Gold, NZD Analysis & News

- Not So Summer Lull in NZD Volatility Markets

- Gold Losing its Shine with Correction Lower

- Oil Prices on the Rise.

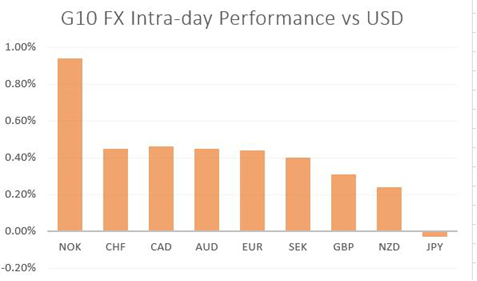

Currencies: US Dollar selling has been the main theme throughout the European session with the greenback dropping 0.3%. As such, the Pound has reclaimed the 1.3100, while the Euro made a test of 1.1800 (little interest above 1.1800). However, as we noted in the COT report, crowded long positioning in the Euro may see 1.19 confirmed as the interim top for EUR/USD.

Not So Summer Lull in NZD Volatility Markets

Perhaps the main event over the next 24 hours in the FX space will be the RBNZ monetary policy decision, and after NZ PM Ardern announced that NZ will increase lockdown measures from tomorrow, this makes for an even more interesting meeting. As it stands, NZD 1-day implied volatility is at the highest level since March, suggesting an implied move of circa 1% either way for NZDUSD. As a reminder, at the last meeting, the main sticking point had been the RBNZ’s concerns over the appreciation of the Kiwi, which on a trade-weighted basis has far exceeded the central bank’s forecast. While little is expected over a change in the OCR, there is a potential for an increase in QE (currently stands at NZD 60bln until May 2021). However, markets are already dovish ahead of the meeting given the recent underperformance in NZD against its major counterparts, most notably the Euro and AUD. That said, while the bar might be high to surprise on the dovish side, the RBNZ has proved time and time again that it can still provide a dovish surprise if needs be. Previous too meetings saw NZDUSD drop 1.2% and 1.8%.

Equities: Firm gains across the board in Europe with major bourses up over 2%, which in turn has spilled over into US equity futures. Cyclical stocks appear to be leading the gains with the energy sector outperforming on the back of the uptick in oil prices.

Stoxx 600 Sector Breakdown

Gold Losing its Shine

Commodities: A corrective move lower gold prices this morning with the precious metal breaks below 2000 with silver also seeing a hefty 5% drop, despite a weaker USD. Although, as we have noted previously, the focus for PMs is on the bond market and real yields, which bottomed out last week with the 10yr now back above 60bps amid a deluge of supply via auctions as well as hefty corporate issuance. Alongside this, in light of the recent retail frenzy into gold (in particular gold ETFs), the sell-off may exacerbate, opening the doors to 1920.

Looking ahead: The main focus will be on the RBNZ monetary policy, while US fiscal talks continue to attract interest.

Source: Refinitiv, DailyFX

WHAT’S DRIVING MARKETS TODAY

- “British Pound (GBP) Latest: GBP/USD Shrugs Off UK Employment Data, Focus Now on Q2 GDP” by Nick Cawley, Strategist

- “US Dollar Bears Increasingly Crowded, GBP/USD Rose on Short-Covering - COT Report” by Justin McQueen, Analyst

- “US Dollar Index (DXY) Continues to Look Weak, Building Continuation Pattern” by Paul Robinson, Strategist