US Dollar Price Action Talking Points:

- The Euro was on the move this morning after the ECB rate decision. A bear trap saw prices rip-higher around the press conference from Mario Draghi. A couple of hours after the rate decision, ‘sources’ indicated that the ECB was fairly set on a rate cut at the September meeting, a fact that was not mentioned by Draghi today but, nonetheless, has helped to finally bring some Euro weakness into the mix.

- Next week’s FOMC rate decision carries big potential for volatility across a number of key markets. A 25 basis point cut appears to be baked-in at this point; but what else might the Fed point to for future policy action?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

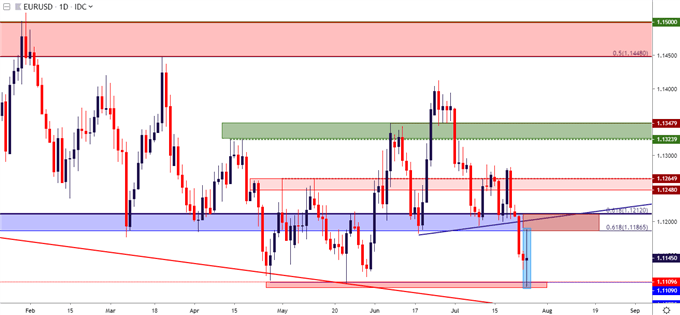

It’s been a busy morning across the FX space as the European Central Bank rate decision drove volatility through FX markets. While the bank’s statement opened the door for future dovish action, particularly towards rate cuts and possibly even more QE. This brought on a bit of Euro weakness but that was mostly erased after the press conference began and Mario Draghi mentioned that the bank didn’t even discuss the possibility of a rate cut today. That brought on a quick bout Euro-strength that drove EUR/USD up to find resistance at prior support. After the fact, however, ‘sources’ have alluded to the fact that the ECB is set-and-ready for a rate cut in September, which has helped to bring in the Euro-weakness that the bank appeared to want from this morning’s rate decision.

In EUR/USD, I had noted the potential for a bear trap in the Tuesday webinar. That ended up playing out as the pair touched down to a fresh low but quickly ripped shortly after. Prices ran all the way until resistance showed around the prior support zone of 1.1187-1.1212.

EUR/USD Daily Price Chart: Doji Prints After Dizzying Day of Drivers

Chart prepared by James Stanley

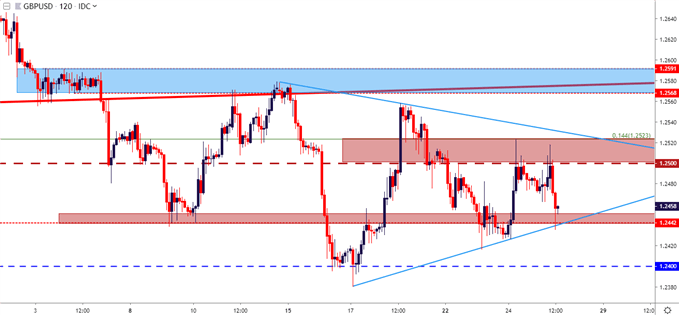

GBP/USD: Set to Surprise? Support Holds in Symmetrical Wedge

I came into the week looking for GBPUSD weakness and while it has so far worked, it may be time to flip to the other side.

It can be very easy to assign bearish biases to the British Pound at the moment. The UK is facing a very uncertain future and a new Prime Minister; a lot remains to be seen about how the country will navigate the oncoming split with the European Union. But – bears have had ample opportunity to re-grab control of the British Pound and so far this week, that hasn’t happened. At this point, price action in GBPUSD is building into a symmetrical wedge pattern and prices are currently at the support side of that formation, finding buyers from a zone that runs around 1.2450.

GBPUSD Four-Hour Price Chart

Chart prepared by James Stanley

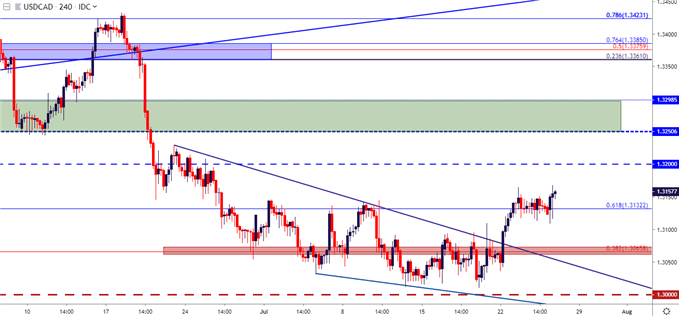

USD/CAD Holds Support Around Prior Resistance

Coming into this week, I had looked at the long side of USD/CAD, largely on the basis of a bullish reversal formation that had started to show after the pair failed to break-below the 1.3000 psychological level. Prices have quickly moved up to the initial target of 1.3132, and there’s been a cauterization of support around that prior point of resistance. This keeps the door open for further topside, looking for that 1.3200 level, followed by longer-term resistance potential around 1.3250-1.3300.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley

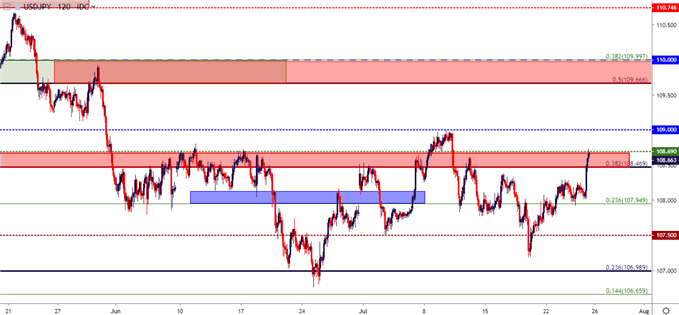

USDJPY Re-Tests Resistance

I had looked at this one for USD short-side themes last Tuesday, waiting for prices to revisit resistance in the 108.47-108.70 zone. That zone is now in play, and the big question is whether resistance holds, thereby allowing for short-side triggers.

USD/JPY Two-Hour Price Chart

Chart prepared by James Stanley

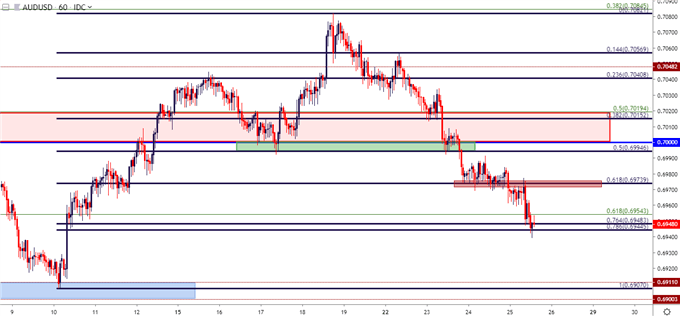

AUD/USD Falls Below the .7000 Big Figure

I had started to line this one up on the long side this week, largely looking to take advantage of USD-weakness similar to what had shown last week around the comment from John Williams. That set up did not work out, and AUDUSD bears have punched this thing back below the .7000 level. At this point, the door may soon re-open for bearish plays. A bounce back to resistance at prior short-term support, taken from around the .6975 level, could allow for the establishment of that play.

AUDUSD Hourly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX