Australian Dollar (AUD/USD) Analysis

- RBA keeps rates unchanged, surprising markets

- Inflation proves stubborn, with elevated levels expected until 2025

- AUD/USD pulls back - AUD more broadly, may find support from interest rate differentials (longer-term)

- Potential stabilization and benefits for the Aussie dollar amid global risk appetite

- Get your hands on the Aussie dollar Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

RBA Sticks to Policy Stance Despite Concerning Inflation Forecast

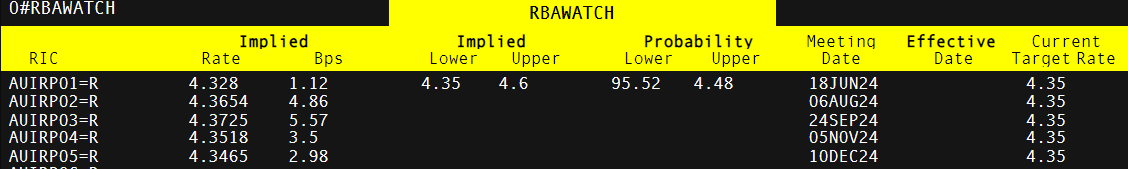

The Reserve Bank of Australia (RBA) decided to keep the interest rate at a 12-year high (4.35%) on Tuesday, deflating the hawkish buildup priced in by the market. Ahead of the meeting, markets had priced in a 43% chance of another rate hike in September, the figure currently sits around 5%.

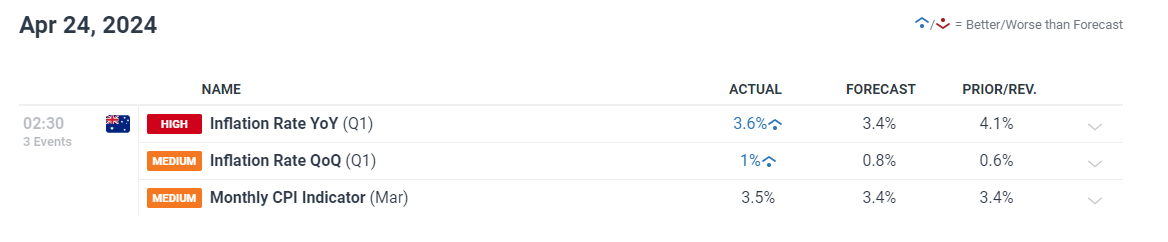

The major stumbling block for the RBA has been the recent resurgence behind inflation. Quarterly and yearly inflation measures proved to be hotter-than-expected for Q1, with the monthly indicator for March adding to the trend of data surprises. Inflation is proving difficult to get under control but Australia is having a particularly tough time.

Customize and filter live economic data via our DailyFX economic calendar

The RBA Governor, Michele Bullock, expressed that she doesn’t necessarily think the Board will need to hike again but isn’t ruling out anything. She went a bit further, communicating her frustration with the first quarters inflation data by stating the RBA hope the economy will not have to stomach even higher rates but if services inflation gets stuck, the committee will have to act.

What shocked the markets even more was the fact the RBA remained committed to their current monetary policy stance despite a notably higher and stubborn inflation forecast. Updated RBA staff forecasts expect inflation of 3.8% in June until December, only dipping back within the 2-3 percent target by December 2025. Central to the forecast is the assumption that the interest rate will remain unchanged until mid-2025 – nine months longer than the February forecast suggested. Therefore, the immediate disappointment playing out via a softer Aussie dollar will eventually find support due to this floor being set below Aussie rates. Other major central bank are seriously considering, or are on the verge of, cutting interest rates – something that may help support AUD provided there is no material risk aversion (flight to safety) playing out in the global economy.

Acquire an in-depth understanding of the role played by the Australian dollar in terms of global trade and its significance as a gauge of risk sentiment :

