- EUR/USD threatens outside-day reversal back above 1.13- constructive while above

- Check out our new 2019 projections in our Free DailyFX EUR/USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Euro has rallied more than 0.6% against the US Dollar today with a reversal back above a critical inflection zone threatening the broader downtrend in price.These are the updated targets and invalidation levels that matter on the EUR/USD charts. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

EUR/USD Daily Price Chart

Technical Outlook: In my latest EUR/USD Weekly TechnicalOutlook we noted that the price was testing a break below critical support at the 1.13-handle with a weekly close below needed to keep the short-bias viable. Euro briefly registered a low at 1.1258 today before reversing sharply higher with price poised to post an outside-daily reversal candle.

Learn how to Trade with Confidence in our Free Trading Guide

EUR/USD 120min Price Chart

Notes: A closer look at price action shows Euro breaking above descending channel resistance extending off the monthly highs with the advance now probing through the objective weekly opening-range high at 1.1330. A push higher here keeps the focus on topside objectives at 1.1356 and the 50% retracement / pitchfork resistance at 1.1385/90 – look for a bigger reaction there IF reached with breach targeting 1.1416/20 and the yearly open at 1.1445.

Initial support rests at 1.13 backed by near-term bullish invalidation at the 11/28 swing low at 1.1267- a break below this level would be needed mark resumption of the broader downtrend targeting 1.1233 and 1.1215.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

Bottom line: The focus remains on the 1.13-handle for now with the short-bias at risk while above. Ultimately a breach above pitchfork resistance is needed to suggest a more significant low is in place and IF this reversal is legit, intraday losses should be limited to 1.1267. From a trading standpoint, I’ll favor fading weakness while above today’s low targeting the upper parallels. That said, weakness beyond 1.13 should be approached with extreme caution- a weekly close will be the ‘tell’ moving deeper into February trade - tread lightly.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

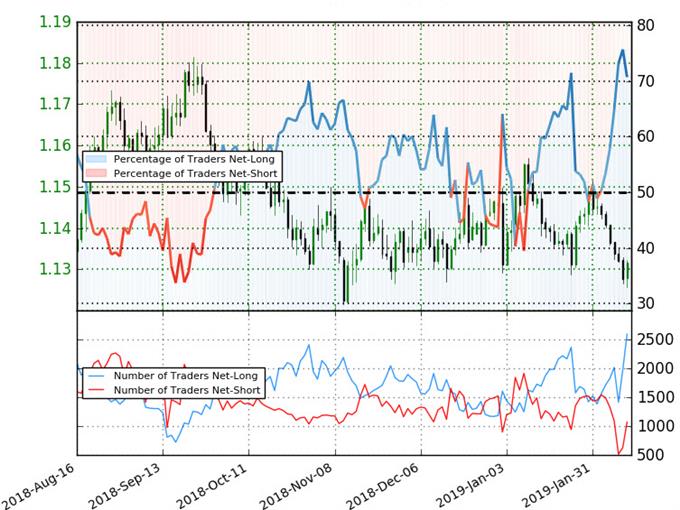

EUR/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long EUR/USD - the ratio stands at +2.42 (70.7% of traders are long) – bearishreading

- Traders have remained net-long since February 4th; price has moved 1.1% lower since then

- Long positions are46.6% higher than yesterday and 49.7% higher from last week

- Short positions are 68.4% higher than yesterday and 33.6% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet, traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed EUR/USD trading bias from a sentiment standpoint.

See how shifts in EUR/USDretail positioning are impacting trend- Learn more about sentiment!

---

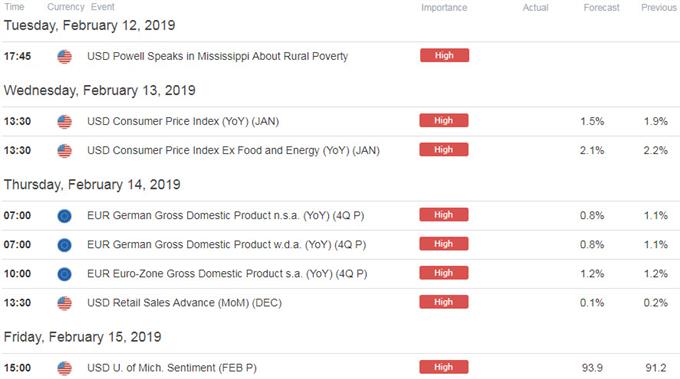

Relevant EUR/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

Active Trade Setups

- Gold Price Technical Outlook: XAU/USD to Threaten Deeper Correction

- Canadian Dollar Price Outlook: USD/CAD Testing Key Trend Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex