- Updated levels on trade setup we’ve been tracking in EUR/USD and AUD/USD

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX EUR/USD Trading Forecasts

New to Forex? Get started with our Beginners Trading Guide !

EUR/USD 120min Price Chart

In my most recent EUR/USD Technical Outlook we noted that price had recovered back above the 1.13-handle with the short-bias at risk while above. Our bottom line cited that, “From a trading standpoint, I’ll favor fading weakness while above today’s low targeting the upper parallels.” Euro broke through the upper parallel on the Tuesday with the subsequent rebound failing just pips ahead of confluence resistance at 1.3175 (50% retracement at 100% ext).

Price has continued to trade within the confines of this ascending channel formation extending of the monthly lows with the lower parallel converging on support at 1.1322 (the 2/19 - 4hr & 2hr high-bar close). Once again, the focus is on 1.13 with a weekly close above needed to keep the near-term long-bias viable. From a trading standpoint, I’m looking for an exhaustion low to fade while above the figure with a topside breach above 1.1375 needed to keep the focus on a stretch towards 1.14- look for a larger reaction there IF reached. Review my latest EUR/USD Weekly Price Outlook for a look at the longer-term technical trade levels.

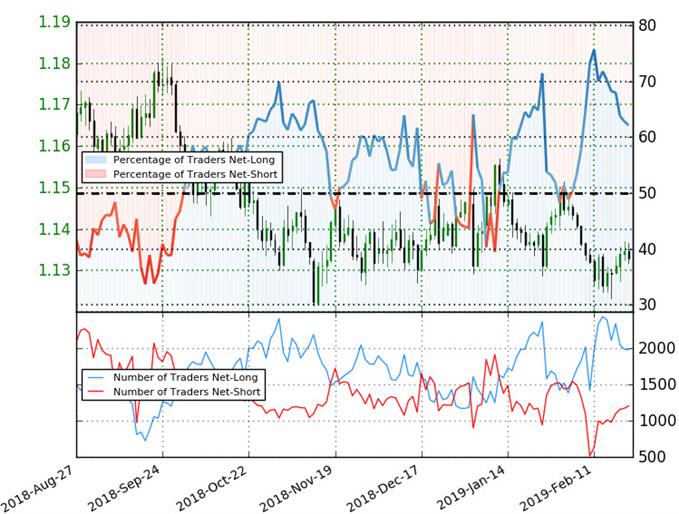

EUR/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long EUR/USD - the ratio stands at +1.64 (62.2% of traders are long) – bearishreading

- Traders have remained net-long since February 4th; price has moved 1.1% lower since then

- Long positions are7.8% lower than yesterday and 23.1% lower from last week

- Short positions are 4.8% lower than yesterday and 7.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week and the recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

AUD/USD 120min Price Chart

In this week’s Australian Dollar Price Outlook we highlighted that the recovery in AUD/USD was approaching the first test of resistance at 7175-7200, “where the 50% & 61.8% retracement of the late-January decline converge on the median-line of the broader descending pitchfork formation we’ve been tracking off the 2017 / 2018 highs.” Price registered a high at 7207 before reversing sharply with the break below pitchfork support at 7115 invalidating the near-term long-bias. Note that price is now poised to carve an outside-day reversal off resistance and further highlights the threat for steeper Aussie losses.

Initial resistance now at the low-week close at 7115 with the focus lower while below the weekly open at 7133. A break below soft support here at 7072 targets subsequent objectives at the yearly open at 7042 and the 50% retracement / October low at 7020/21 – look for a larger reaction there IF reached.

Find yourself getting trigger shy or missing opportunities? Learn how to build Confidence in Your Trading

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex