Equity Analysis and News

Looking for a technical perspective on Equities ? Check out the Weekly Equities Technical Forecast.

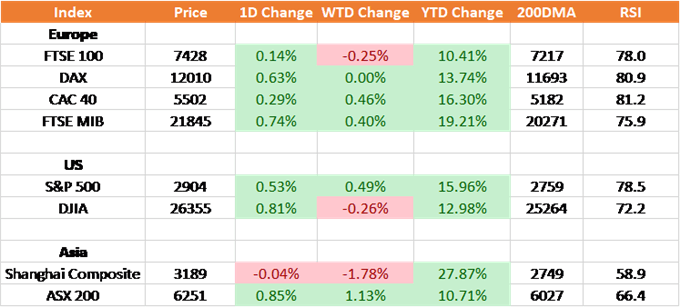

Source: Thomson Reuters, DailyFX

S&P 500 | 2900 Barrier Curbs Upside for Now

The S&P 500 clocked marginal gains of 0.5% for the week. Despite the notable events throughout the week, if there is one thing that has been made apparent, is the continued decline in cross asset volatility. Consequently, this may raise eyebrows as to whether investors are becoming complacent in underpricing risk. Nonetheless, the S&P 500 has continued to grind higher is now hovering around the 2900 handle with the upside on Friday underpinned by China’s credit splurge, which in turn raises scope for a potential rebound in Q2. Next week will see the release of China’s GDP report for Q1, which is seen dropping to the lowest level in almost 30yrs. Looking ahead, with earning season now officially started, the S&P 500 may take its cue from key earning reports, although given that it will be a holiday shortened week, price action may be relatively tame.

S&P 500 Price Chart: Daily Time Frame (Sep 2018 – Apr 2019)

Source: DailyFX

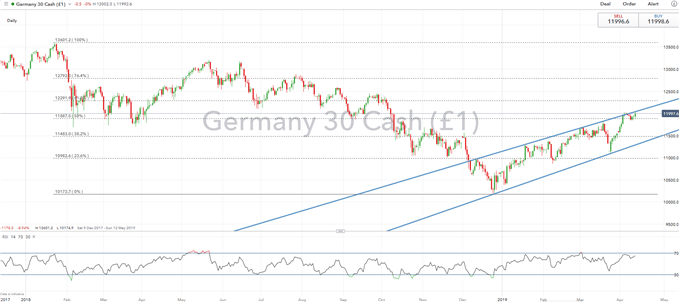

DAX | EU/US Trade War Brewing

A relatively quiet week for the DAX, as upside had been curbed at 12000, which also coincides with the rising trendline. With a trade deal between the US and China is expected in the near-term, concerns may soon turn towards a potential trade war between the US and the EU. This week saw the US move towards imposing USD 11bln worth of tariffs on the EU over the current dispute regarding aircraft subsidies. In retaliation to this, the EU have made a list to target around EUR 20bln of US goods. While this may have had a limited impact on the broader market, a step up in rhetoric over potential auto tariffs could be enough to spark a pullback, particularly in the DAX, given Germany’s large exposure. However, much like the S&P 500, the DAX is unlikely to see a notable move with a range of 12,940-12,055 seen.

DAX Price Chart: Daily Time Frame (Dec 2017-Apr 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Other Weekly Fundamental Forecast:

Australian Dollar Forecast – Australian Dollar Outlook Bearish on RBA. AUDUSD Eyes China Q1 GDP

Crude Oil Forecast – Crude Could Crumble if Growth Concerns Catch Fire Again

British Pound Forecast – GBPUSD Rate Defends Bull Trend Ahead of UK CPI Amid Brexit Extension

US Dollar Forecast – US Dollar Looks to Earnings, Economic Data to Shape Growth Bets