Check out the brand new DailyFX trading forecasts for Q3

MARKET DEVELOPMENTS – USD BREACHES KEY RESISTANCE ON EM ROUT

US equity futures are trading with losses across the board as European bourses are dragged lower by EU banks amid reports that some banks could be exposed to the drop in the Turkish Lira.

USD: Safe haven flows have flooded into the US Dollar this morning, with the currency breaking above YTD highs to trade above the 96.00. This has largely been due to the selling seen in the Euro after reports from the FT that EU banks may be exposed by the fall in the Turkish Lira. Consequently, EURUSD broke below key support at 1.15, trading at around the mid.1.14s. This also opens the way for further losses to 1.1350. Elsewhere, US inflation remains firms with the core CPI figure posting its largest gain since September 2018 and as such further underpinned the USD.

TRY: As mentioned, reports from the FT that the ECB are increasingly concerned over the exposure that European banks have on the falling Turkish Lira. Prompted a fresh record low in the Lira, which hit lows of 6.36 against the USD, this in turn has sparked a 12% gain in USDTRY today. Alongside this, the Trump added to the pressure on the Lira by

RUB: Another EM currency that has taken a hit for much of the week is the Russian Rouble, which has fallen to the lowest level since June 2016 amid concerns over further sanction measures from the US against Russia. In response to this potential threat, the Russian PM stated that moves to limit banking activity will be an act of war.

GBP: The Pound is softer amid the rise in the USD, however, losses had been pared slightly amid the generally firmer UK data. UK GDP for Q2 bounced back from the slowdown in Q1, while manufacturing, construction and industrial had also been relatively firm. However, Brexit continues to be the key driver for the Pound in the near term.

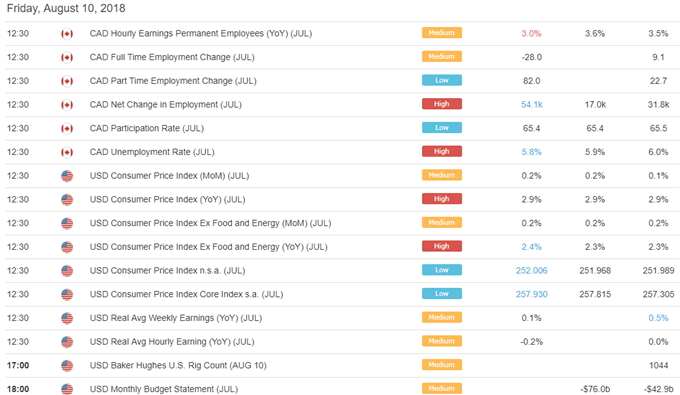

DailyFX Economic Calendar: Friday, August 10, 2018 – North American Releases

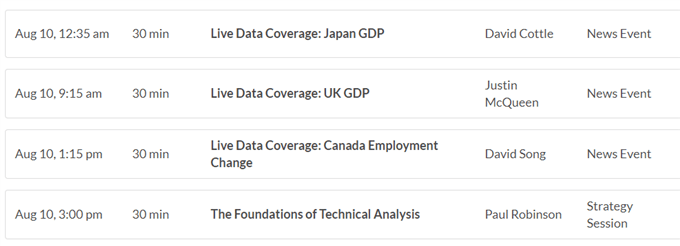

DailyFX Webinar Calendar: Friday, August 10, 2018

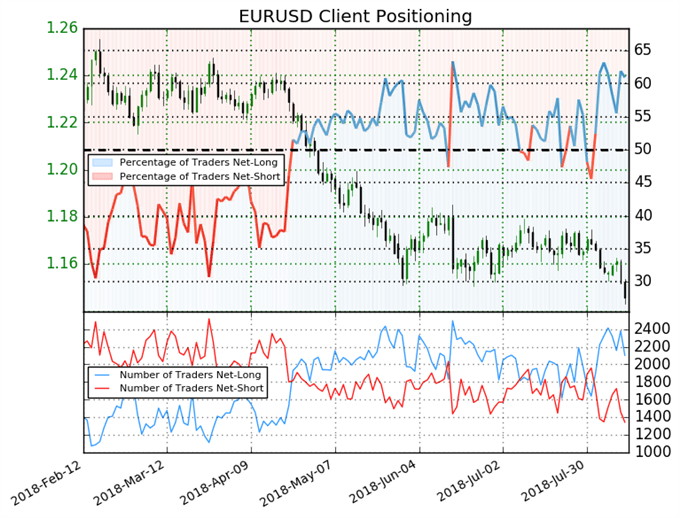

IG Client Sentiment Index: EURUSD Chart of the Day

EURUSD: Data shows 61.0% of traders are net-long with the ratio of traders long to short at 1.56 to 1. In fact, traders have remained net-long since Aug 01 when EURUSD traded near 1.15861; price has moved 1.1% lower since then. The number of traders net-long is 2.8% lower than yesterday and 8.0% lower from last week, while the number of traders net-short is 21.9% lower than yesterday and 2.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

Five Things Traders are Reading

- “US Dollar Maintains Gains as July CPI Report Shows Elevated Inflation”by Christopher Vecchio, CFA, Sr. Currency Strategist

- “EUR/USD Triangle Breakdown Fueling DXY Index Breakout" by Christopher Vecchio, CFA, Sr. Currency Strategist

- “Bitcoin & Ripple Technical Analysis - Charts Point to Further Losses”by Nick Cawley, Market Analyst

- “GBP Pares Losses as GDP Bounces Back, However, Brexit Remains Key Driver”by Justin McQueen, Market Analyst

- “US Dollar Soars, Gold Slumps, EUR Rattled on Turkish Lira Concerns” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com Follow Justin on Twitter @JMcQueenFX