US Dollar, DXY Index, USD, SVB, ASX 200, RBA, Fed, FOMC, Crude Oil - Talking Points

- US Dollar wilted again despite higher Treasury yields

- Crude oil and equities are generally firmer from renewed optimism

- A Fed pause might not be a lock. If they hike, will it boost the DXY Index?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

The US Dollar sunk further today, adding to losses seen into the New York close on Monday.

The general reversal in fortunes for risk assets continued through the Asian session on Tuesday with Australia’s ASX 200 adding over 1%. Retail sales data there printed in line with expectations at 0.2% month-on-month for February.

The fairly benign number underscored perceptions of the RBA pausing in its rate hike cycle on Tuesday next week.

Other APAC equity markets have been mostly positive, with mainland Chinese indices the only ones in the red.

The rescue of SVB Financial announced yesterday appears to have calmed market concerns of the banking crisis enlarging.

This perspective saw further oscillation in the pricing on what the Fed will do at the next Federal Open Market Committee (FOMC) meeting in early May. The interest rate market is now pricing in a roughly 50/50 bet for a 25 basis point (bp) hike then.

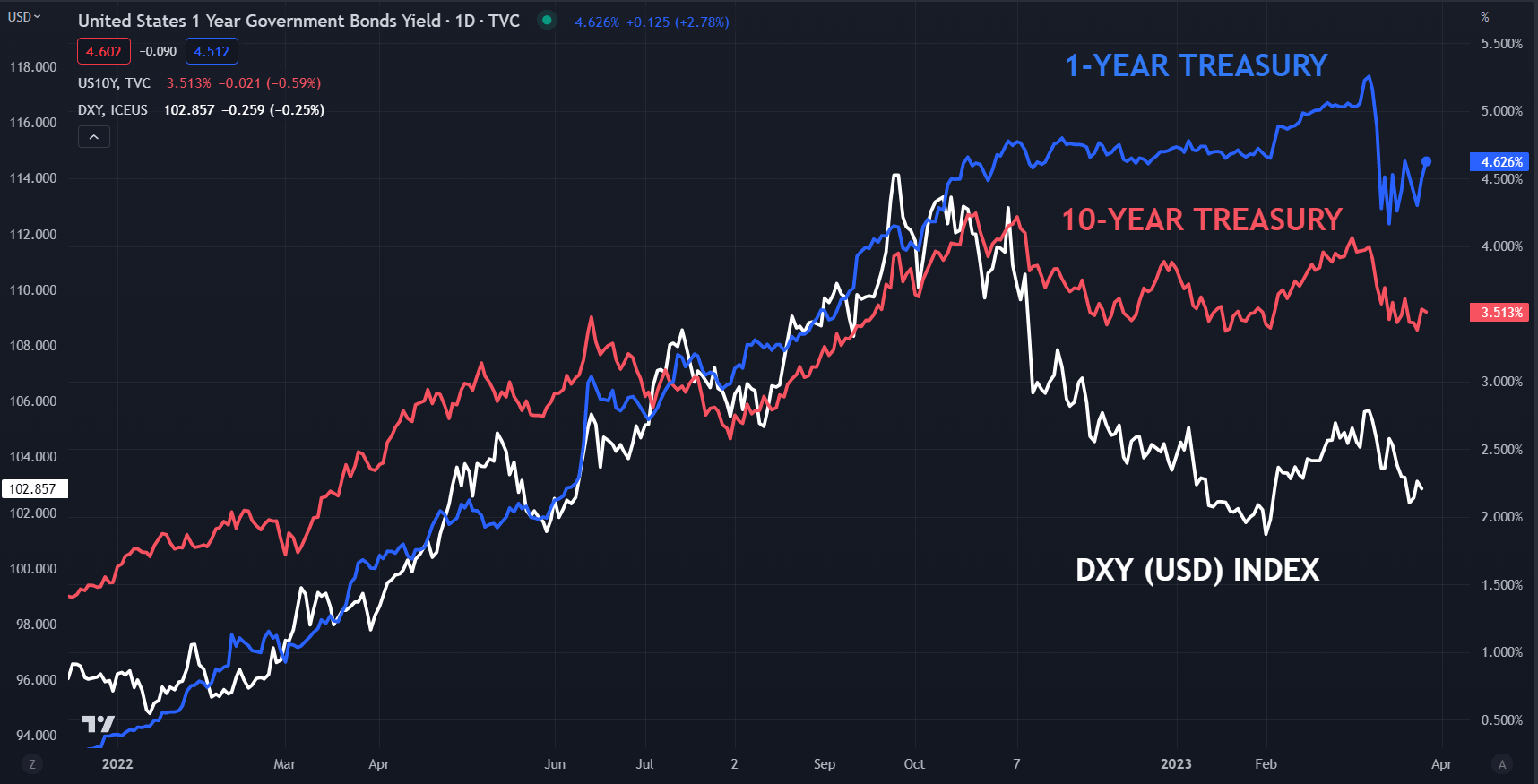

Treasury yields leapt higher across the curve yesterday but has given up a few bp today, with the exception of the 1-year bond. It has jumped 60 bp from the low seen 2-weeks ago to be back above 4.60%.

Crude oil has consolidated yesterday’s outsized gains with the WTI futures contract near USD 73 bbl while the Brent contract is a touch under USD 78 bbl. Natural gas failed to be swept up in oil’s rally as it continues to languish.

Gold has made a slight recovery from yesterday’s selloff, trading above USD 1,950.

The Japanese Yen has been today’s outperformer in currency land with USD/JPY edging toward 130.50. All other G-10 currencies are firmer to some degree against the greenback.

There will be a number of speakers from the European Central Bank (ECB) and the Bank of England (BoE) today.

The full economic calendar can be viewed here.

DXY (USD) INDEX AND TREASURY YIELDS

The DXY index has not moved up with the increase in Treasury yields so far this week. This dislocation might be worth watching and could provide clues for risk appetite across different asset classes.

If yields continue higher, but the US Dollar struggles to gain traction, it may indicate an increased appetite for other risk assets, such as AUD and NZD for example.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter