US Dollar, Treasury Yields, Yuan, Yen, Kiwi, Aussie, Crude Oil - Talking Points

- The US Dollar is under short-term pressure, but the bigger picture is rosier

- Japanese and Chinese PMI data gave APAC equities a needed boost

- Biden talked tough on excessive oil company profits. Can the DXY index rise?

The US Dollar is weaker against all developed market currencies today as Treasury yields softened throughout the Asian session. The moves unwound the previous day’s gains. The benchmark 10-year note is holding above 4% for now.

Some positive risk sentiment also emerged after solid Japanese and Chinese PMI numbers. The Jibun Bank Japanese manufacturing PMI was 50.7 and the Caixin Chinese manufacturing PMI was 49.2, above estimates of 48.5.

The Chinese Yuan is one of the few currencies to weaken against the ‘big dollar’. It is at its lowest level since early 2008, with USD/CNY trading as high as 7.3270. That’s a long way from the March low of 6.3035.

Japan’s Ministry of Finance (MoF) revealed that they had spent 6.3 trillion Yen (42.5 billion USD) in October on currency intervention.

The Kiwi Dollar has been the best-performing major currency so far after building approvals data there showed an increase of 3.8% month-on-month in September.

AUD/USD had a run up toward 0.6450 but backed away after the RBA hiked their cash rate target by 25 basis points (bps) to 2.85%. It appears to be a case of “buy the rumour, sell the fact.”

APAC equities are all in the green with Hong Kong’s Hang Seng Index (HSI) leading the way, up over 4% at one stage. US futures are pointing to a positive start to their cash session after yesterday’s declines.

US President Joe Biden said that record profits of oil companies are a windfall of war and that producers that don’t reinvest their gains to increase output could face an extra tax.

Crude oil edged higher with the WTI futures contract above US$ 87 bbl while the Brent contract has surpassed US$ 93.50 bbl.

More PMI data is due out today from Switzerland, the UK, Canada and the US. The latter will also publish analogous ISM figures. The market remains anxious ahead of the Fed rate decision on Wednesday.

The full economic calendar can be viewed here.

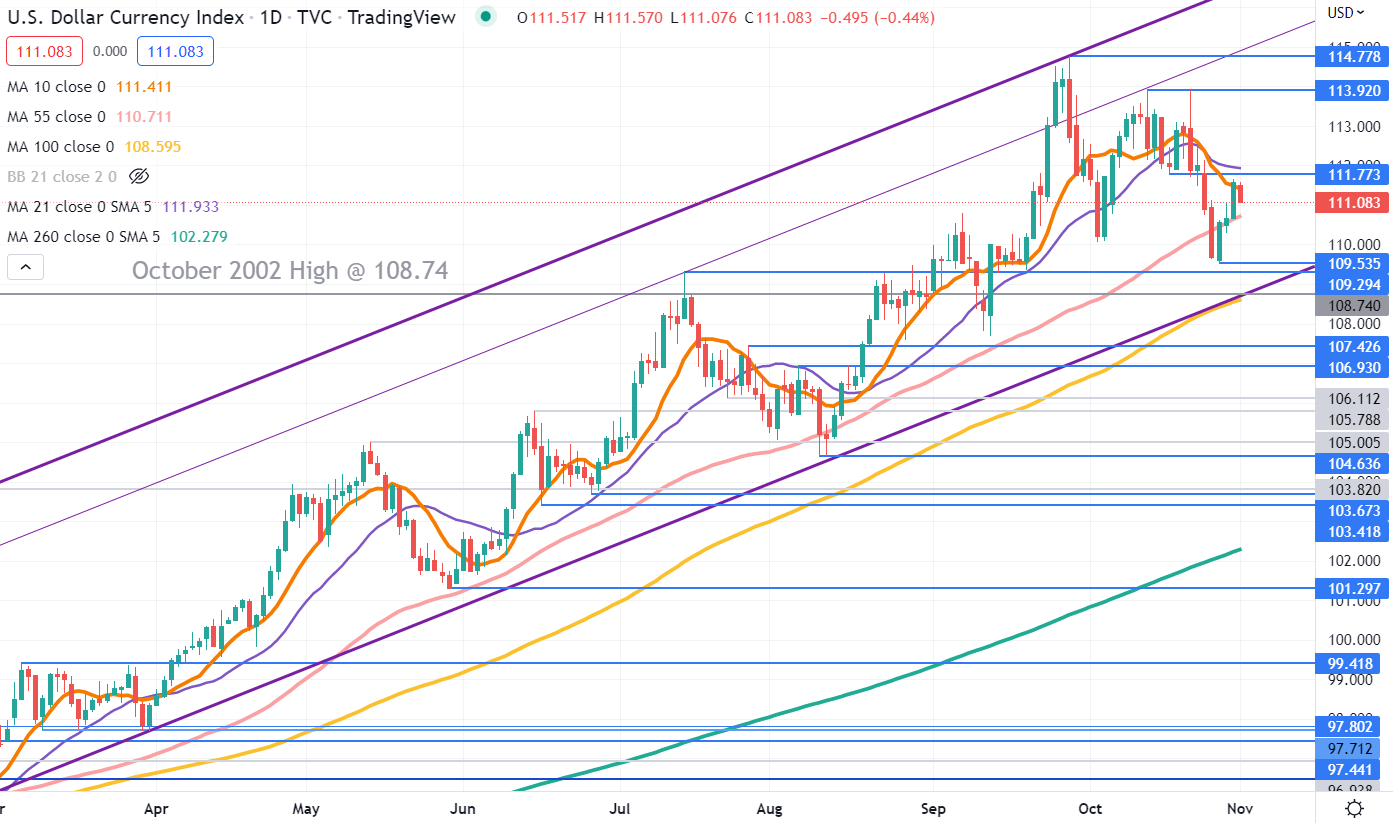

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY index remains with an ascending trend channel and might be regaining bullish momentum after crossing above the 55-day simple moving average (SMA).

The lower bound of the ascending channel coincides with the 100-day SMA, currently intersecting at 108.60 and this might provide support.

Ahead of that level, the recent low and the break point at 109.54 and 109.29 respectively may provide support.

On the topside, resistance could be at break point of 111.77 or further up at the previous peaks of 113.92 and 114.78.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter