- Technical trade setups we’re tracking into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

Euro Testing Make-or-Break Support

We’ve been discussing a key support zone at the 1.13-handle in EUR/USD for the past few months and price is testing this critical zone at the January lows to start the week. The focus is on a reaction off this zone with the immediate short-bias at risk while above. In this webinar we review updated technical setups on DXY, EUR/USD, USD/JPY, USD/CAD, Gold, Crude Oil (WTI), USD/CHF, EUR/AUD, GBP/AUD, and AUD/USD.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Rally testing January highs at 96.96 – subsequent resistance at 97.20 and the December high-day close at 97.42 (both levels of interest for exhaustion IF reached). Interim support 96.45 with bullish invalidation at 96.26.

EUR/USD – Focus is on a critical support zone at 1.1290-1.13. Looking for a definitive reaction off this region with a break / close below needed to keep the short-bias viable. Near-term bearish invalidation at 1.1375. A break lower targets 1.1233.

Gold – Rally remains at risk near-term sub-1321. Interim support 1302 backed by 1295. Topside breach targets 1342 & the 2018 HDC at 1348.

Crude Oil – Near-term focus is lower sub-53 with bearish invalidation at 53.80. Initial support targets at 51.40 and 50.61.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

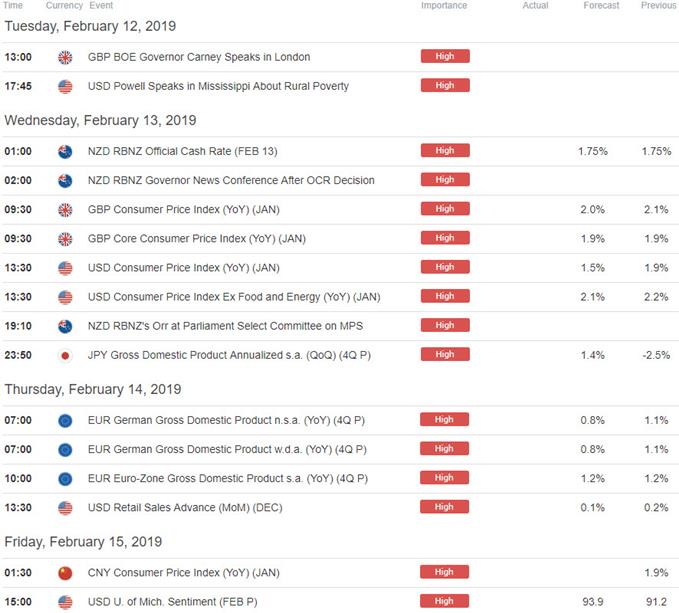

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Gold Price Technical Outlook: XAU/USD to Threaten Deeper Correction

- Canadian Dollar Price Outlook: USD/CAD Testing Key Trend Support

- EUR/USD Price Outlook: Euro Fails at 1.15 - Levels to Know for NFP

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex