To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- EURGBP responds to confluence resistance- Risk for larger correction with a break sub-8788

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook:EURGBP responded to confluence resistance earlier today at 8944 where the 76.4% retracement of the late-October decline converges on slope resistance. The pullback is now testing initial support at the January highs at 8852. Bearish divergence into the median-line suggests the risks remains for a larger set-back here with a break lower targeting a more significant support confluence at 8788/95.

EUR/GBP 120min

Notes: A closer look at the 120min chart highlights a near-term descending pitchfork formation extending off the recent highs with the median-line converging on basic trendline support and the weekly open at 8845/52. While it’s still too early to heavily rely on this slope, I’ll be look for initial resistance back at the 50-line just shy of 8900 with a break lower targeting 8815/22 and 8795.

We’re likely to get some relief on a dip into the highlighted support pocket but from a trading standpoint, I’ll favor fading strength sub-8900 with broader bearish invalidation steady at 8944- a breach above this threshold would shift the focus back to the long-side with such a scenario targeting subsequent resistance objectives at 9002 & 9049.

Join Michael on July 21st for a Live Webinar on the Foundations of Technical Analysis- Register for Free Here !

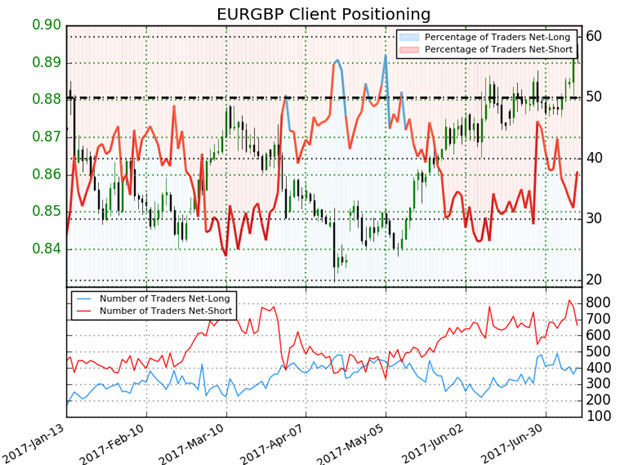

- A summary of IG Client Sentiment shows traders are net-short EUR/GBP- the ratio stands at -1.64 (37.9% of traders are long) - bullish reading

- Retail has been net-short since May 16th; price has moved 5% higher since then

- Long positions are 2.2% lower than yesterday and 14.2% lower from last week

- Short positions are 13.0% lower than yesterday but 5.2% higher from last week

- We typically take a contrarian view to crowd sentiment,and the fact traders are net-short suggests EUR/GBP prices may continue to rise. That said, positioning is less net-short than yesterday but more net-short compared with last week and the recent changes in sentiment gives us a further mixed trading bias.

- Bottom line: look for a build in long positioning / trimming in short exposure to further support the reversal scenario as price responds to resistance.

What to look for in retail positioning - Click here to learn more about sentiment!

---

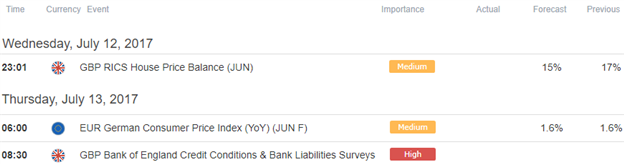

Relevant Data Releases

Other Setups in Play:

- NZD/USD Rally Unravels Ahead of Yellen Testimony

- AUD/USD Technical Analysis: Price Testing Key Slope Support

- Strategy Webinar: Dollar Crosses, Gold in Focus as Yellen takes Center Stage

- USD/CAD Breakdown Takes a Reprieve- Rebound to Offer Opportunity

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.