- Technical trade setups we’re tracking into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Crosses in Focus Ahead of FOMC Interest Rate Decision

The FOMC rate decision takes center stage on Wednesday with market participants eagerly awaiting the updated quarterly economic projections as they pertain to growth, employment and inflation. We discussed the importance of the interest rate dot-plot as Fed Fund Futures continue to highlight expectations for no hikes this year. From a trading standpoint, the majors are on the menu this week with numerous setups stretching into key technical zones heading into the release. In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, GBP/NZD, USD/CAD, NZD/USD, AUD/USD, Gold, Crude Oil (WTI) and EUR/JPY.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Key support at the monthly open at 96.22 backed by the 61.8% retracement at 96.05- Close below is needed to validate the break. Initial resistance with bearish invalidation at 97.20.

EUR/USD – Looking for possible price exhaustion on a move towards 1.1367 or ~1.1390s. Support at 1.1280 with broader bullish invalidation at 1.1215. Critical yearly open resistance at 1.1445.

GBP/USD – Risk for a pullback while below 1.3363. Near-term support at 1.1312 with broader bullish invalidation at 1.2985.

AUD/USD – Aussie has set a well-defined monthly opening-range and we’re looking for the break for guidance. Risk for price exhaustion heading into key resistance 7140 with support eyed at the March low / 2019 low-day close at 7003/05.

Gold – Price remains vulnerable for further losses while below 1321 (initial resistance at the monthly open at 1313). Support at 1292 with backed by the yearly open at 1280 and 1275/76 – both areas of interest for possible price exhaustion / long-entries IF reached.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

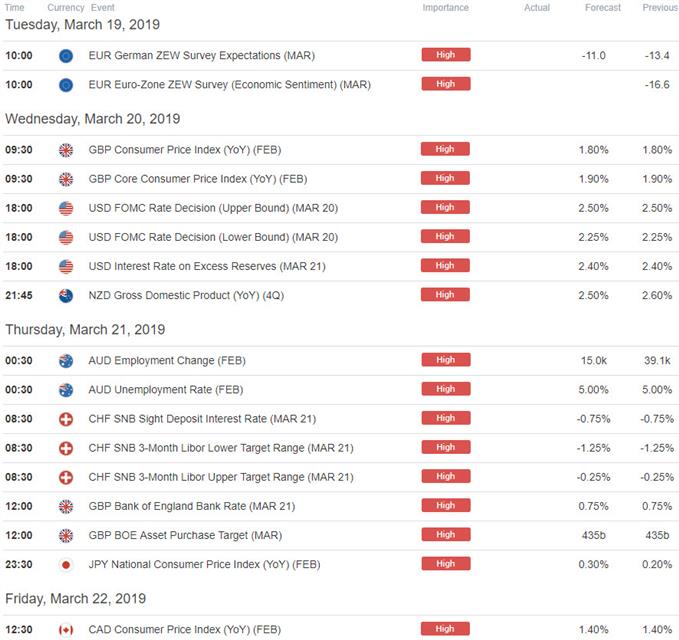

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Gold Price Technical Outlook: XAU/USD Reversal to Risk Further Losses

- British Pound Price Outlook: Brexit Game Plan Targets Sterling Range

- NZD/USD Technical Price Outlook: Kiwi Consolidation Narrows

- Australian Dollar Price Outlook: AUD/USD Recovery Faces First Test

- Canadian Dollar Price Outlook: USD/CAD Fails at Monthly Range Highs

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex