Talking Points:

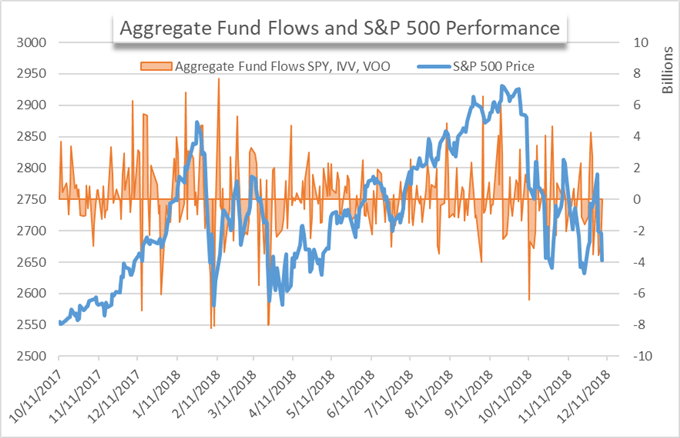

- SPY, IVV and VOO funds saw assets under management sink by -$9.3 billion over the last five days

- Defensive sector funds saw few inflows despite the equity tumble

- A lack of ‘buying the dip’ points to a fundamental shift in the mood of investors

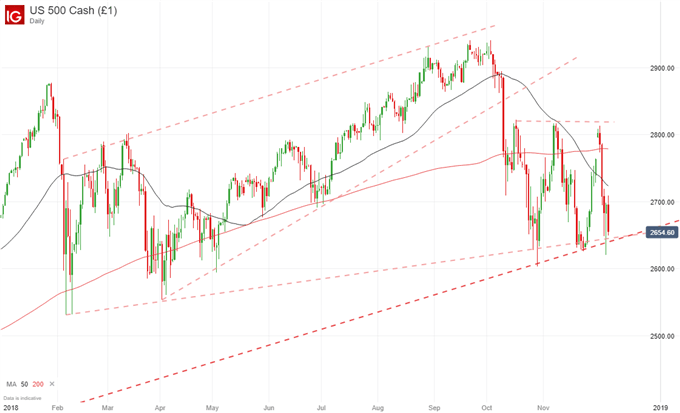

Trade War Truce Proven Insufficient

The trade war truce heralded by President Trump after the G20 Summit drove equities higher on Monday. As the consequences were analyzed further, many speculators questioned the long-term efficacy of the truce and the rest of the week saw equities falter.

S&P 500 Price Chart Daily, Year-to-Date (Chart 1)

Learn to day trade the S&P 500.

According to fund flows from SPY, IVV and VOO, some investors were bearish heading into the weekend. From Friday to Wednesday, $6.5 billion exited the three funds and Thursday saw another $3 billion head elsewhere. The flows were above average on a weekly basis despite closed markets on Wednesday.

Aggregate Fund Flows for Broad Market ETFs versus S&P 500 Performance (Chart 2)

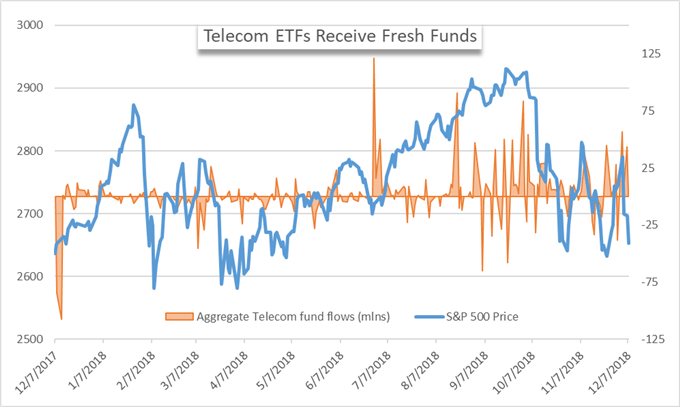

Telecom in Demand

With a significant amount of capital leaving broad-market tracking funds, questions arise about its reallocation. Last week we looked at healthcare and short-term government bonds which were heavily in demand. This week however, telecommunication ETFs seem to be the new fad. The telecom sector performed admirably this week relative to the rest of the market and the funds saw robust inflows relative to their market capitalization.

Despite the inflows, the cumulative market capitalization of telecom funds is a drop in the bucket compared to that of SPY, IVV and VOO. Still, the flows reflect demand for a sector many investors enjoy for its resilience.

VOX, IYZ, IXP, FCOM Fund Flows (Chart 3)

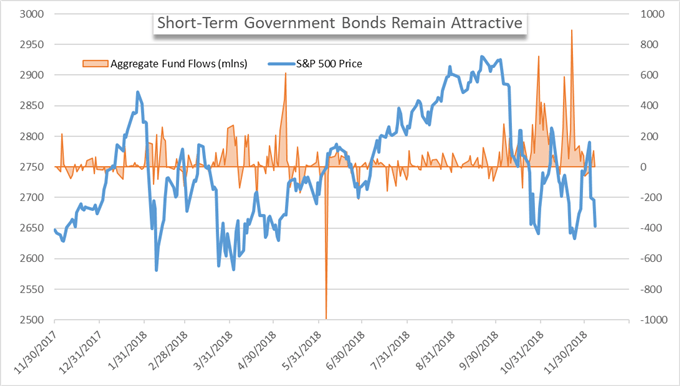

Short-term government bonds received new capital again this week but to a much lesser extent. Yield curve inversion, often cited as the first sign of a recession, has been the talk of markets this week but surprisingly the sector saw little capital change hands.

BIL, SHY Aggregate Fund Flows (Chart 4)

Has a Risk-Off Attitude Taken Hold?

In spite of a massive decline in US equities and a substantial amount of capital leaving some of the largest exchange traded funds, many of their defensive counterparts saw little inflow. This may suggest investors are content with cash ahead of the Brexit vote and ongoing trade concerns. Moreover, the lack of buying after a sharp equity decline could signal a shift from the generally bullish investor sentiment.

In my reports from October and November, many sharp equity drops were followed by a series of inflows in the days following that effectively equated to ‘buy the dip’. This latest round of equity trouble has equaled the depth of previous month’s but the subsequent demand for cheap shares is lacking. This is one of the more notable takeaways from the precipitous declines and could finally mark a more palpable shift to risk averse investments. We will be able to confirm or deny my suspicions in next week’s ETF report.

Read more: Consumer Confidence Remains Stable but Future Expectations Wane

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.