Talking Points:

- President Trump tweeted support for a Chinese mobile phone maker, but the market didn't register it as 'trade war averted'

- There was little to offer a strong foothold for Dollar recovery, but EUR/USD Monday upper wick raises technical interest

- Chinese and UK labor data is noteworthy, discrete event risk ahead; but the best tech pictures (NZD, CHF) don't have cues

What do the DailyFX Analysts expect from the Dollar, Euro, Equities, Oil and more through the 2Q 2018? Download forecasts for these assets and more with technical and fundamental insight from the DailyFX Trading Guides page.

President Trump's Tweet Does Not Restore Speculative Appetite Lost Through Trade Wars

Over the past two to three months, movement towards protectionism by some of the largest economies in the world had finally tipped the scales to outright trade war engagement. Fear that the US was withdrawing from the global economy and would incur retaliation from its major peers added to the scrutiny over a speculative run these past few years in particular that had grown increasingly dependent on the status quo. While we haven't seen more recent events spur progress with critical breaks that usher in full, self-sustaining bear trends; there remains a bias on this front where bad news will further undermine market confidence while the alleviation of tension will not put the smashed tea cup of speculative appetite back together. Over the weekend, US President Donald Trump tweeted that he was working with Chinese President Xi Jinping to reverse a sanction on Chinese telecom ZTE imposed in 2017. While some see this as the administration walking back on its tough stance on trade through metals and intellectual property theft, it can also be read that there is easing on a stark and aggressive trade front. That said, the market's didn't respond with measurable enthusiasm. Neither the US benchmark indices (S&P 500, Dow), the Chinese markets (Shanghai Composite) or trade and risk sensitive assets (emerging markets) showed much relief - much less confidence.

Dollar Retreat Stalls with Competing Signs of Stall and Pause

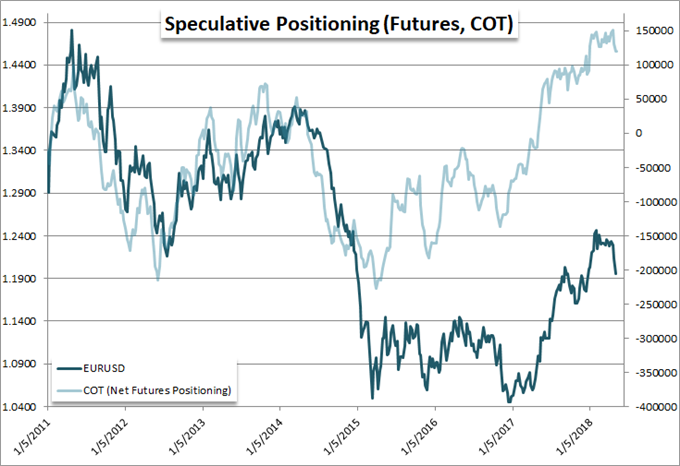

The Dollar's two-day retreat to end this past week didn't pick back up immediately on the bearish charge to start things off Monday. While the Greenback did ease through the morning, momentum never showed up and the market made a quick turn to put the currency back on the bid. The result for the EUR/USD was the largest 'upper wick' since January 29. This has strong history for calling short-term turns, but it is by no means a sign of certainty that the benchmark pair is going to immediately return to its month-long - and still emergent - bullish reversal. For other Dollar-based pairs, we are still standing at key thresholds (USD resistance) such as GBP/USD, NZD/USD and USD/CHF. One of the complicating factors to the revival of trend is the lack of an explicit catalyst. The Dollar's recovery is finding more motivation from a collective weakening of counterparts and rebalancing of extreme net short USD holdings than a clear cut driver like rising interest rate expectations or binary as a NFPs release. The ingredients are there, but the speculative reaction will unfold slowly until an accelerant is added.

China and UK Labor Data is Key Event Risk

There are a few notable economic releases on the docket for the upcoming session. For the US Dollar, we have: Fed speak to fine tune a locked in interest rate forecast; testimony by two Fed candidates (Clarida and Bowman) to fill two of the four empty FOMC Board seats and the March TIC flows which will tell us whether trade wars have incurred any measurable financial consequence for the US. The Euro meanwhile is scheduled for the Eurozone investor sentiment survey for ZEW where we can establish concerns over lingering issues for this economic giant. Neither currency is likely to elicit a strong reaction from the event risk. That said, the employment data from the UK and China have far greater capacity. The UK jobs figures has a history of sparking drama for the Pound when it sufficiently surprises. This has its greatest potential for putting pairs like GBP/USD and EUR/GBP on new trend through BoE timing through wage statistics, but that may be a reach. Watch for the volatility response. As for the Chinese data, we have the standard retail sales, industrial production and fixed assets figures. The real interest is in the new jobs series. This data has a poor track record of charging trend; but it is very important as an economic update nonetheless.

The Best Technicals Don't Have Good Fundamental Triggers

While there is some moderate potential for fundamentally-triggered movement for the Dollar, Euro and Pound; the best looking broad-spectrum charts don't have any high profile data or event on tap. I'm particularly intrigued by the conditions reflected in the Swiss franc and New Zealand Dollar. Both have shown exceptional technical patterns on a trade-weighted basis and particularly among their crosses. The franc has slid consistently over weeks to the pleasure of the SNB, but its recent congestion suggests pause that could boost the potential for reversal. A USD/CHF turn looks like it could be particularly dramatic, but it doesn't align to the slow progress of the Dollar and my view on EUR/USD. If I were to take a perspective on the franc, it would be through EUR/CHF or CAD/CHF. In a similar fashion, the Kiwi has sunk aggressively of late, and is now pressuring a further break lower. Amongst the NZD crosses, there are a number of pairs that are at the technical cusp - NZD/USD, NZD/CAD, NZD/JPY - which I will monitor for technical course setting an a more reliable fundamental backdrop. We discuss all of this in today's Trading Video.