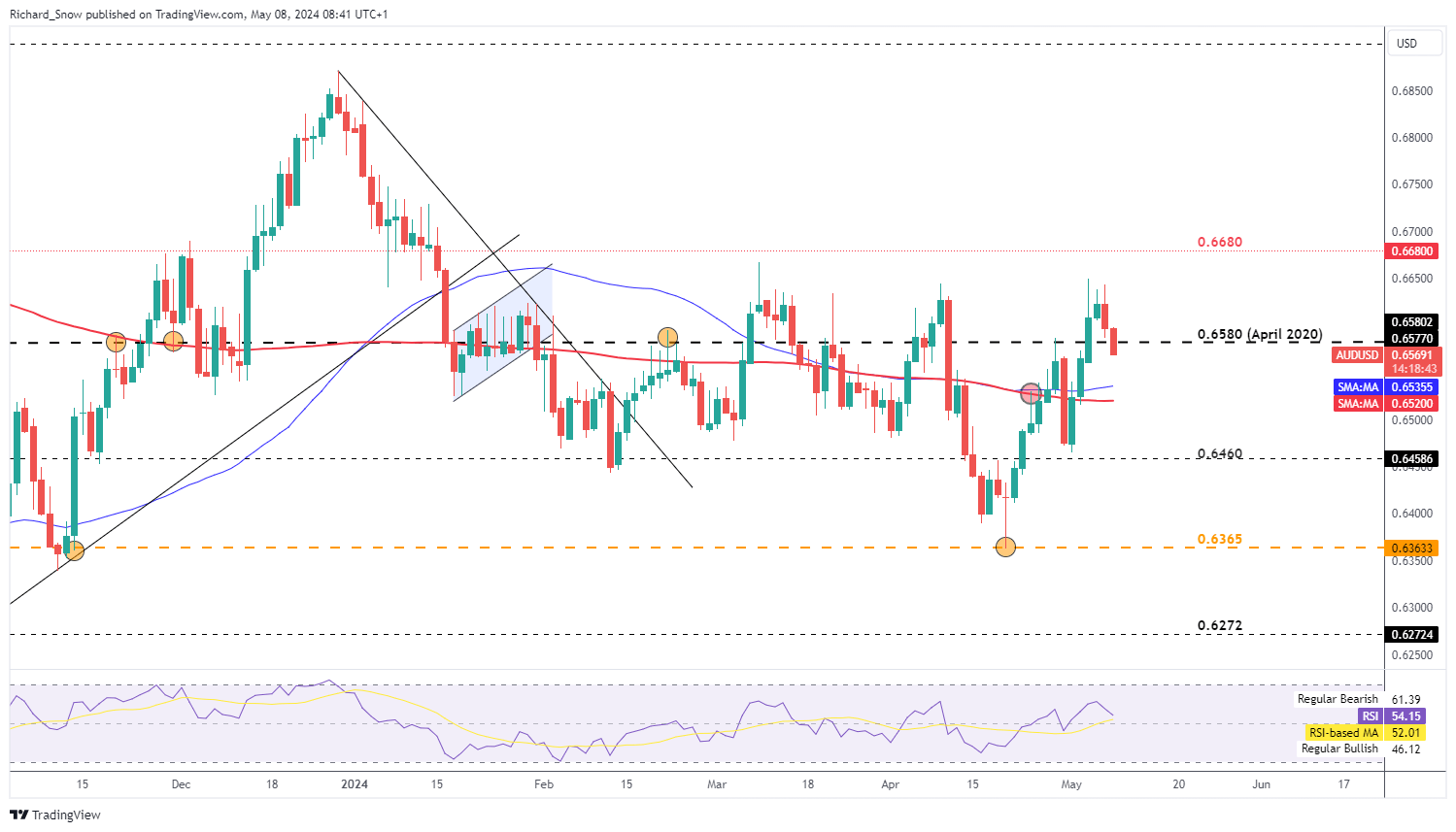

AUD/USD Disappointment May Self-Correct

The move lower in AUD/USD is understandable after the RBA failed to live up to hawkish expectations and that disappointment is playing out via a softer AUD. Recent US dollar strength has also helped extend the move but the updated RBA forecasts suggest there may be little room for dovishness for the rest of the year which could see the Aussie dollar stabilise.

With inflation expected to rise and remain elevated into 2025, the RBA may be forced to keep the policy rate steady at a time when major central banks are seriously considering cutting their policy rates. An improving interest rate differential alongside the current, global risk appetite may prove beneficial for the Aussie dollar.

The current pullback may extend to the 200-day simple moving average (SMA) – the next level of interest after breaking below 0.6580. Weaker US jobs data (NFP, average hourly earnings) has also calmed expectations around re-accelerating inflation in the US, which may start to take affect in a relatively quieter week. Another thing to note with the US dollar is the divergence between the recent USD uplift despite treasury yields heading lower. If the dollar follows yields lower, the AUD/USD pullback may lose steam.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -5% | 4% | 0% |

| Weekly | -18% | 22% | 0% |

Market Implied Rate Hikes in Basis Points (Bps)

Source: Refinitiv, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX