- EUR/USD rebound fails ahead of resistance; decline targeting support into yearly lows

- Check out our 2018projections in our Free EUR/USD DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Euro is down more than 1.2% off the weekly highs with the decline now looking to confirm resumption of the broader downtrend. Price is approaching key support into the yearly lows and the final hope for a near-term recovery in the single currency. These are the updated intraday targets & invalidations levels that matter for EUR/USD.

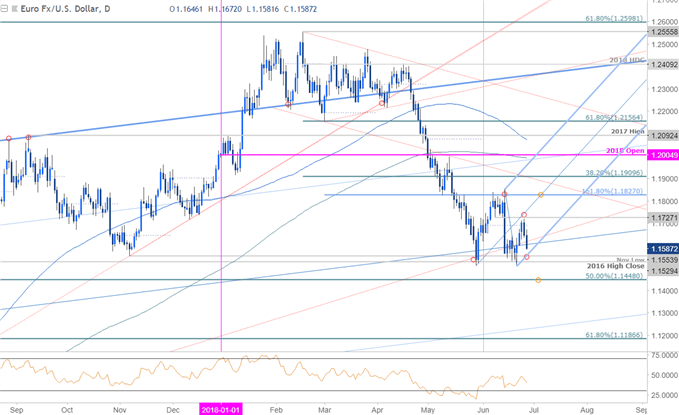

EUR/USD Daily Price Chart

Technical Outlook: In this week’s Technical Perspective on the EUR/USD, we highlighted a rebound off weekly confluence support in the Euro with our focus on a larger recovery in price while above 1.16. The rally failed just above monthly open resistance early in the week with price breaking back below the figure today in U.S. trade.

A proposed pitchfork extending off the yearly lows highlights support at the November lows at 1.1554 with the 2016 high-close just lower at 1.1529- note that price has been unable to close below this range and a daily close here is needed to validate resumption of the broader downtrend targeting the 50% retracement at 1.1448. Daily resistance stands at 1.1727 with a breach above 1.1827 ultimately needed to shift the medium-term focus higher.

New to Forex Trading? Get started with this Free Beginners Guide

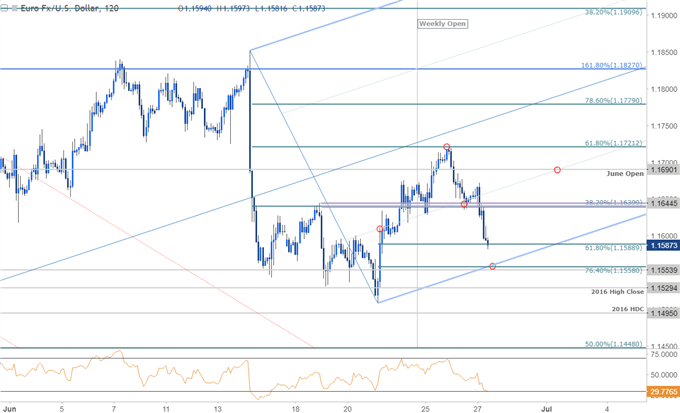

EUR/USD 120min Price Chart

Notes: A closer look at Euro price action sees EUR/USD probing below the 61.8% retracement at 1.1589 with confluence support seen just lower at 1.1554/58- an objective break of the weekly opening-range low has us looking for a late-week low but IF price is going to recover, this is would be the spot to watch. Initial resistance stands back at 1.1640/45 backed by the monthly open at 1.1690 and the weekly range high / 61.8% retracement at 1.1721. A break below this formation targets 1.1529 backed by the 2016 high-day close at 1.1495 am 1.1448.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: Euro is heading back towards the yearly lows and we’ll need a daily close below this near-term support barrier to keep the immediate focus lower. IF this is just a final washout, look for exhaustion ahead of the monthly lows with a recovery back above the monthly open needed to get things going. From a trading standpoint, this could go both ways down here so watch price action heading into this near-term support zone.

If you’re already short, look to adjust exposure and bring in protective stops on a move into 1.1558/54. With the same respect, failure/exhaustion down there may offer favorable long-entries for a near-term recovery- we’ll re-asses at the close of the week. Join me on Friday for the return of my Foundations of Technical Analysis webinar series to review this setup and more!

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

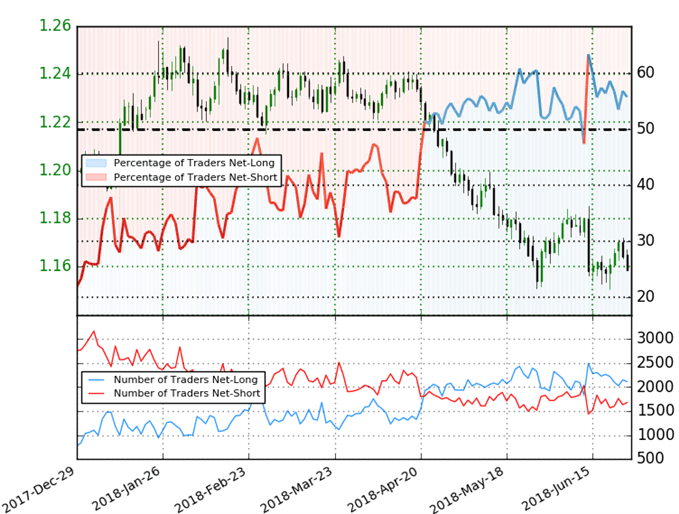

EUR/USD IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long the Euro (EUR/USD)- the ratio stands at +1.26 (55.7% of traders are long) – bearishreading

- Traders have remained net-long since June 14th; price has moved 1.8% lower since then

- Long positions are 5.2% lower than yesterday and 8.8% lower from last week

- Short positions are5.1% lower than yesterday and 8.6% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in EUR/USD retail positioning are impacting trend- Learn more about sentiment!

---

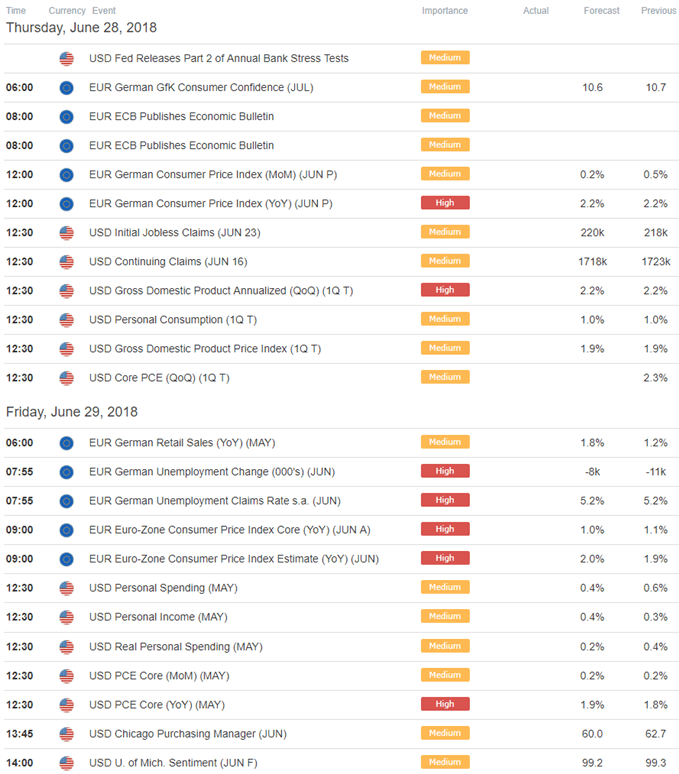

Relevant EUR/USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- GBP/USD Technical Outlook: Sterling Threatens Larger Price Reversal

- US Dollar Reversal Under Review– USD Setup We’re Tracking This Week (Webinar)

- NZD/USD Price Analysis: Kiwi Testing Support at Fresh Yearly Lows

- XAU/USD Technical Outlook: Gold Prices Search for Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com