- Technical trade USD setups we’re tracking into the start of the week / month

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

DXY, Euro, Loonie Monthly Opening-Ranges Intact

The US Dollar Index is trading into the monthly opening-range highs into the start of the week and the focus is a reaction around the 98.05/10 resistance zone- note that the monthly ranges in Euro and Loonie also remain intact. In this webinar we review updated technical setups on DXY, EUR/USD, USD/CAD, GBP/USD, Crude Oil (WTI), Gold, USD/JPY, AUD/USD, EUR/AUD & SPX.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

DXY – Immediate focus is on topside resistance at 98.05/10. Initial support at 97.87 with near-term bullish invalidation raised to 97.71.

EUR/USD – Euro is coiling into the monthly opening-range just above slope support. Immediate focus is on support at 1.1140. Initial resistance at 1.1187 with near-term bearish invalidation at monthly-open resistance at 1.1215- look for a bigger reaction there IF reached. A break lower would expose 1.1110.

GBP/USD – Sterling broke below multi-month slope support last week with price responding to near-term pitchfork support into the open. Initial resistance at 1.2798 with bearish invalidation at 1.2859. Downside support objectives at the August low-day close at 1.2697 and the 100% extension at 1.2662.

Gold – Risk for near-term recovery while above the yearly / monthly low-day close at 1270. Initial resistance at 1280 with near-term bearish invalidation with the monthly open a 1283.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

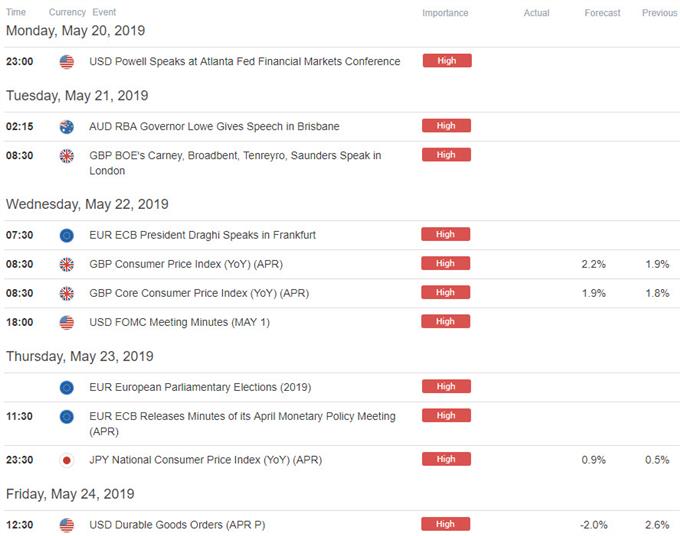

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Oil Price Outlook: Crude Decline Testing Critical Trend Support

- Canadian Dollar Price Outlook: USD/CAD at Weekly High as Loonie Dives

- Gold Price Outlook: XAU Testing Yearly Lows – Shorts Vulnerable

- Sterling Price Outlook: GBP/USD Bulls Buckle Up for Fed, BoE, NFP

- Euro Price Outlook: EUR/USD Snap Back- Trade or Fade?

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex