- Technical trade setups we’re tracking into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Majors and the Post-FOMC Drift

While last week’s FOMC interest rate decision did fuel a surge in volatility, prices largely remain range-bound with the USD majors broadly holding within the March opening-range. That said, the longer-term technical levels are clear and we’re looking to validate our near-term outlook on numerous setups early in the week. In this webinar we review updated technical setups on DXY, EUR/USD, NZD/USD, AUD/USD, USD/CAD, Crude Oil (WTI), Gold, and S&P 500 (SPX).

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Post-FOMC recovery vulnerable ahead of 97.10. Interim support / near-term bullish invalidation at the monthly open / 61.8% retracement at 96.15/22.

EUR/USD – Initial resistance at 1.1340 with bearish invalidation at 1.1370/80. Support at 1.1280 with critical slope support at ~1.1250s.

NZD/USD – Price remains vulnerable while below critical resistance at 6930/41. Interim support 6865 – a break there exposes 6818 and the monthly open / 100-day moving average at 6806/07 -look for a bigger reaction there IF reached.

Gold – Price targeting key near-term resistance range at 1321/23 – a breach / close above is needed to fuel the next leg higher targeting 1332. Interim support 1313 with near-term bullish invalidation at 1302.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

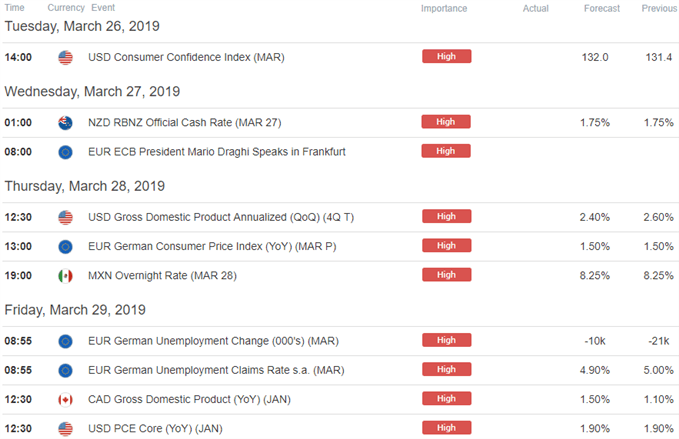

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Canadian Dollar Price Outlook: USD/CAD Eyes Resistance- Rally at Risk

- Gold Price Technical Outlook: XAU/USD Reversal to Risk Further Losses

- British Pound Price Outlook: Brexit Game Plan Targets Sterling Range

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex

https://www.dailyfx.com/nzd-usd?ref-author=Boutros