- Technical trade setups we’re tracking into the start of the week the USD Majors

- Check out our 2018 USD projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET- Foundations of Technical Analysis Webinar this Friday at 10ET

US Dollar Falls Post-NFP

Friday’s US Non-Farm Payrolls report showed continued strength in the labor markets while highlighting subdued underlying wage growth. The USD sold-off into the close of the week with the Dollar Index (DXY) closing below daily support. Heading into the start of the week we’re looking for some recovery in the greenback with our broader focus weighted to the downside while below monthly open resistance at 94.63.

Key Levels in Focus

DXY – Look for resistance ahead of 94.20/27- next support targets 93.69 & ~93.40s.

EUR/USD – Constructive while above 1.1672- topside resistance objectives at 1.1779 & 1.1827/52

GBP/USD – Risk for near-term exhaustion but focus is higher while above 1.3164. Topside resistance objectives at 1.336 & 1.3450.

USDCAD – Looking to validate this break of key weekly support- Focus is lower sub 1.3132 for now with support targets eyed at ~1.3046 & ~1.2985.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

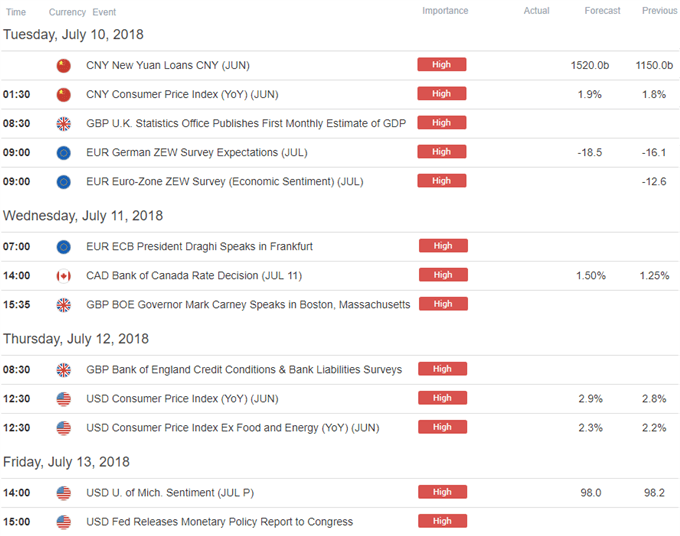

Highlighting this week’s economic calendar will be the Bank of Canada interest rate decision later on Wednesday and the US Consumer Price Index (CPI) on Thursday. In this webinar we review updated technical setups on DXY, EUR/USD, AUD/USD, USD/CAD, GBP/USD, NZD/USD, Crude Oil, Gold (XAU/USD), GBP/JPY, EUR/AUD, and EUR/JPY.

New to Forex? Get started with this Free Beginners Guide

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play:

- XAU/USD Technical Outlook: Gold Price Relief or Larger Recovery?

- Weekly Technical Perspective on the Australian Dollar (AUD/USD)

- Weekly Technical Perspective on the Canadian Dollar (USD/CAD)

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com