Here's an update on the setup's I’ll be tracking into the weekly open. Find a detailed, in-depth review of all these setups and more in this today’s Strategy Webinar.

USD/JPY 240min

Price broke below channel support late-last week and after reversing of key resistance at 114.37/60. The focus range to start the week is 112.32-113 with a downside break (favored) targeting more significant confluence support at 111.57/78- this threshold is defined by the 100-day & 200-day moving averages and converges on the June opening range highs & near-term channel support. A breach above Friday’s range high would be needed to shift the focus back towards the monthly highs.

Join Michael on July 21st for a Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

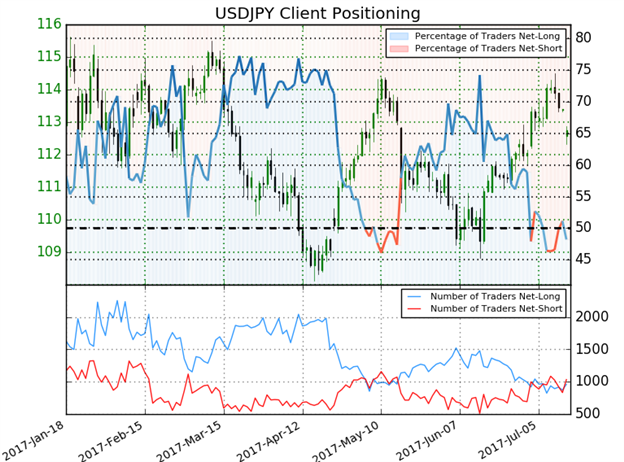

- A summary of IG Client Sentiment shows traders are net-long USD/JPY - the ratio stands at -1.07 (48.2% of traders are long)- Weak bullish reading

- Long positions are 7.8% higher than yesterday but 1.5% lower from last week

- Short positions are 22.6% higher than yesterday and 5.3% lower from last week

- Whilewe typically take a contrarian view to crowd sentiment, positioning is more net-short than yesterday but less net-short from last week and the combination of current sentiment and recent changes gives us a further mixed USDJPY trading bias. That said, I’ll be looking for a near-term recovery to fade while below structural resistance.

What do shifts in retail positioning hint about the broader USD/JPY trend? Learn how Sentiment can help your trading in this free guide !

EURGBP: The pair posted an outside weekly-reversal bar off confluence resistance last week, keeping the focus lower while below the January highs at 8852. A break below near-term slope support highlighted last week targets subsequent support objectives at 8700 & 8664. Keep in mind we have the UK Consumer Price Index (CPI) on tap overnight.

See our New 3Q projections in the DailyFX Trading Forecasts.

NZD/USD:We’ve been looking for Kiwi exhaustion for the past few weeks and I still think the pair remains at risk while below daily slope resistance discussed in today’s webinar. That said, IG Client Sentiment has continued to pullback from extreme short-side positioning and leaves the long-bias vulnerable heading into the start of the week while below resistance. An assertive break below the 2017 high-day close at 7301 would be needed to validate a near-term reversal in the pair.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or