Talking Points

- AUDCAD reversal in focus

- Weekly OR break keeps topside bias in play

- Key Event Risk on Tap

ADUCAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- AUDCAD breaks above weekly opening range high- bullish near-term

- Resistance at 9835 / January TL & 9927/36

- Support at 9700 & 9630/57- bullish invalidation

- Daily RSI signature remains constructive / 50-bounce today

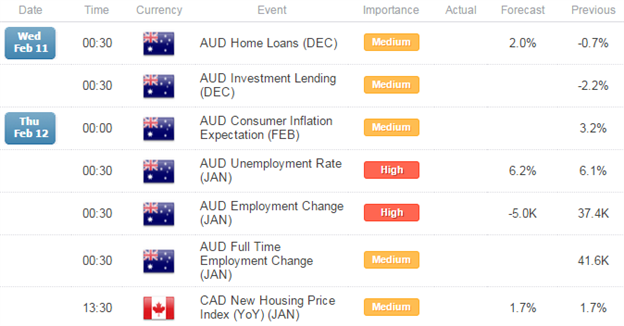

- Event Risk Ahead: Australia Employment data & Canada New House Price Index on Thursday

AUDCAD 30min

Notes:On January 27th we noted a short-bias on AUDCAD while below 9928 with the ensuing sell-off taking the pair into the 9630/57 key support zone. The rebound closed last week just below near-term resistance at 9777/85- where this week’s opening range high was targeted. A slope line extending off the February high also converges on this region today with momentum signature holding 40-support since the start of the week- constructive.

The breach above this region this afternoon was accompanied by a trigger break in momentum, confirming our near-term topside bias eyeing targets at 9835 & the 100% extension at 9864. Note that this level converges with basic trendline resistance off the January high into the close of Asia trade tonight. Bottom line- we’ll favor buying pullbacks while above 9750 (gap) with a breach above 9864 opening up targets into 9895 & 9928. A break below the weekly opening range low invalidates the setup with such a scenario targeting key support at 9557/66. A quarter of the daily ATR yields profit targets of 31-34 pips per scalp. Caution is warranted heading into event risk out of Australia with the employment report on Thursday likely to fuel added volatility in Aussie crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

- Weekly Setups Target Key Opening Ranges in USD, GBP, Gold & Silver

- Scalping GBPUSD Correction- Long Scalps in Play Ahead of BoE, NFP

- Scalping USDJPY Opening Range Ahead of NFPs- Shorts Favored Sub-118

- Scalping EURAUD Breakout- Longs Favored Above 1.44

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video