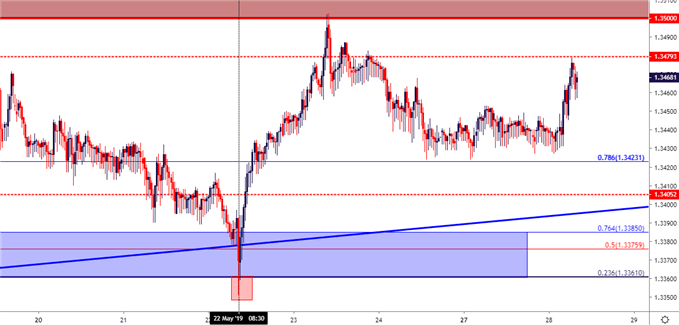

Last week’s support test in USD/CAD was short-lived. Prices in the pair had tilted-lower leading into Wednesday trade, at which point a disappointing data point was released with Canadian retail sales figures. That print hit at 8:30 AM ET last Wednesday, and that syncs well with the short-term reversal of price action in the pair, when prices quickly pivoted from below support and all the way back to resistance over the next 24 hours. That resistance hold held into the open of the fresh week, and as US markets come back online after the Monday holiday, USD/CAD price action is pushing right back towards range resistance.

USDCAD 30-Minute Chart

Chart prepared by James Stanley

USDCAD Breakout Potential: Is BoC the Catalyst?

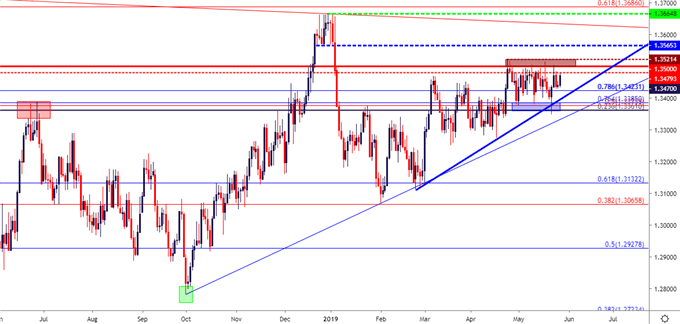

At this point, USDCAD has spent the bulk of the past five months with a bullish bias, including the past month of range-bound behavior; aided by the trend-line looked at above. More recently, resistance at the 1.3500 handle has become somewhat of a hindrance, as that bullish advance has simply been unable to incline above this very key level on the chart.

Given last month’s dovish Bank of Canada rate decision, the wide expectation appears to be looking for a more-dovish BoC to elicit a move of further weakness in the currency, which could allow for topside breakouts in the USDCAD pair.

Last month’s dovish pivot at the BoC, in which the bank hinted away from the prospect of rate hikes this year, prices in USD/CAD temporarily tested above the 1.3500 handle. Swing traders quickly pulled prices back into the range, which remains in-play today. But, should the BoC further that dovish language, the potential opens for a topside break and a resumption of the longer-term trend in the pair. Breakout targets can be attractive around the prior January swing-low in the 1.3570 region, followed by targets cast towards the two-year-high of 1.3665.

USDCAD Daily Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX