- Technical trade setups we’re tracking across the USD Majors into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Under Duress Post-NFP – Exhaustion Ahead?

The US Dollar remains in a precarious position heading into the open of the week. The decline off the yearly highs has taken price to levels not seen since March with the US Dollar Index (DXY) straddling Fibonacci support on the back of Friday’s NFP report. While the broader risk remains weighted to the downside, the immediate decline may be vulnerable near-term with numerous crosses testing key technical pivot zones early in the week. In this webinar we review updated technical setups on DXY, EUR/USD, AUD/USD, NZD/USD, USD/CAD, Gold, Crude Oil (WTI), SPX (S&P 500), GBP/USD & USD/JPY.

Key Trade Levels in Focus

DXY – Interim resistance at 97.16 backed by 97.58. Downside support objectives unchanged at 96.31 & the yearly open at 96.14- look for a bigger reaction there IF reached.

EUR/USD – Interim support around 1.13 with near-term bullish invalidation at 1.1251. Topside resistance objectives at 1.1375 and the 61.8% retracement of the yearly range at 1.1393.

AUD/USD – Key resistance range at 7005/018 (with the yearly open just higher at 7042). Interim support 6957/62 with bullish invalidation at 6925/26.

USD/CAD – Interim resistance at 1.3330s backed by near-term bearish invalidation at 1.3357. Weekly open support at 1.3238 with a break lower targeting subsequent support objectives at 1.32 and 1.3175.

Gold – Rally tested the 2018 high-day close on Friday at 1348 – risk for a larger set-back while below the yearly high-close at 1341 - Look for possible exhaustion at 1316 & 1307 IF reached. A topside breach keeps the focus on 1366.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

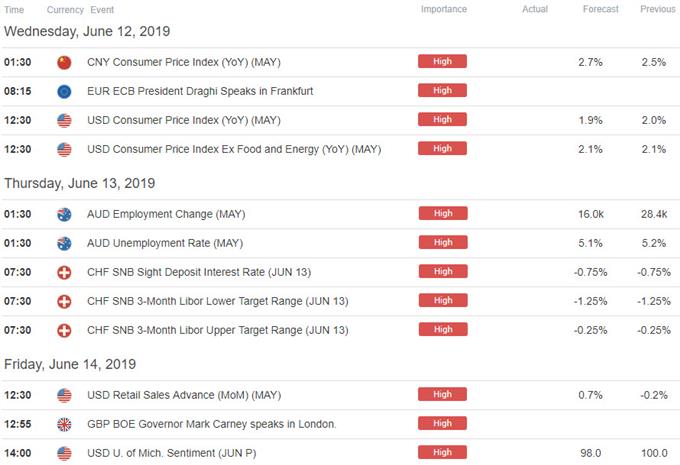

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- New Zealand Dollar Price Outlook: Kiwi Fails Flight into Resistance

- Euro Price Outlook: EUR/USD Breakout Testing Key Pivot Ahead of ECB

- Gold Price Outlook: XAU Breakout - Too Far, Too Fast?

- Aussie Price Outlook: Australian Dollar Breakout Vulnerable into RBA

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex