- Updated weekly technicals on the Canadian Dollar (USD/CAD) – recovery testing key pivot at fresh yearly high

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

In this series we scale-back and look at the broader technical picture to gain a bit more perspective on where we are in trend. The Canadian Dollar is up more-than 0.4% against the US Dollar this week with USD/CAD pullback back from confluence technical resistance. These are the updated targets and invalidation levels that matter on the USD/CAD weekly chart.

New to Forex Trading? Get started with this Free Beginners Guide

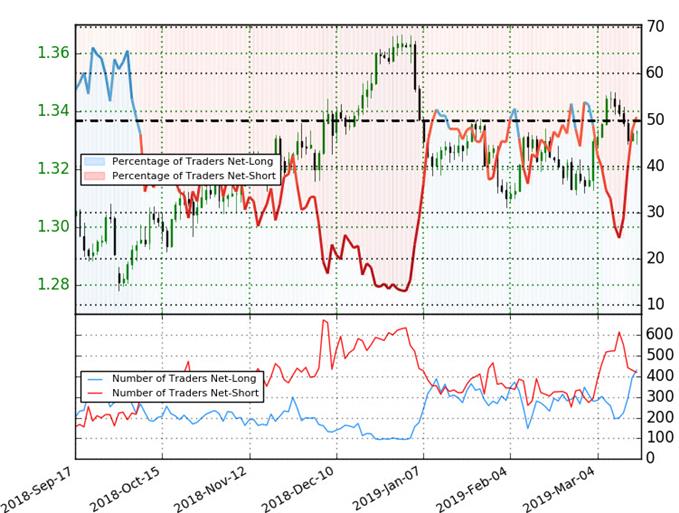

USD/CAD Weekly Price Chart

Notes: In last month’s USD/CAD Weekly Technical Outlook we noted that price was, “approaching a critical weekly support confluence at 1.3037/57 and we’re looking for a reaction in price on a drop into this zone early in the month. From a trading standpoint, a good area to reduce short-exposure / lower protective stops.” Price registered a low at 1.3068 before rebounding with the advance now trading below confluence resistance at 1.3435/37- a region defined by the 61.8% retracement of the December decline and the 2017 yearly open. A breach / close above this threshold is needed to fuel the next leg higher targeting 1.3647/86.

Weekly support now stands at the highlighted slope confluence around ~1.3140 with broader bullish invalidation steady at 38.2% retracement / 200-day moving average at 1.3052/70. Note that weakness beyond this level would also constitute a break of the yearly opening-range lows and would risk substantial losses in price with such a scenario targeting the October low-week reversal close at 1.2939.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: We’re looking for a pivot off the 1.3435/37 confluence resistance zone with the immediate long-bias vulnerable while below. From a trading standpoint, a good place to reduce long exposure / raise protective stops and be on the lookout for possible price exhaustion. I’ll publish an updated USD/CAD Price Outlook once we get further clarity in near-term price action. Keep in mind the FOMC interest rate decision is on tap next week.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +1.03 (50.6% of traders are long) – neutral reading

- The percentage of traders net-long is now its highest since March 4th

- Long positions are 39.3% higher than yesterday and 60.1% higher from last week

- Short positions are 14.3% lower than yesterday and 26.7% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias from a sentiment standpoint.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

---

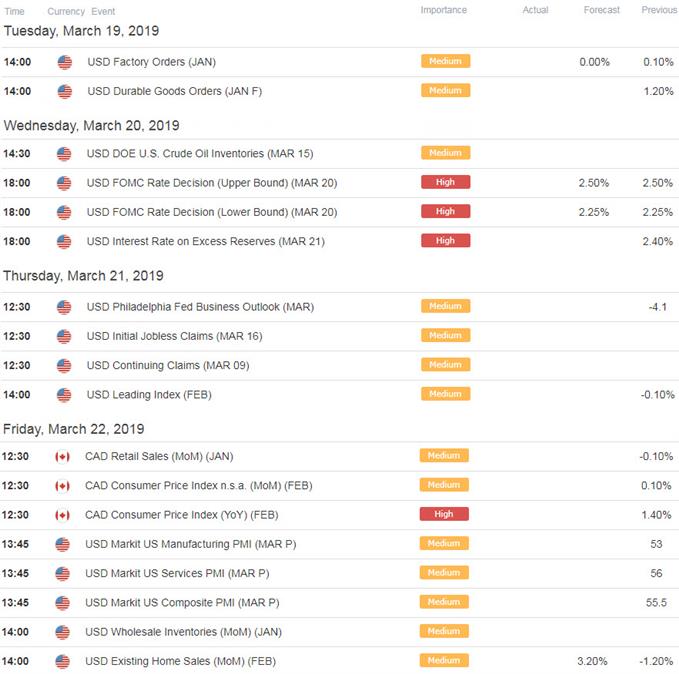

Relevant USD/CAD Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Previous Weekly Technical Charts

- British Pound (GBP/USD)

- Gold (XAU/USD)

- New Zealand Dollar (NZD/USD)

- Crude Oil (WTI)

- Australian Dollar (AUD/USD)

- Euro (EUR/USD)

- Japanese Yen (USD/JPY)

- Euro vs Japanese Yen (EUR/JPY)

Learn how to Trade with Confidence in our Free Trading Guide

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @ MBForex