- GBP/USD reverses off long-term slope support; risk for larger recovery while above 1.3164

- Check out our 2018projections in our Free GBP/USD DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The British Pound posted an outside-day reversal off slope support last week, shifting our near-term focus higher in price. The recovery has now pulled back from the monthly open and IF prices are indeed heading higher, this decline may offer near-term entries on the long-side. These are the updated intraday targets & invalidations levels that matter for GBP/USD.

GBP/USD Daily Price Chart

Technical Outlook: In last week’s Technical Perspective on the British Pound, we highlighted a confluence support zone in GBP/USD around ~1.3164, “This region is defined by the 50% retracement of the post-Brexit advance and converges on the lower median-line parallel & basic trendline support extending off the 2017 lows.” We noted that IF prices were going to recover- this would be a, “good spot” with daily RSI divergence further highlighting the risk for a near-term recovery.

Sterling rallied more than 1.6% off the lows last week before pulling back from monthly open resistance at 1.3290. A rally surpassing the 61.8% retracement of the monthly range at 1.3330 would be needed to suggest a more significant low is in place and validate a breakout with such a scenario targeting confluence resistance into the 1.35-handle. A downside break of this range keeps the broader short-bias in play targeting the lower parallel / October low at 1.3027.

New to Forex Trading? Get started with this Free Beginners Guide

GBP/USD 240min Price Chart

Notes: A closer look at Sterling price action highlights last week’s reversal off descending pitchfork support with price closing just below the monthly open at 1.3290- note that this level also represents the objective weekly opening-range high. A breach above this threshold keeps the focus higher targeting subsequent resistance objectives at 1.3330, the trendline confluence around 1.3360 and the 76.4% retracement at 1.3384. Interim support rests at 1.3203/08 with our near-term bullish invalidation level steady at 1.3164.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: The near-term risk is for a larger recovery on this rebound with our focus higher while above 1.3164. From a trading standpoint, I’ll favor fading weakness targeting the median-line - a breach / close above would be needed to keep the long-bias viable targeting 1.3450 and a more significant resistance confluence at 1.3495-1.3504 (2017 high-day close / 2018 open).

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

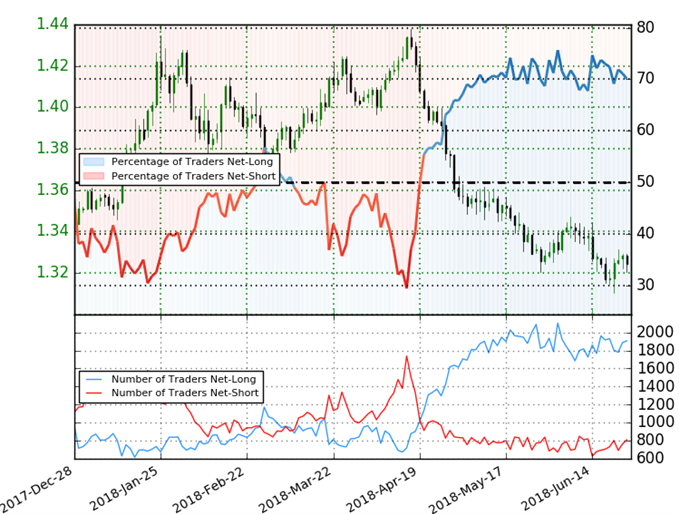

GBP/USD IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long the British Pound (GBP/USD)- the ratio stands at +2.34 (70.1% of traders are long) – bearishreading

- Traders have remained net-long since April 20th ; price has moved 6.6% lower since then

- Long positions are 2.9% lower than yesterday and 1.9% higher from last week

- Short positions are4.5% higher than yesterday and 10.5% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Sterling prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in GBP/USD retail positioning are impacting trend- Learn more about sentiment!

---

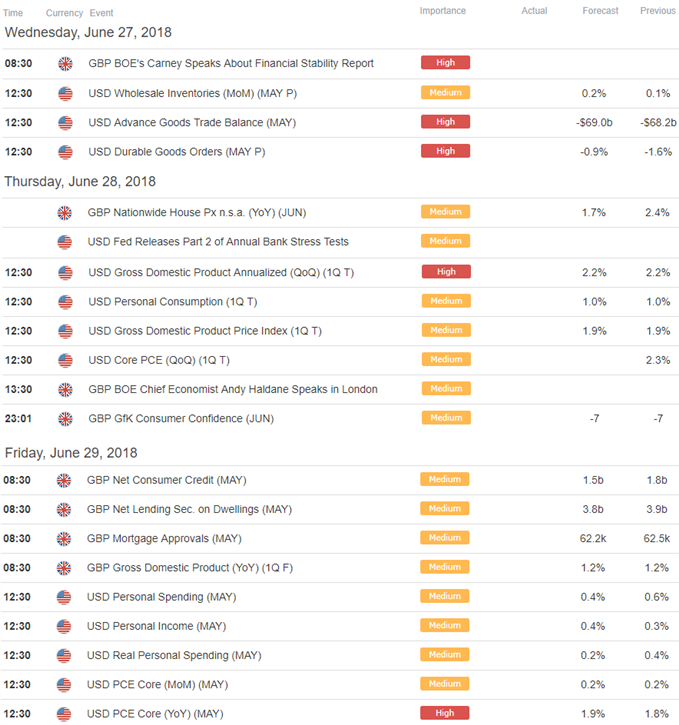

Relevant GBP/USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- US Dollar Reversal Under Review– USD Setup We’re Tracking This Week (Webinar)

- NZD/USD Price Analysis: Kiwi Testing Support at Fresh Yearly Lows

- XAU/USD Technical Outlook: Gold Prices Search for Support

- AUD/USD Technical Outlook: Charts Highlight Nearby Price Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com