- USD/CAD testing key resistance confluence into yearly open– 1.3686 critical

- Check out our new 2019 projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The US Dollar is testing a critical resistance confluence against the Canadian Dollar and leaves the broader uptrend vulnerable into the start of the year. These are the updated targets and invalidation levels that matter on the USD/USD charts.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CAD Daily Price Chart

Technical Outlook: In my latest USD/CAD Weekly Technical Outlook we noted that the price breakout was, “accelerating towards the next major confluence resistance zone at the 61.8% retracement of the 2016 decline / 2017 high-week close at 1.3647/86.” Note that the 61.8% slope line of the broader 2017 ascending pitchfork formation also converges on this region into the start of the month and further highlights its technical significance.

Interim support rests with the median-line (currently ~1.3450s) backed closely by the October channel support / 2017 open at 1.3435- a break / close below this region would suggest that a larger price correction may be underway with such a scenario targeting the 38.2% retracement at 1.3328.

Learn how to Trade with Confidence in our Free Trading Guide

USD/CAD 240min Price Chart

Notes: A closer look at price action highlights the October channel with USD/CAD carving out a weekly opening-range just below slope resistance. A break below 1.3565 would risk a deeper pullback here targeting the lower parallels at ~1.35 and 1.3535- look for a bigger reaction there for guidance IF reached. A breach above channel resistance would be needed to mark resumption of the broader uptrend targeting subsequent topside objectives at 1.3793.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

Bottom line: The USD/CAD rally is vulnerable near-term while below 1.3685. From a trading standpoint, I’ll favor fading weakness while below this region targeting a move towards the lower parallel. Ultimately, a larger setback may offer more favorable long-entries closer to daily slope support.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

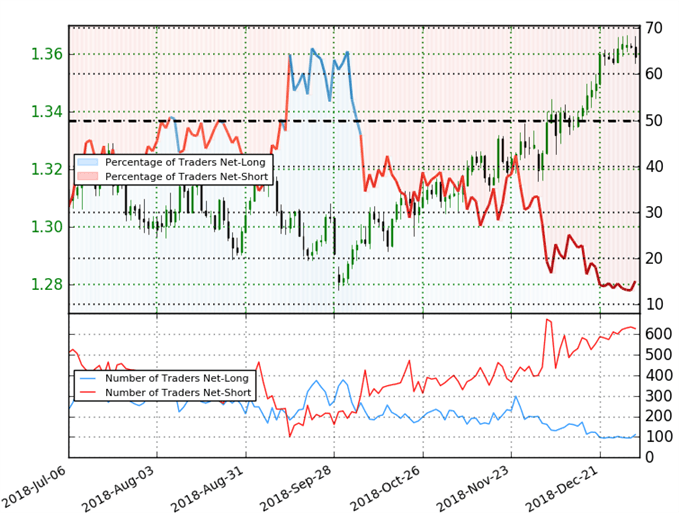

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -----5.64 (15.1% of traders are long) – bullishreading

- Traders have remained net-short since October 9th; price has moved 4.2% higher since then

- Long positions are15.6% higher than yesterday and 5.7% higher from last week

- Short positions are 0.8% lower than yesterday and 2.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

---

Relevant USD/CAD Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- Gold Technical Outlook: Price Shines as USD Dives Post-FOMC

- EUR/USD Price Outlook: Euro Consolidation Looks to FOMC For Fuel

- AUD/USD Price Outlook: Aussie Bounces from Big Support Ahead of Fed

- NZD/USD Technical Outlook: Price Reversal Targeting Trend Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex