- USD/CAD weekly opening-range intact ahead of US NFPs – breakout pending

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Canadian Dollar is virtually unchanged against the US Dollar since the start of the week and we’re looking for a break of the weekly opening-range heading into US Non-Farm Payrolls on tap tomorrow morning. These are the updated targets and invalidation levels that matter on the USD/CAD charts this week. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CAD Daily Price Chart

Technical Outlook: In my latest USD/CAD Price Outlook we noted that Loonie was, “testing the origins of last week’s breakout and we’re looking for support ahead of 1.34 IF the broader up-trend is to remain viable– be on the lookout for possible price exhaustion / long-entries on a love lower.” Price briefly registered a low at 1.3377 before reversing sharply higher on with the advance now testing the weekly opening-range highs ahead of NFPs – look for the break for guidance.

A pivot / close back below 1.3435/37 would expose the monthly open at 1.3388 with bullish invalidation at the lower parallel / April open / 100-day moving average at 1.3340/45. A breach / close above the median-line is needed to fuel the next leg higher in price targeting the highlighted confluence zone at the 78.6% retracement of the yearly range at 1.3537.

Why does the average trader lose? Avoid these Mistakes in your trading

USD/CAD 120min Price Chart

Notes: A closer look at price action shows Loonie attempting to breach above near-term channel resistance today with the weekly opening-range capping the highs at 1.3479. A topside breach is needed to keep the immediate long-bias viable targeting the 100% extension at 1.3515 and confluence resistance at 1.3537- look for a bigger reaction there IF reached. Initial support rests at 1.3435/37 – weakness beyond this threshold would shift the focus back towards the 61.8% retracement at 1.3369 backed by the lower parallel at 1.3340/45.

Learn how to Trade with Confidence in our Free Trading Guide

Bottom line: USD/CAD has set a clean weekly opening-range and we’re looking for the break heading into NFPs tomorrow. From at trading standpoint, the immediate focus is on a break of the 1.3435-1.3479 zone for guidance with a breach above the median-line needed to fuel the next leg high. Ultimately, I’d be looking to fade strength on a spoke towards 1.3537. Review my latest Canadian Dollar Weekly Price Outlook for look at the longer-term technical picture.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

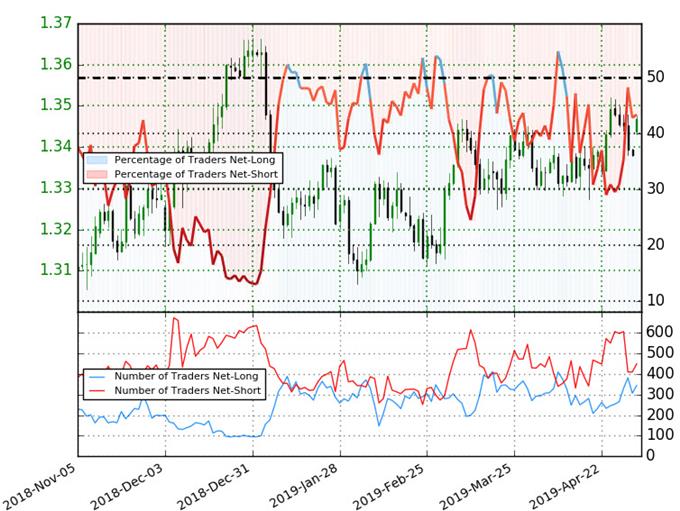

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short USD/CAD- the ratio stands at -1.31 (43.4% of traders are long) – weak bullishreading

- Long positions are17.1% lower than yesterday and 26.6% higher from last week

- Short positions are13.7% higher than yesterday and 26.0% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Traders are further net-short than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias from a sentiment standpoint.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

---

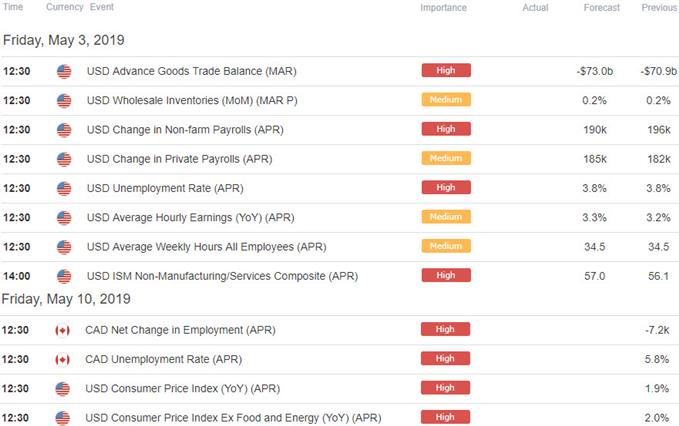

Relevant US / Canada Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- Gold Price Outlook: XAU Testing Yearly Lows – Shorts Vulnerable

- Sterling Price Outlook: GBP/USD Bulls Buckle Up for Fed, BoE, NFP

- Euro Price Outlook: EUR/USD Snap Back- Trade or Fade?

- Aussie Price Outlook: AUD/USD Collapse Targeting 70 Support

- Kiwi Price Outlook: New Zealand Dollar Recovery could be Short-Lived

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex