The S&P 500 finally showed some weakness yesterday and gives shorts a chance to start looking for lower prices even if one more stab higher develops. The DAX hit the 2011 trend-line and also at risk of trading weaker in the sessions ahead. Crude oil touched off on resistance and in-line with stocks is poised to soften a bit from here. Gold pulled back to a trio of support levels and as long as that holds a neutral bias at worst will be held, a break will have the precious metal likely reeling.

Technical Highlights:

- Gold price hit trio of support, holding for now

- Crude oil likely to trade soft after hitting resistance

- S&P 500 and DAX 30 to weaken from here

New Quarterly Forecasts are out, check them out along with other helpful resources on the DailyFX Trading Guides page.

Gold price hit trio of support, holding for now

Yesterday, gold pulled back to important support via the crossroads of the slope from August, the trend-line from November, and the 1276 low from Jan 4. So far, we are seeing price abide by support, and giving it the benefit of the doubt it keeps shorts at bay and gives would-be longs a spot to lean on for assessing risk. It will require a slice through 1276 to further downside momentum.

Gold Daily Chart (confluent support)

For an intermediate-term fundamental and technical outlook check out the Gold Forecast

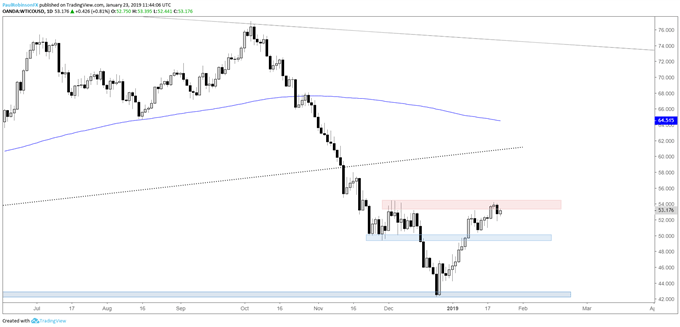

Crude oil likely to trade soft after hitting resistance

WTI crude oil ran into resistance over 54, a spot created in December prior to the final leg lower. This should keep a lid on a further advance and could soon have support under 50 in play, especially if we see global stocks take a hit.

WTI Crude Oil Daily Chart (Resistance keeping a lid on price)

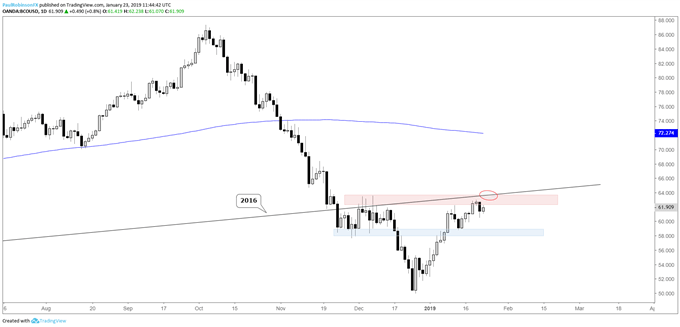

Brent crude has the same resistance created back in December along with the trend-line running up from the 2016 low. Looking for weakness to develop back towards 59.

Brent Crude Oil Daily Chart (Looking for decline to 59 or so)

For an intermediate-term fundamental and technical outlook check out the Crude Oil Forecast

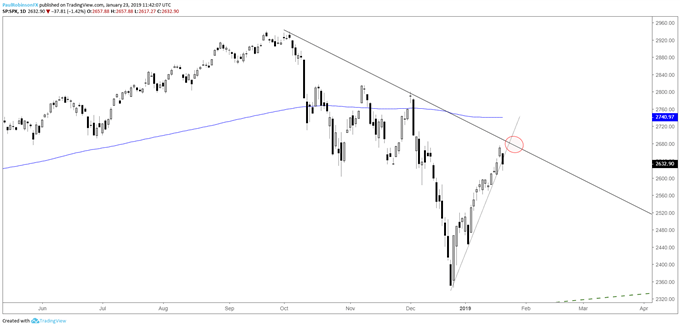

S&P 500 and DAX 30 to weaken from here

Yesterday, the S&P 500 finally weakened and for the first time in a couple of weeks it suggests two-way trade may be underway. This was a welcomed sight for traders as shorts can finally be under considered with momentum showing a break. The market could trade a little higher from here but look for any further strength in the near-term to fail.

S&P 500 Daily Chart (Rallies at risk)

For an intermediate-term fundamental and technical outlook check out the Global Equities Forecast

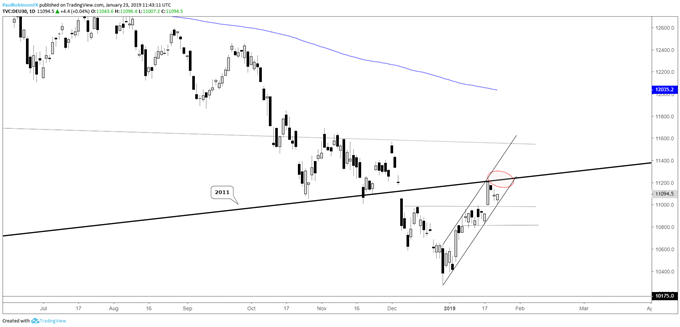

The DAX is pulling back from a kiss of the 2011 trend-line, with support not far below to help keep it from falling apart in the very near-term. But overall it should struggle and as is the case with the S&P, there should be more two-way trade now with sellers gaining the upper hand.

DAX Daily Chart (2011 trend-line resistance)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX