Talking Points

- Review of current / active setups into the weekly open

- Review the Foundations of Technical Analysis mini-series

- Join Michael for Live Weekly Trading Webinars on Mondays at 12:30GMT

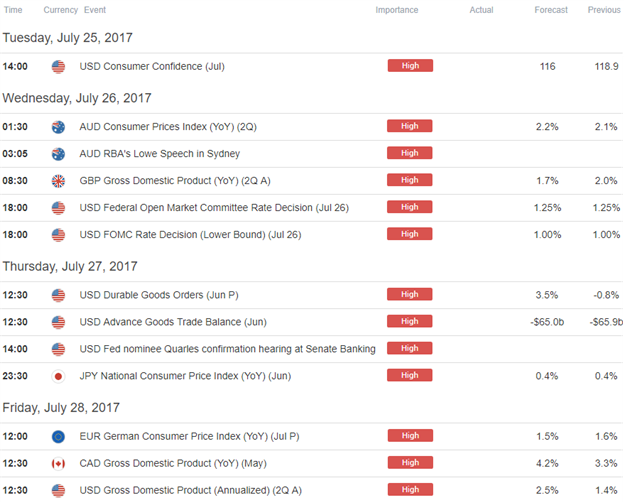

The DXY breakdown is in focus to start the week with the index slipping to some key levels. The focus remains lower sub-94.50 with support coming up at 93.52 & the 2016 low-day close at 93.06. The immediate short-bias is at risk heading into these levels however as sentiment on a few USD pairs stretches into extremes. Bottom line, the dollar is vulnerable for some near-term exhaustion lows down here with the FOMC interest rate decision and 2Q U.S. GDP on tap this week.

Cable has some room for another pull-back, but remains constructive while above 1.2920. Key resistance remains 1.3121. Keep in mind we have UK GDP on tap this week as well.

See our New 3Q projections on the majors in the DailyFX Trading Forecasts.

AUDJPY reversed off resistance last week with the pullback now eyeing key near-term support into 87.55/64. The focus is on this zone to start the week- a break lower would risk a decline into more significant support at 86.93-87.13.

Gold is nearing key resistance at the median-line extending off the 2016 highs, currently around 1260- The immediate long-bias is at risk heading into this threshold with a breach above needed to fuel the next leg higher in gold. That said, look for interim support at 1248 with bullish invalidation set to the monthly open at 1241.

In this webinar we reviewed current & pending setups and updated technical levels on DXY, EURUSD, GBPUSD, GBPJPY, USDJPY, EURGBP, AUDJPY, AUDCAD, AUDNZD, USDCAD, Gold & GBPNZD.

Join Michael for his bi-weekly Webinar on the Foundations of Technical Analysis- Register for Free Here!

---

Key Data Releases

Other Setups in Play:

- Gold Prices Rally into Resistance- Outlook Constructive Above 1230

- ECB Preview- EUR/USD Rally Faces Moment of Truth

- GBP/USD Rejected at Resistance- Price Constructive Above 1.2890

- AUD/JPY Rallies to Fresh Yearly Highs – Initial 2017 Targets in View

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.