Bullish US Dollar Forecast (EUR/USD, GBP/USD, USD/JPY):

- The mighty dollar is back as CPI data impacts policy paths

- EUR/USD at risk after the ECB laid out the conditions for lowering rates

- GBP/USD decline may extend if wage, inflation data softens in the week ahead

- US CPI catalyst sends USD/JPY into the danger zone

- Get your hands on the U.S. dollar Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

The Mighty Dollar is Back as CPI Data Impacts Policy Paths

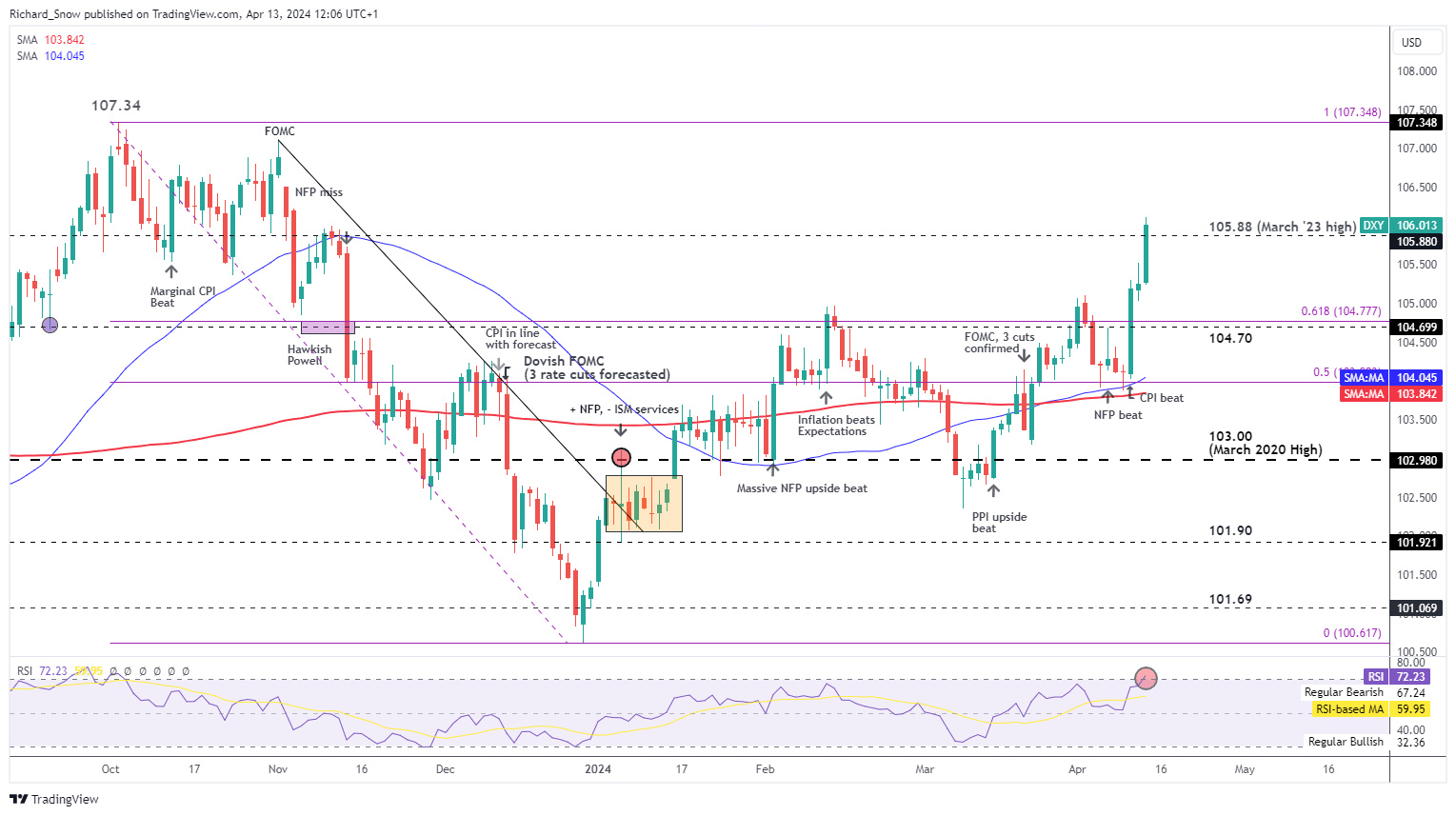

The US dollar has regained prominence in the FX market after hotter-then-expected CPI data forced a hawkish repricing of the world’s reserve currency. The CPI print was released on Wednesday, when prices were trading above the 50% Fibonacci retracement of the major 2023 decline and above the 50 and 200-day simple moving averages. In the lead up to the print there was a notable departure between US yields and the dollar, opening up the possibility for the greenback to bridge the gap really quickly, which it did.

Since then, the dollar index has skyrocketed, taking out multiple levels of resistance as markets shaved off another rate cut this year – anticipating less than 50 basis points worth of cuts which implies only one cut expected before year end. The dollar is also likely to remain supported amidst the anticipated escalation in the Middle East with US President Joe Biden announcing that he expects an imminent attack by Iran in response to Israel’s strike on an Iranian embassy in Damascus.

Outside of the conflict, the differing directions of travel for the Fed and ECB highlight a worsening outlook for EUR/USD, GBP/USD and the potential for further upside on USD/JPY although that particular pair is fraught with risk at such elevated levels.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/USD at Risk after the ECB Laid out the Conditions for Lowering Rates

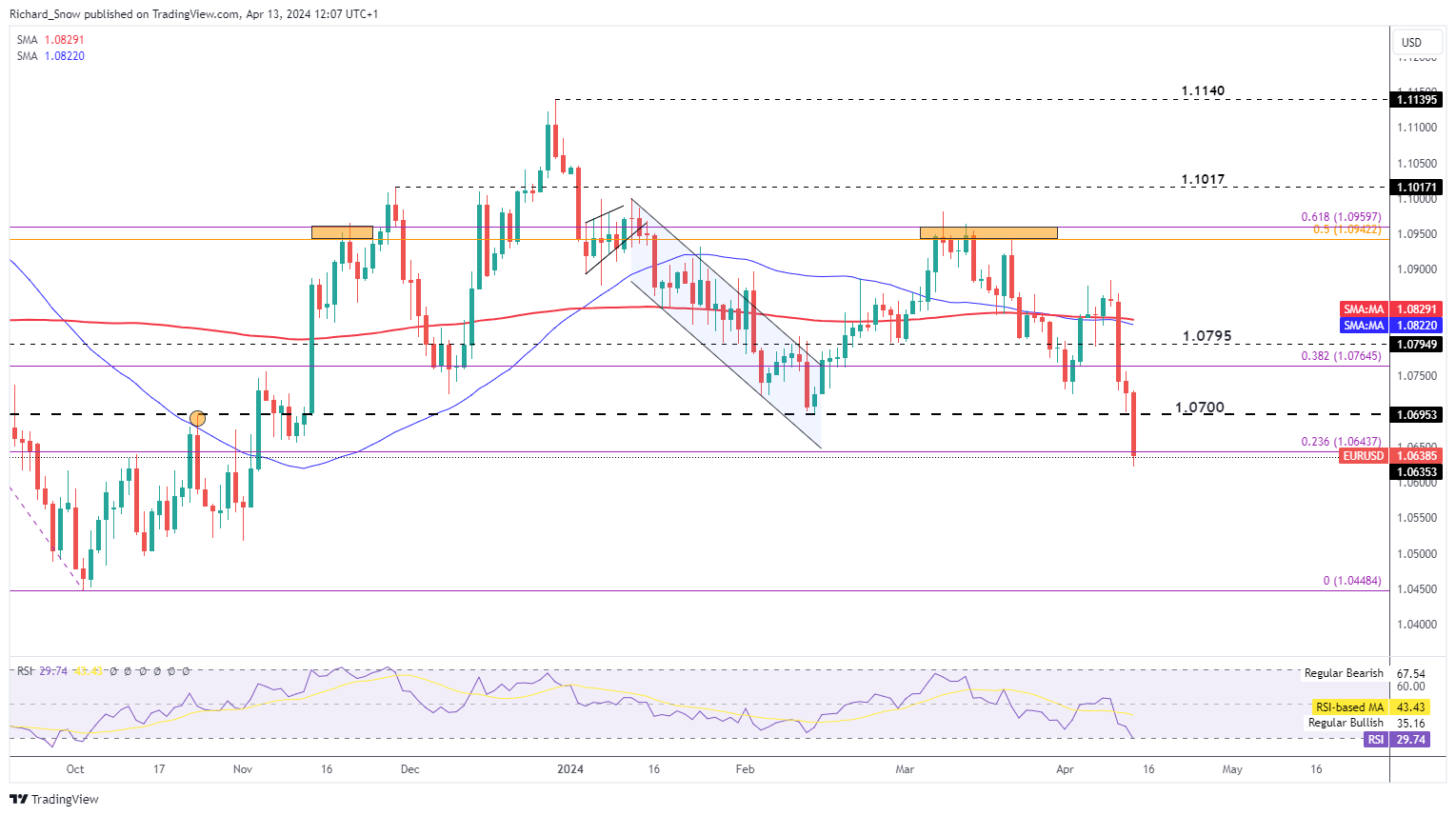

The ECB statement confirmed that the governing council will not pre-commit to any rate path but will instead respond to incoming data. However, this hasn’t put a stop to prominent ECB officials from communicating a preference for a June cut. But it was the doves that ultimately found joy in the statement due to the acknowledgement that interest rates will be lowered if inflation dynamics fill the committee with greater confidence that general price pressures are heading towards the target.

EUR/USD powered through the 50 and 200-day SMAs, falling through the 38.2% Fib retracement of the 2023 decline, and the 1.0700 psychological whole number. The descent even witnessed a close below the 23.6% Fib retracement, potentially opening up a move towards the 2023 low. One thing standing in its way is the aggressive nature of the move which places the pair on the very edge of entering oversold territory (RSI).

The medium-term outlook still points to a weaker EUR/USD but in the interim, considering the near oversold conditions and the lack of high impact US economic data next week, the pair may ease back slightly as traders reassess the situation. Furthermore, a positive ZEW figure could help the euro claw back some of the recent losses as general sentiment and confidence indices appear to have turned the corner for the better.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Get your hands on the Euro Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

GBP/USD Decline May Extend on Softer Wage, Inflation Data

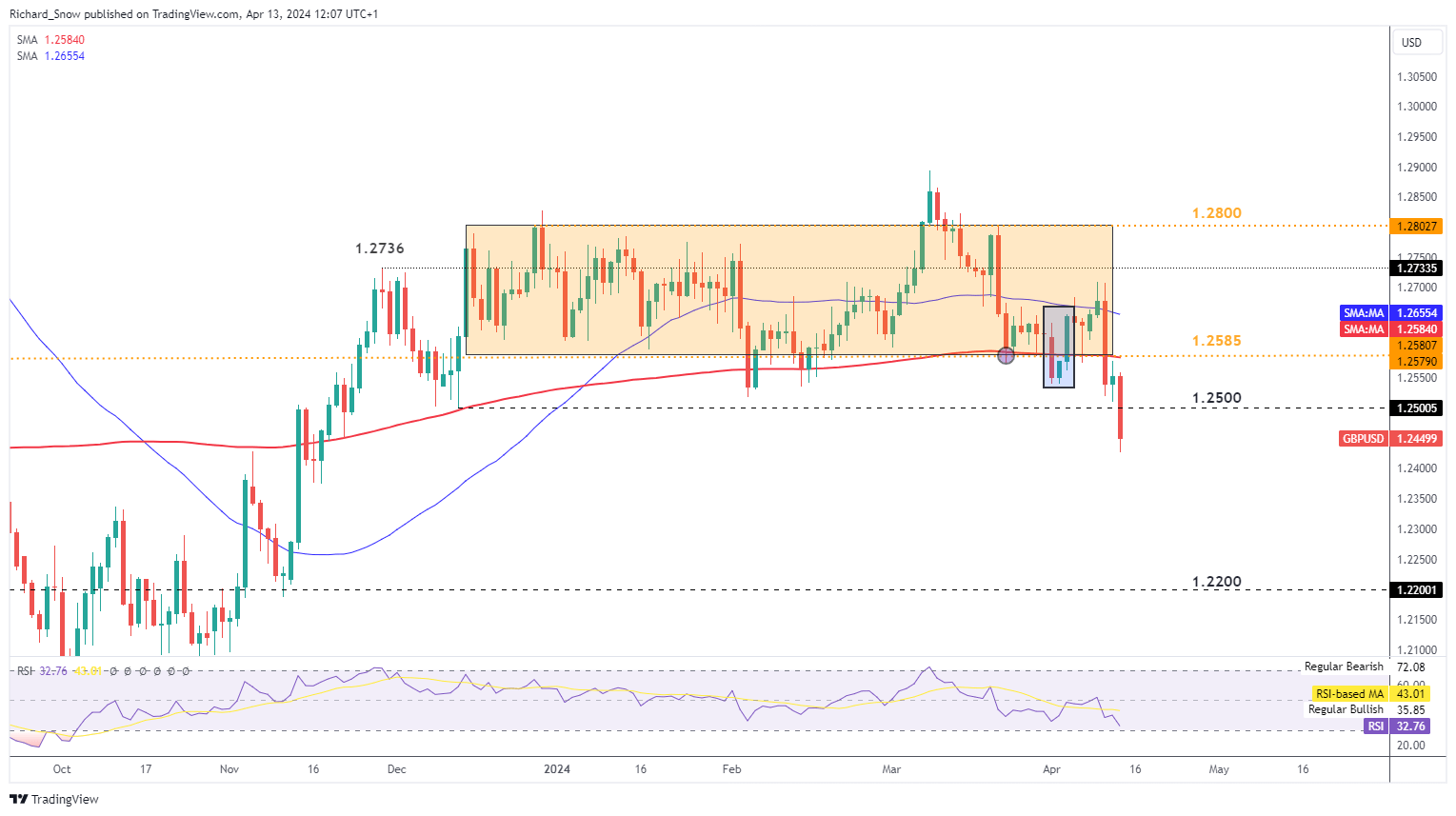

Cable, like EUR/USD has dropped sharply, providing the most convincing breakdown attempt since early April and February before that. Previous attempts failed to close below the prior swing low of 1.2500, until now.

The bearish move has the potential to extend late into next week should UK inflation and wage growth data ease. The Bank of England (BoE) forecasted that inflation will drop sharply to the 2% target by mid-year, meaning a rate cut may be closer than the market currently anticipates. In the event we see more encouraging data in the week ahead, sterling may feel the pressure and continue to weaken against the firm greenback.

Recent downside targets for the pound are difficult to come by, which opens up a path towards 1.2200 which is currently a very long distance away. The RSI could enter oversold territory in the coming week and remains something to monitor in the event of a shorter-term retracement.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Currency pairs have unique idiosyncrasies that ought to be understood by all who trade them. Discover these by reading our dedicated GBP/USD trading guide below:

