Talking Points

- Review of current / active setups into the weekly open

- Updated targets & invalidation levels

- Join Michael for Live Weekly Trading Webinars on Mondays at 12:30GMT

The DXY remains at risk to open the session after breaking below the July open last week. Likewise, EURUSD is probing the highs ahead of Thursday’s ECB interest rate decision- Price is vulnerable for a near-term pullback but the outlook remains constructive while above 1.1340.

Aussie remains one of my favored setups after last week’s key technical breakout. The pair opens the week just below up-slope resistance with the outlook still constructive while above 7735.

Gold prices are on firm footing but the advance is now approaching some levels of interest for resistance at 1234 backed by 1240/41- watch for possible near-term exhaustion there. A review of the crypto currencies also sees room for a bit of a rebound higher before turning lower again.

See our New 3Q projections on the majors in the DailyFX Trading Forecasts.

In this webinar we discussed examples of multi-timeframe analysis and review both current and pending setups & updated technical levels on DXY, EURUSD, USDJPY, BTCUSD, NZDUSD, AUDUSD, AUDNZD, USDCAD, Gold, Crude, Silver, GBPUSD & GBPJPY.

Join Michael on July 21st for a Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

---

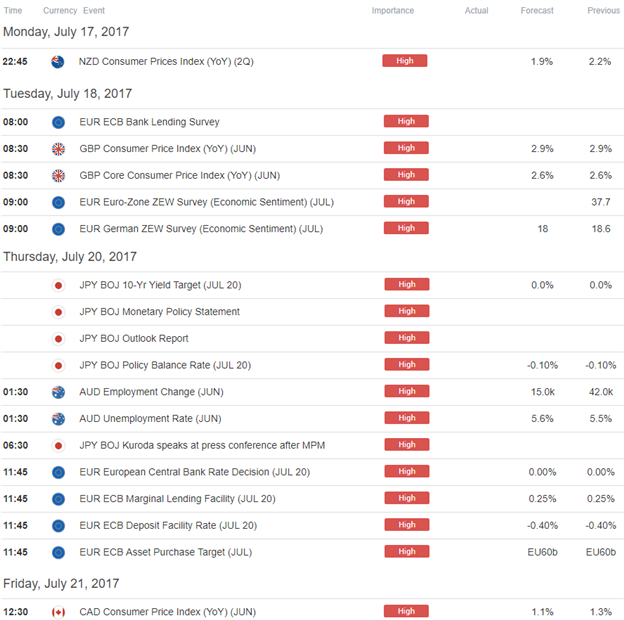

Key Data Releases

Other Setups in Play:

- USD/JPY Rally Vulnerable Ahead of U.S. CPI / Retail Sales

- Is the Bitcoin Party Over? Crypto Threatens Major Reversal

- Did EUR/GBP Just Top?

- NZD/USD Rally Unravels Ahead of Yellen Testimony

- AUD/USD Technical Analysis: Price Testing Key Slope Support

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.