Talking Points:

- We are just a day away from closing out the quarter and an eighth consecutive quarterly advance for the S&P 500

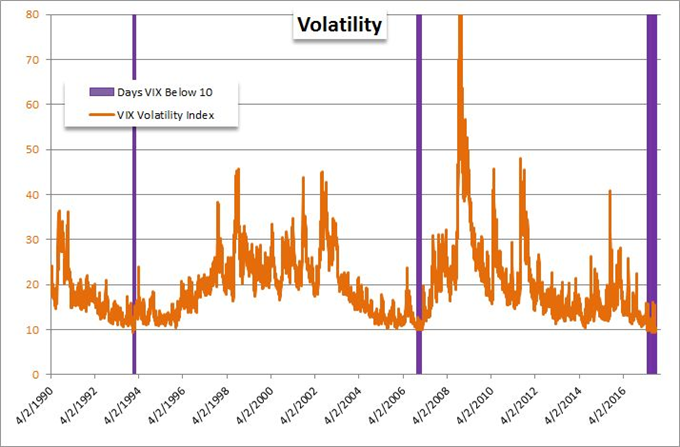

- The VIX's station below 10 defines the foundation to the market's optimism - as well as its risk

- Dollar, Euro and Pound trends this week have hesitated with plenty of technical appeal resulting

How do you trade around scheduled event risk without 'winging it'? What is the number one mistake that uninitiated traders most frequently make? How can you build your confidence for trading? We have trading guides for all of this and more on the DailyFX Trading Guide page.

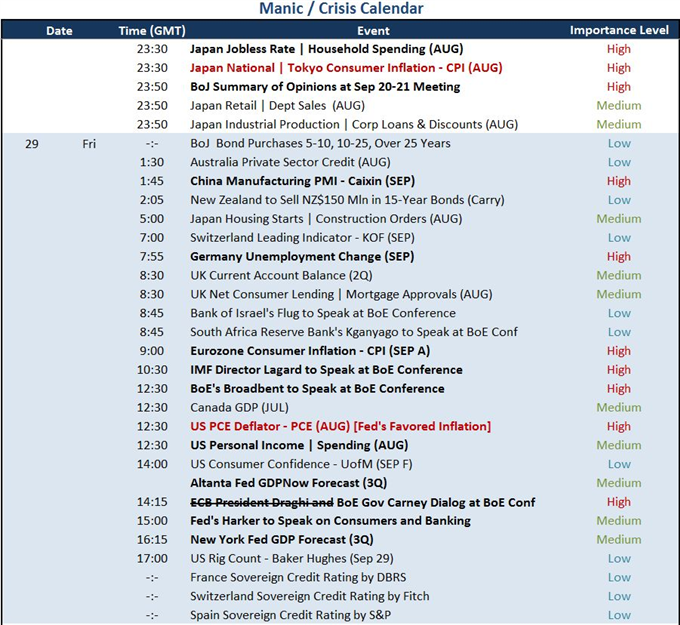

We are heading into the final 24 hours of the week, month and quarter. And the kind of activity we are seeing from the financial system reflects well on the depth of complacency and opportunism that defined the third quarter. From broad risk measures, we see buoyancy but not exactly the ambitious pace of climb that has highlighted previous quarters and years. Equity indexes from the German DAX, UK FTSE 100 and Japanese Nikkei 225 are all near their recent highs. Meanwhile, the junk bond market continues to consolidate while emerging market and carry trade measures are easing to different degrees. None of these benchmarks however come close to the explicit speculative drives of the US equity markets and the VIX volatility index. From the S&P 500, the past session's close was yet another record high - though oddly still not as impressive as the Russell 2000's drive to record highs this week. The truly lurid measure remains the VIX which has slunk back below 10. This deflation is despite the seasonal norm of September as a peak activity month and the Fed changing take on the monetary policy - risk relationship. Yet, it fits nicely with the unyielding appetite for risk that has defined this year.

A quarter-end volatility related to portfolio rebalance is possible, but I wouldn't anticipate a normal function of the financial system turning out a catalyst for a long-overdue rebalance. Meanwhile, the Dollar's more nascent recovery effort this week had some of the air taken out of it this past session. Fundamentally, there was textbook 'reason' for the Dollar to slip in its advance. On the docket, the August trade deficit shrunk to favor US growth. Fed speakers were general supportive of the monetary policy course that has been reset in the Dollar's favor - Esther George said hikes were necessary to promote stability and soon-to-retire Vice Chair Stanley Fischer similarly stated reducing the balance sheet was necessary progression. Even the optimistic outlook for President Trump's aggressive tax plan still carries the appeal of capital inflow - though not necessarily credit rating optimism. The Dollar is still on the action side of bullish breaks for EURUSD, GBPUSD, USDCAD and USDJPY. AUDUSD and USDCHF meanwhile could be readily find themselves in similar positions of technical progress if properly motivated.

From two of the Dollar's primary counterparts, the event risk has picked up more significantly and looks to be active into the end of the week. The Euro absorbed a contrast in its important themes Thursday when ECB's Praet insinuated that the October ECB meeting would not provide the stimulus guidance that markets have attached considerable hawkishness too. Yet, data showing economic confidence in the Eurozone hitting a record high seemed to be the more immediate interest for speculators. We'll see if the potential - though reportedly unconstitutional - Catalonia independence referendum this weekend will raise any of the old Eurozone stability concerns of recent years. From the Pound, the support via improved Brexit and BoE forecasts has cooled with BoE Governor Carney refusing to repeat the optimism of Prime Minister May and the government on the EU withdrawal. More BoE speak is due ahead and there are a range of appealing technical setups among the Pound crosses if the Sterling were to slip. We discuss big picture and specific opportunities in the markets in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE