EURUSD Talking Points:

- While there have been some flashes of volatility in EURUSD, the bigger picture measures are painfully restricted

- Key fundamental themes - from monetary policy, trade wars and growth - carry dangerous exposure for this benchmark pair

- While volatility within controlled range is the most reasonable scenario, narrow boarders eventually fall to persistent volatility

See how retail traders are positioning in EURUSD and other liquid FX crossesusing the DailyFX speculative positioning data on the sentiment page.

EURUSD Is the Most Liquid FX Cross And One of the Most Resistant to Breakout/Trend

Most traders seek out the markets and pairs with the most movement. From volatility, the average market participant believes they can generate a significant swing for which direction and timing will simply come through their speculative prowess. Volatility and momentum are ultimately very useful; but when neither is the standard for the broader financial system, their presence is more often a source of risk than the genesis of reliable opportunities. As has been the case since soon after the turn of the year, the general course for the financial system has been congestion with a lack of clear trend intent and erratic - but sometimes sharp - volatility. It follows that when we look for opportunities, they would better fit this mold of the market.

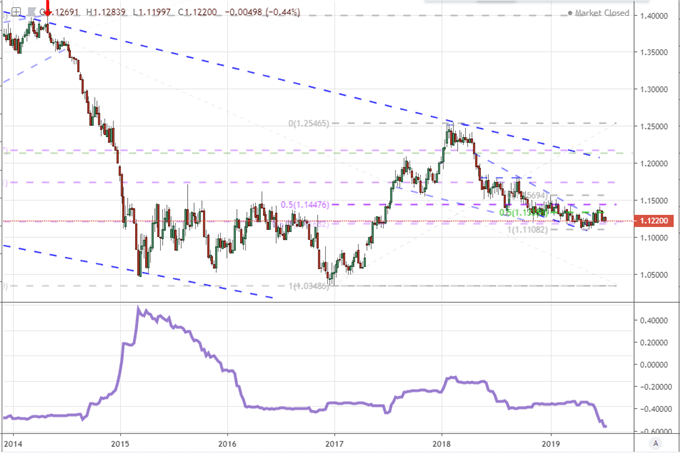

If we are looking for volatility within range, there are few more appropriate currency pairs than EURUSD. The world's most liquid currency pair has kept frustratingly consistent to its range. The 20-day (1-month) average true range as a measure of volatility is near the lowest since Summer 2014 - the definition of quiet market. Further, the historical range of the pair (as a percentage of range) over the past 60 days holds near the most restrictive since summer 2014 as well while 60 weeks has dropped to a record low. That is not to say that these measure have to hold, but if this remains the underlying pace, there are few more appropriate.

Chart of EURUSD and Historical 60-Week Range as Percentage of Spot (Weekly)

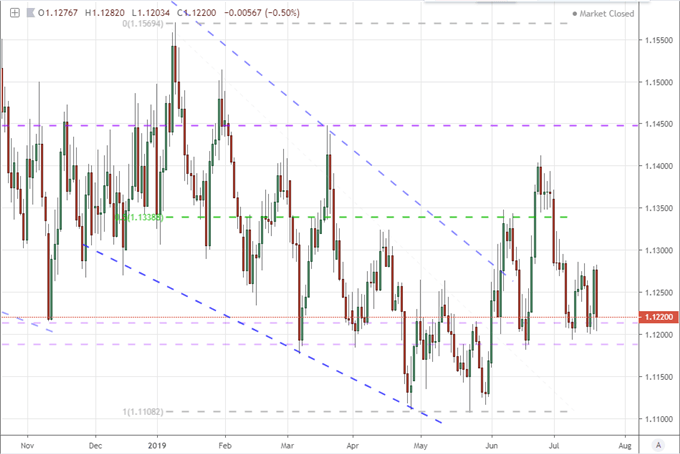

If we are to break from these constraints or see significant swings within them, it is important to find activity to charge the market. There are a few high-profile events on the docket for the week ahead that can contribute to a theme like growth (or more aptly recession fears), but there is also serious potential for alternative systemic risks like monetary policy and trade wars. With a few benchmark levels to track on EURUSD, we may find some trade potential develop.

Chart of EURUSD (Daily)

An ECB Rate Decision and Heavy Fed Speculation

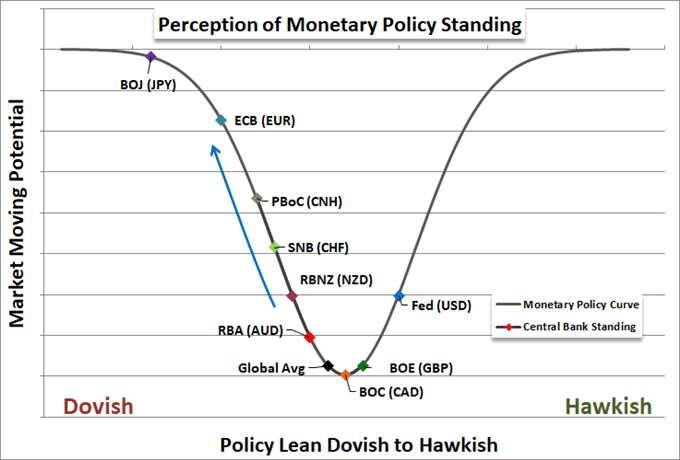

In terms of highest risk of significant movement for the EURUSD in the week ahead, the top fundamental theme on my radar is monetary policy. This past week showed how market moving the issue can be with Federal Reserve members generating enormous amounts of volatility by little more than remarks. There are few high-profile statements schedule, but attention is such that unexpected remarks can generate even more response as the market anticipates the Fed's rate decision on July 31st.

The tangible monetary policy event in the coming week is the European Central Bank (ECB) rate decision. The world's second biggest central bank is due to weigh on monetary policy Thursday. While it is not expected to change its policy mix at this particular meeting, speculation has picked up dramatically that a dovish turn is coming. That could encourage some preemptive signaling beforehand. Watch for reference to exploring options on excess reserves and a return to purchasing government bonds.

Monetary Policy Perception Chart

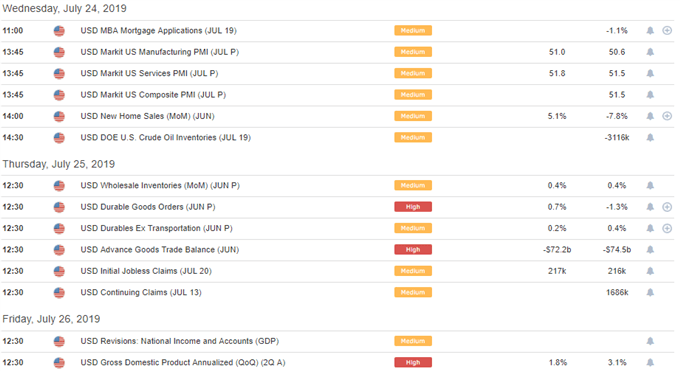

Growth Measures Will Offer a More Data Driven Fundamental Swell

If we are simply following the lines of known event risk, the most easily followed theme for EURUSD this coming week will be growth. A global mix of July PMIs - a timely proxy for official GDP figures - is due on Wednesday. If there are meaningful changes in course or intensity, from either the European or US data, the impact can be significant in volatility terms for the pair. However, with an expected official 2Q US GDP reading due Friday, it would take a clear and severe reading from one or both sides to override the anticipation that will naturally draw attention to the end-of-week update.

Trade Wars Are a Looming Risk With Severe Consequences

Perhaps the least reliable event risk ahead as it doesn't have any definable milestones on the calendar is the threat of trade wars expanding to the EURUSD. For the US, the pressure is relentless from the White House but the consideration is more retaliation. The risk to the Euro is whether President Trump turns his efforts towards the region. There have already been lists of products made that have been threatened for tariff - over $25 billion in European goods recently - and there have been acute flare ups. The issue between Boeing and Airbus as well as France's move towards digital taxes on US tech firms are just a few flash points.

If you want to download my Manic-Crisis calendar, you can find the updated file here.