Gold is trying to push above a long-term resistance zone but at risk of a pullback to develop soon. Crude oil is consolidating and building the right side of a bullish price sequence. U.S. indices are trading near resistance, with the Dow Jones near confluent resistance by way of a trend-line off the record high and 200-day MA. The DAX is trading around the 2011 trend-line but yet to turn lower and give shorts momentum.

Technical Highlights:

- Gold price around long-term resistance

- Crude consolidating, forming right side of inverse H&S

- Dow Jones near confluent resistance, DAX 2011 trend-line

New Quarterly Forecasts are out, check them out along with other helpful resources on the DailyFX Trading Guides page.

Gold price around long-term resistance

Gold has snuck itself above the 1305/10 zone, but in an extended state it may not stay there for long. Not that interested in being a bear despite thinking there will be a pullback simply because it is still in a strong upward trend. Looking lower the trend-line off the November low and Jan 4 high under 1300 may offer support on a pullback.

Gold Daily Chart (Resistance from last year)

For an intermediate-term fundamental and technical outlook check out the Gold Forecast

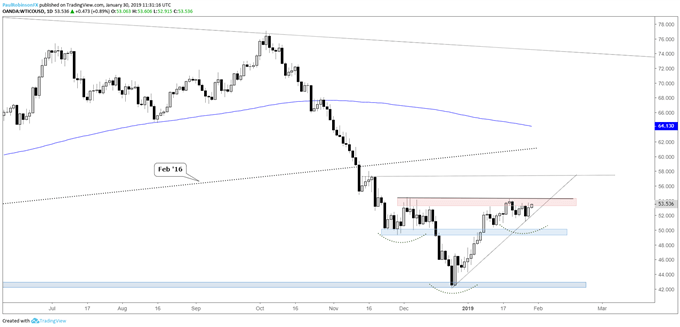

Crude consolidating, forming right side of inverse H&S

Crude oil continues to hang tough and possibly putting in the right shoulder of an inverse head-and-shoulders pattern. The symmetry of the H&S is leaving something more to be desired as both shoulders are rather shallow. However, a clean break above 54.48 should have crude pushing onward; a Feb 2016 trend-line test may come into view at some point.

WTI Crude Oil Daily Chart (Inverse H&S forming)

For an intermediate-term fundamental and technical outlook check out the Crude Oil Forecast

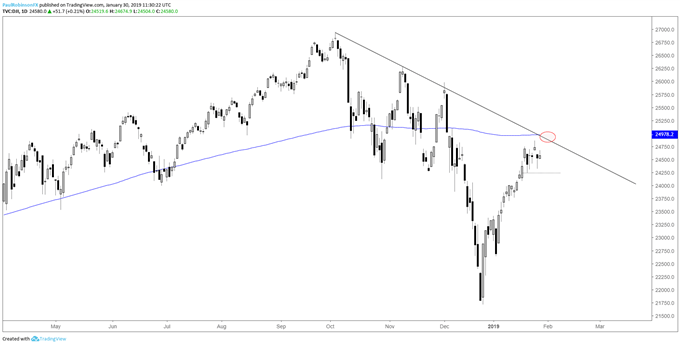

Dow Jones near confluent resistance, DAX 2011 trend-line

The Dow Jones is hanging tough despite being so far off the December low so fast. This smacks as a somewhat bullish development in the near-term, but it won’t take much of a push higher to have the index up against solid resistance by way of the trend-line off the record high and 200-day MA. From there a pullback looks likely to be in the works. Stay tuned, as price action could soon heat up…

Dow Daily Chart (t-line, 200-day combo)

For an intermediate-term fundamental and technical outlook check out the Global Equities Forecast

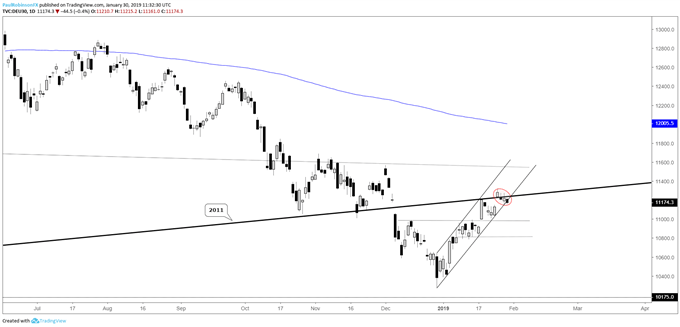

The DAX is hanging out around the 2011 trend-line, and while it is considered strong long-term resistance we have yet to see sellers show up in earnest. The channel off the December low is keeping the near-term bullish structure intact. A break of the lower parallel may do the trick in sending the German benchmark in reverse.

DAX Daily Chart (2011 t-line)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX