Fundamental Forecast for Gold:Neutral

- Gold Holds Up at $1200, SPX 500 Remains in Consolidation Mode

- Gold Price 1170s Still Seen as Support

- Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

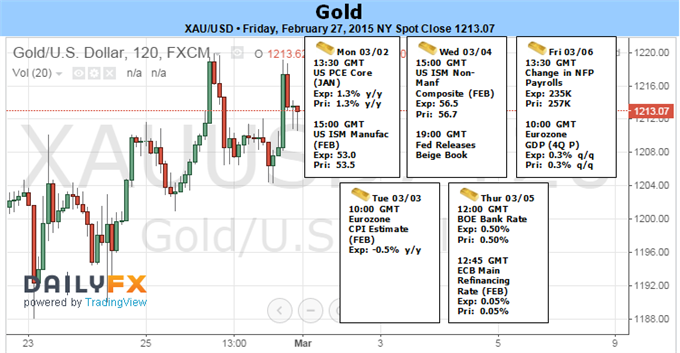

Gold prices snapped a four week losing streak with the precious metal rallying 1.27% to trade at $1216 ahead of the New York close on Friday. The fresh batch of central bank rhetoric from the Humphrey-Hawkins testimony suggests that the Fed remains cautiously on course to normalize monetary policy, but the fundamental developments due out in the days ahead may heavily influence interest rate expectations as the central bank struggles to achieve its 2% target for price growth.

Beyond the slew of central bank rate decisions kicking off the March trade (RBA, ECB, BoE & BoC), the U.S. Non-Farm Payrolls report may have the biggest implications for gold on the back of the USD strength story. Despite the stronger-than-expected 4Q GDP print, the disinflationary environment may put increased emphasis on the wage growth figures due out on Friday, and signs of subdued household earnings may undermine the bullish sentiment surrounding the dollar especially as market participants anticipate Average Hourly Earnings to narrow to an annualized 2.1% in February. We’ll look for possible softness in the greenback to further support the recent gold rally with prices closing out the week just below key resistance.

Last week we highlighted key technical support at $1196/98, a level defined by “the confluence of the 61.8% retracement of the November advance & the 1.618% extension of the decline off the January high and is backed closely by a basic trendline support off the November low. We’ll reserve this region as our near-term bullish invalidation level and although the broader bias remains weighted to the down-side, near-term this structure may offer stronger support. Interim resistance (near-term bearish invalidation) stands at $1218/24… Bottom line: looking for a low early next week with a general topside bias in play near-term while above $1196/98.” - Indeed the market fell to a fresh low on Monday before rebounding to test the $1218/24 resistance range. Our outlook remains unchanged heading into March with the 1196-1224 range in focus to start the week. A topside breach keeps the long-bias in play targeting resistance objectives at 1234 & 1248/50 with a break sub 1195 (close basis) risking substantial declines into subsequent support targets at $1171 & $1155.