US Dollar, Euro, Australian Dollar Vs Japanese Yen – Price Action:

- USD/JPY looks drop toward its January low of 127.20.

- A bit more downside for AUD/JPY and EUR/JPY.

- What are key level to watch in the yen crosses?

The Japanese yen looks set to retest its January high against the US dollar amid worries regarding the stability of the European financial sector and hopes that the US Fed is closer to a peak in rates.

Markets are pricing in around an 80% chance that US rates have already peaked, while the first Fed rate cut is priced in for July after the central bank on Wednesday shifted to a more cautious stance on rates to account for the stress in the banking sector. Minneapolis Fed President Neel Kashkari said on Sunday that authorities are monitoring “very, very closely” to see if the banking sector stress turns into a broader credit crunch, pushing the economy into recession.

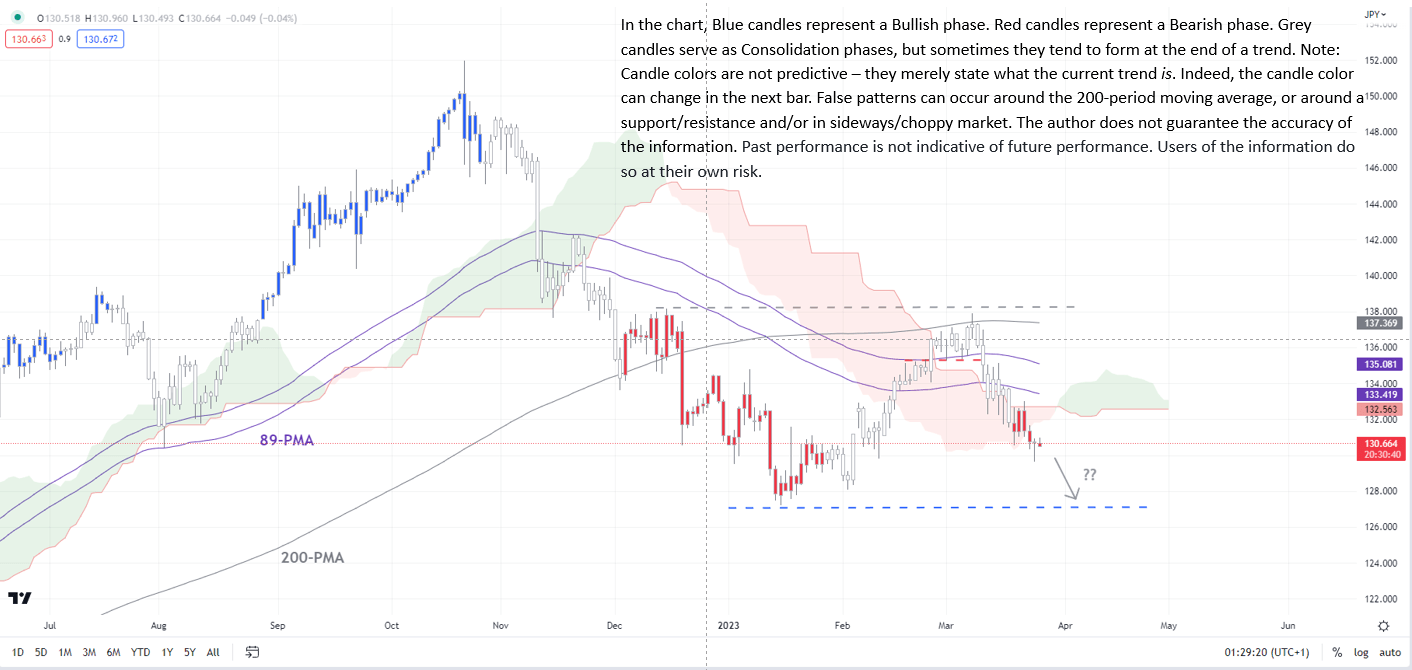

USD/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

USD/JPY – Weak bias

On technical charts, USD/JPY appears to be drifting lower toward the January low of 127.20. This follows a retreat from a tough barrier around 137.00-138.20, including the 200-day moving average and the December high of 138.20 – a possibility highlighted in the recent updates. See “Japanese Yen Forecast: SVB Fallout Uncertainty to Weigh on USD/JPY”, published March 12, and “Japanese Yen Forecast: High Bar for USD/JPY to Crack Resistance”, published February 26.

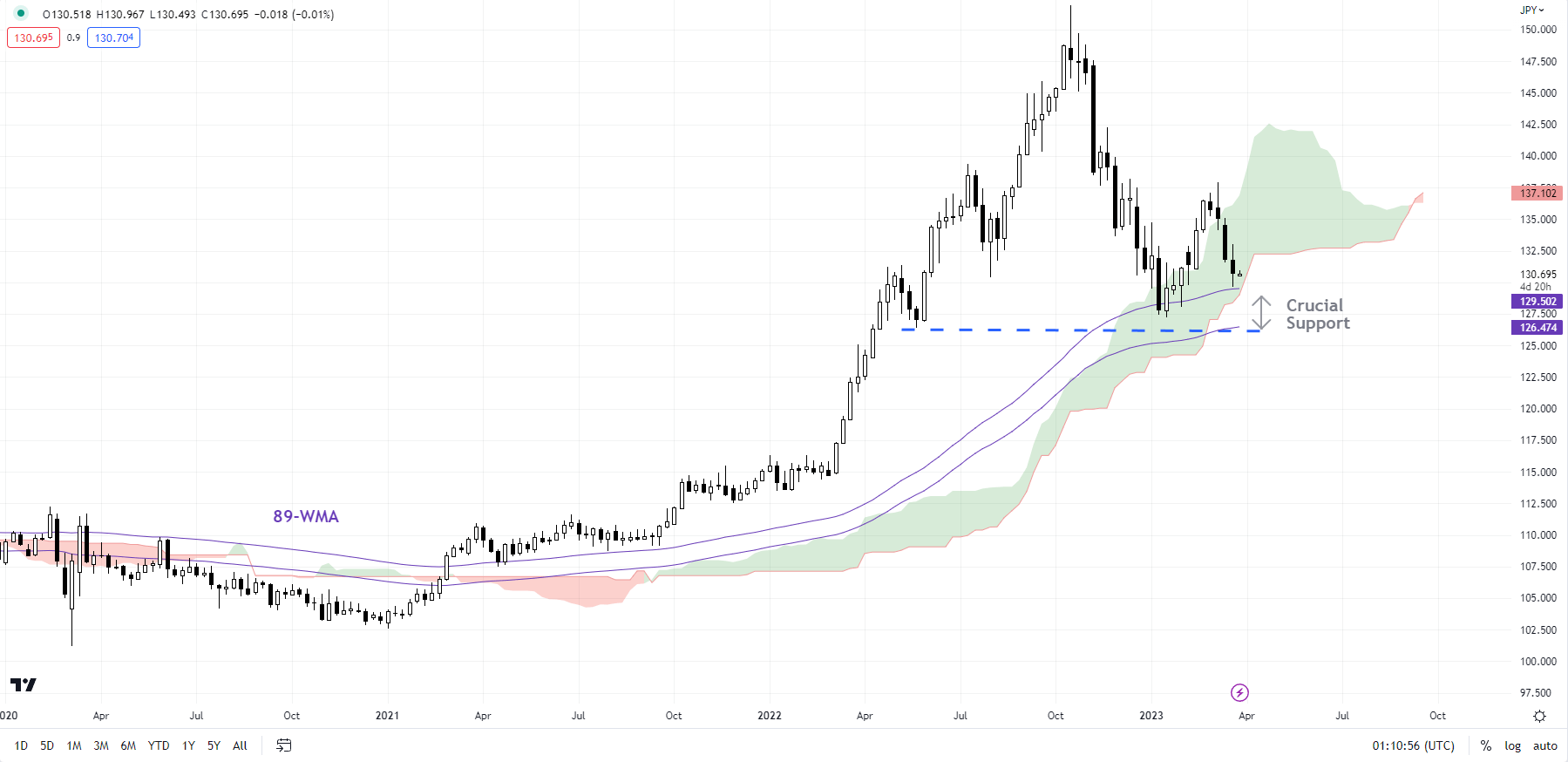

USD/JPY Weekly Chart

Chart Created Using TradingView

The January low of 127.20 coincides with the lower edge of the Ichimoku cloud on the weekly charts and the May 2022 low of 126.35. A break below is by no means imminent, but any such break could pose a risk to the two-year-long USD/JPY uptrend.

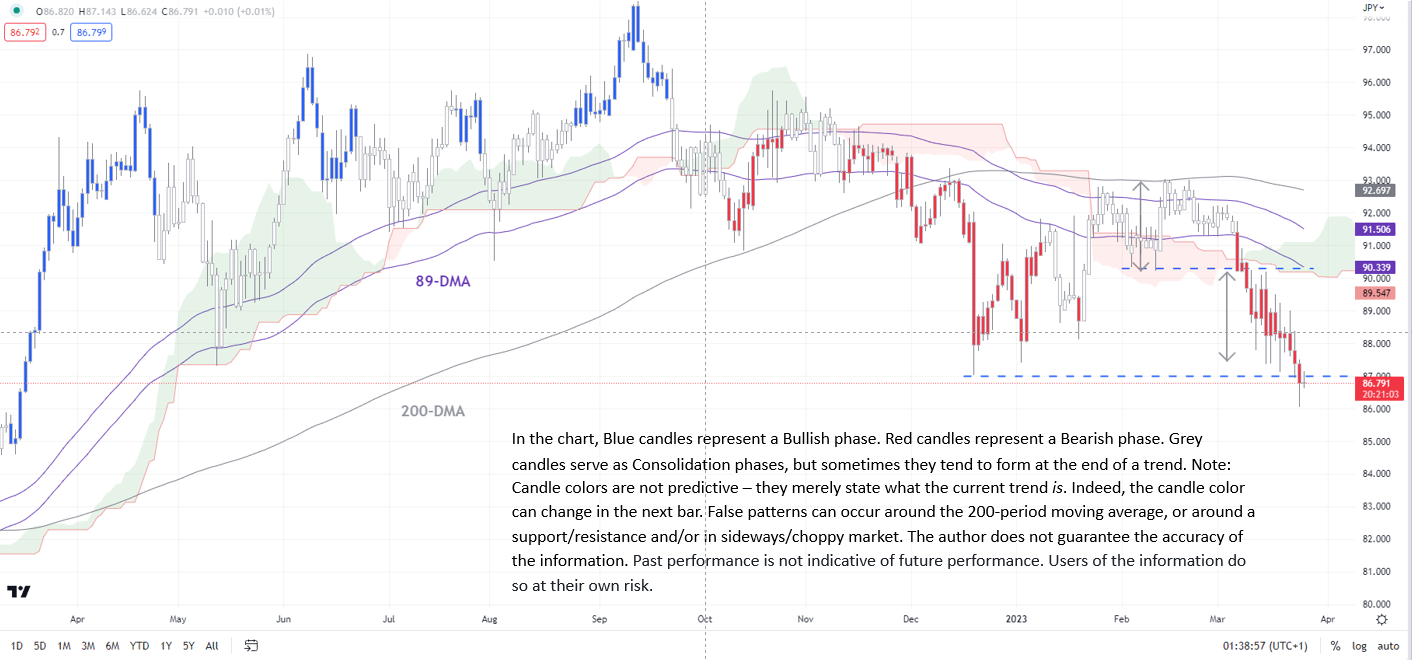

AUD/JPY Daily Chart

Chart Created by Manish Jaradi Using TradingView

AUD/JPY – Attempting to break below key support

AUD/JPY is threatening to break below the vital cushion on a horizontal trendline from May 2022 (at about 87.40). Such a break could pave the way toward the 200-week moving average (now at 81.60). The break earlier this month below the February low of 90.20 triggered a minor double-top pattern (the January and February highs) with a price objective of around 87.50, near the December low of 87.00. See “Japanese Yen Price Setup Ahead of BOJ: USD/JPY, EUR/JPY, AUD/JPY”, published March 9.

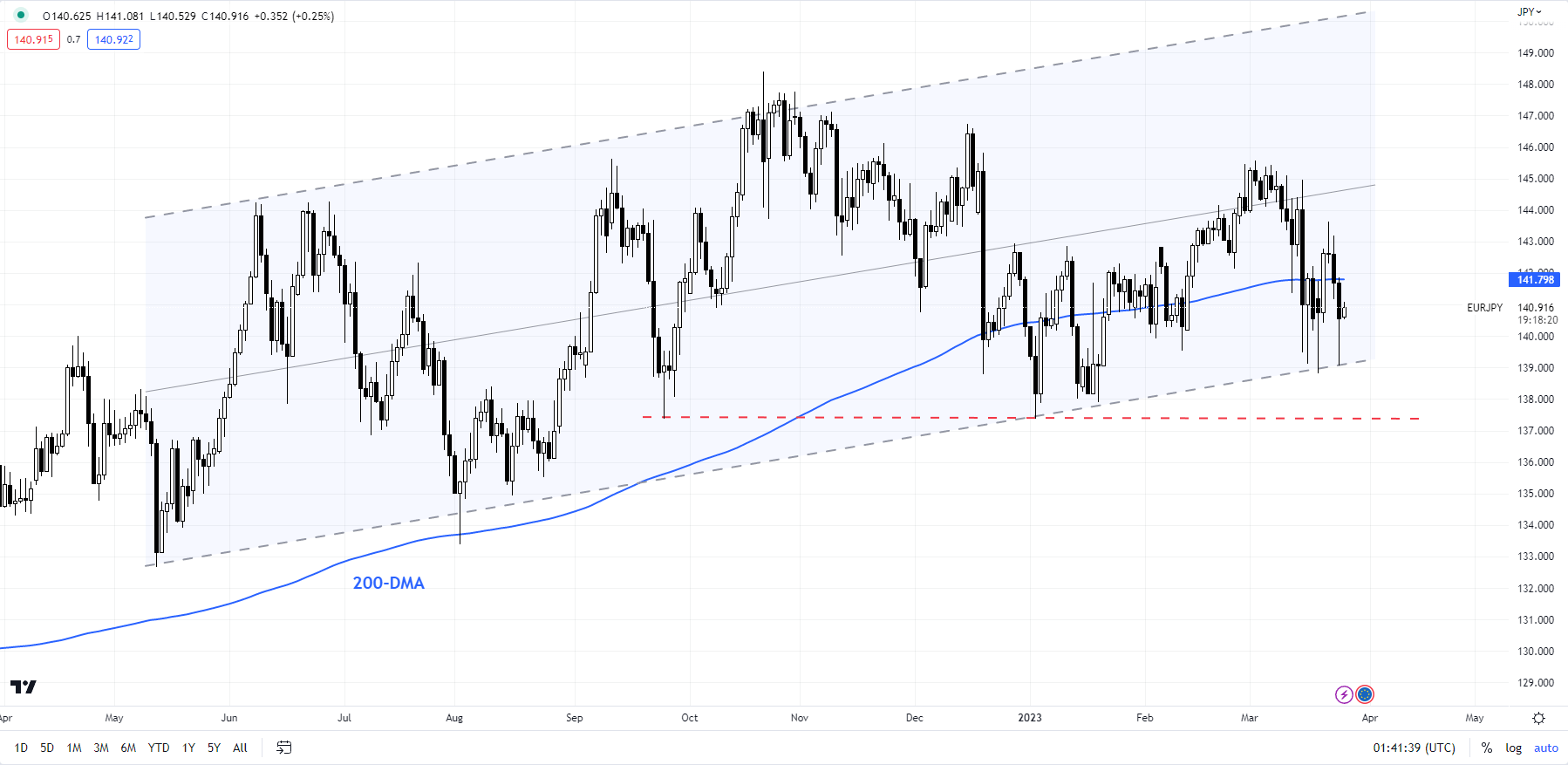

EUR/JPY Daily Chart

Chart Created Using TradingView

EUR/JPY – Approaching quite strong support

EUR/JPY’s upward pressure has faded after the fall below key support at the late-February low of 142.15, surpassing the price objective of the triple top pattern pointed out onMarch 9. In the near term, EUR/JPY risks a drop toward the January low of 137.35.

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish