To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- AUD/JPY breaks above 2017 opening range- initial yearly targets now in view

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: AUD/JPY closed above technical resistance at 87.55/64 last week, keeping the broader long-bias intact. Price is pushing through the yearly opening-range highs on this stretch with the rally now eyeing our initial yearly target at 90.64-91.23. This range is defined by the 1.618% extension of the 2016 advance and the 50% retracement of the decline off the 2014 highs. Note that RSI is testing the 70-threshold and the weekly close will be important here.

AUD/JPY Daily

Today’s high (so far) registered just pips ahead of the July 2015 swing lows at 89.16 before pulling back. Note that near-term slope resistance converges on this region and further highlights the importance of today’s close. Interim daily support now rests at 87.55/64 with broader bullish invalidation at 86.93. A topside breach targets subsequent resistance targets at 90.03 & 90.64/72.

Learn more about Multi-Timeframe Analysis in Michael’s three-part trading series

AUD/JPY 240min

Notes: A closer look at the 240min chart highlights an embedded ascending channel formation we’ve been tracking off the June lows with price failing to hold above the upper bounds. The immediate topside bias is at risk while below this threshold but the broader outlook remains constructive while within this formation. Interim support at 88.18 backed by 87.55/64.

From a trading standpoint, I’ll be looking for signs of near-term exhaustion here with a pullback to offer more favorable long-entries. Added caution is warranted heading deeper in the week with Aussie employment figures and the BoJ likely to fuel increased volatility in their respective crosses

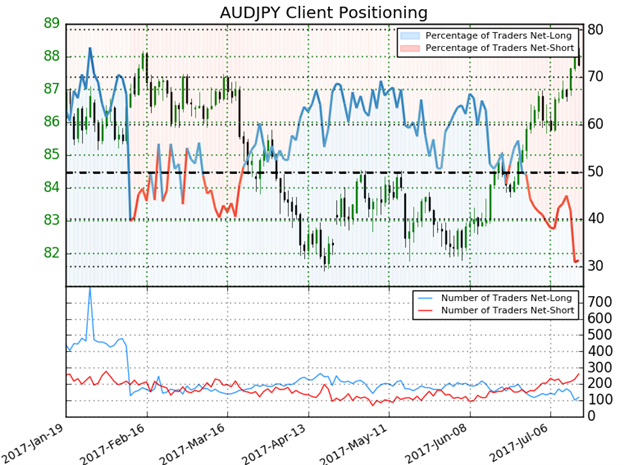

- A summary of IG Client Sentiment shows traders are net-short AUD/JPY- the ratio stands at -2.19 (31.3% of traders are long) – bullish reading

- Retail has been net-short since June 29th- price has moved 4.1% higher since then

- Long positions are 2.6% higher than yesterday but 31.4% lower from last week

- Short positions are 1.5% higher than yesterday and 26.4% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/JPY prices may continue to rise. That said, Positioning is less net-short than yesterday but more net-short from last week and the combination of current sentiment and recent changes gives us a further mixed near-term trading bias.

- Bottom line: Sentiment is coming off extremes and highlights the near-term risk to this advance. Ultimately, I would be looking to fade a broader pullback in the pair.

What to look for in AUD/JPY retail positioning - Click here to learn more about sentiment!

---

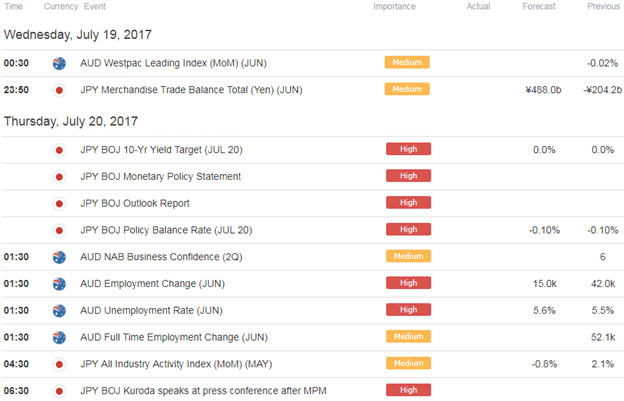

Relevant Data Releases

Join Michael on July 21st for a Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- Strategy Webinar: Aussie Breakout Testing 2016 Highs- What Next?

- USD/JPY Rally Vulnerable Ahead of U.S. CPI

- Is the Bitcoin Party Over? Crypto Threatens Major Reversal

- Did EUR/GBP Just Top?

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.