To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- USD/CAD approaching near-term support targets- Rebound to offer opportunity

- Check out our 3Q USD/CAD projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

USD/CAD Daily

Technical Outlook:USDCAD broke below key support highlighted last month at 1.3141/45 with the decline marking fresh yearly lows. The immediate short-bias is at risk heading into key support at 1.2883/90 to start off the week / month with the broader focus still weighted to the downside while below the highlighted slope confluence around 1.3060s.

USD/CAD 240min

Notes: A closer look at the 240min chart sees the pair trading within the confines of a well-defined descending pitchfork formation with price rebounding off parallel support into the open of the week. The focus range for now is 1.2883 – 1.3027 – Look for the break to validate our near-term directional bias with a breach higher to mark a correction before resumption of the broader downtrend.

From a trading standpoint, I’m looking for a reaction at the median-line with a break of the lows targeting 1.2832 backed by 1.2746. Added caution is warranted heading into key event risk on Friday with the release of both the U.S. Non-Farm Payroll and Canada employment data likely to fuel increased volatility in the cross.

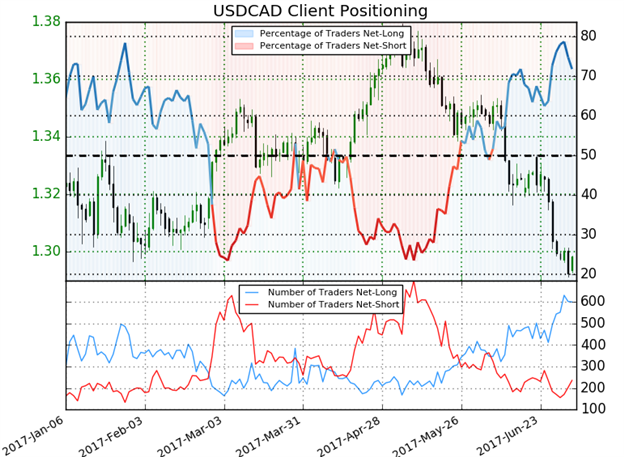

- A summary of IG Client Sentiment shows traders are net-long USDCAD- the ratio stands at +2.54 (71.8% of traders are long) - bearish reading

- Retail has been net-long since June 7th; price has moved 3.8% lower since then

- Long positions are 7.1% lower than yesterday but 44.6% higher from last week

- Short positions are 29.0% higher than yesterday but9.2% lower from last week

- We typically take a contrarian view to crowd sentiment,and the fact traders are net-long suggests USDCAD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week and the combination of current sentiment and recent changes gives us a further mixed USDCAD trading bias and highlights the risk for a near-term recovery.

See how shifts in USDCAD retail positioning are effecting market trends- Click here to learn more!

---

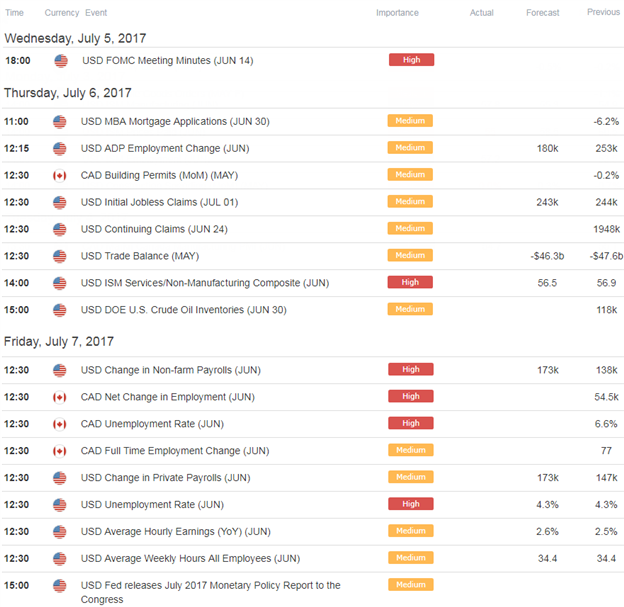

Relevant Data Releases

Other Setups in Play:

- Strategy Webinar: Gold, Crude Prices in Focus as USD Rebounds

- AUD/USD Runs to Highs as Dollar Sell-off Deepens

- Crude Oil Prices Continue to Rally- Nearing Resistance

- NZD/USD: Has the Rally Finally Peaked?

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.