CPI Catalyst Sends USD/JPY into the Danger Zone

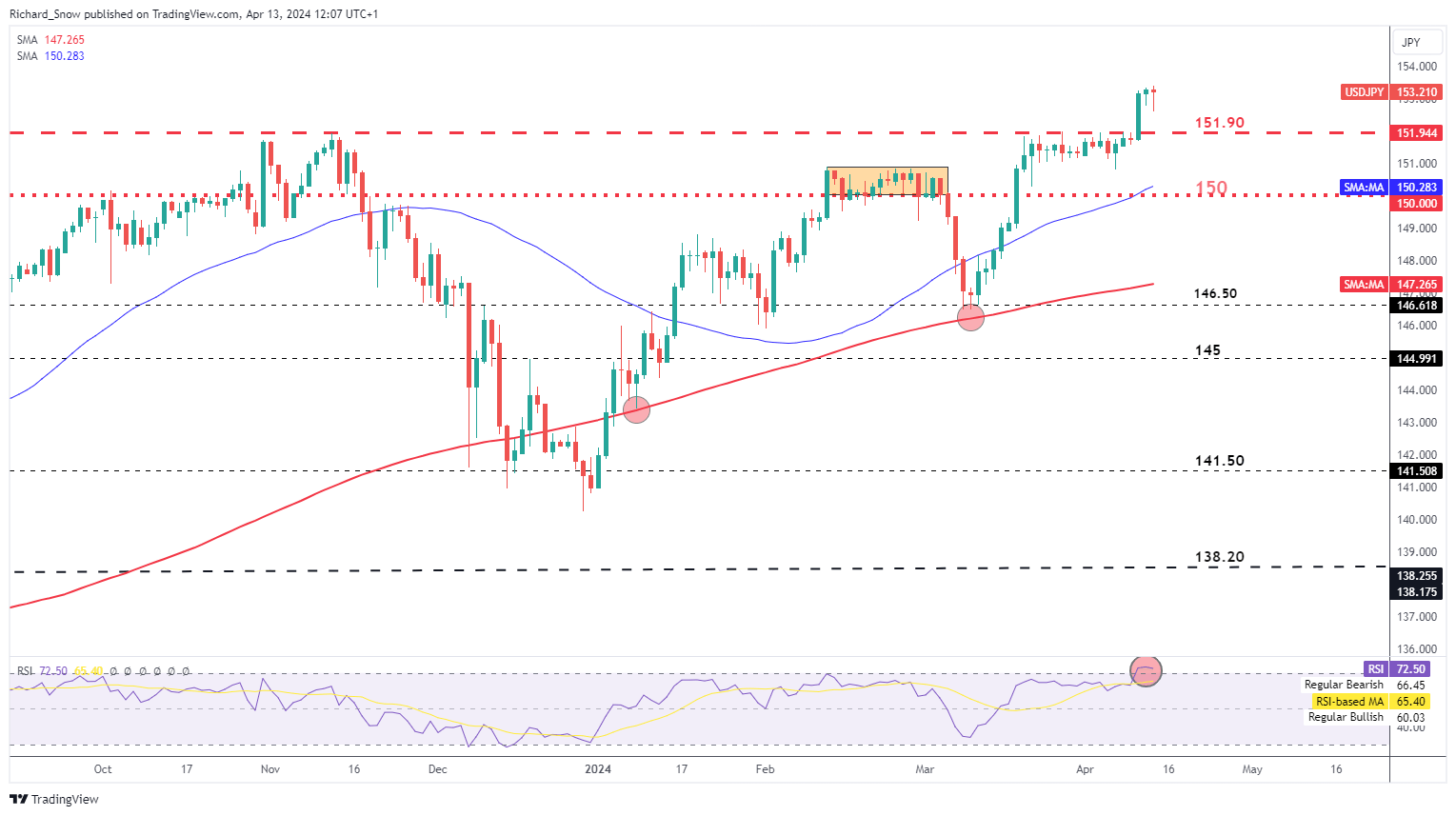

US inflation data provided the launchpad for the latest bullish move in USD/JPY, into a very dangerous zone. It has been well documented that 152.00 was the highest level that Japanese officials could tolerate before intervening in the FX market to strengthen the Japanese yen.

The recent move failed to induce a harsher response from currency officials who have voiced their displeasure with unfavourable, volatile moves. At the end of March, the Japanese finance minister Shunichi Suzuki stated that authorities could take ‘decisive steps’ in his strongest warning to the FX market this year. However, the more recent advance has not yet seen more urgent warnings from the ministry of finance.

USD/JPY suffers from a lack of recent upside target levels, with the next best indication at the April 1990 high of 160.00. Former FX diplomat, Watanabe suggested the authorities may not intervene until the pair reaches 155.00 but even if that is the case, chasing the market higher from here poses a terrible risk-to-reward ratio. Prior intervention saw the yen claw back around 500 pips in the moments that followed the decisive action and eventually saw a sustained decline in USD/JPY.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Stay up to date with breaking news and market themes currently driving markets by subscribing to the DailyFX weekly newsletter:

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX